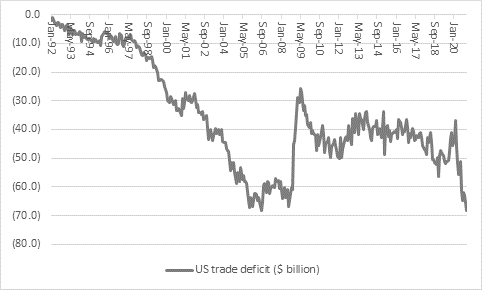

“Donald Trump is hardly going quietly as his Presidential term comes to an end but one thing that he won’t be shouting about is the US trade deficit. This is back to a record monthly high of $68 billion, to show that his tariff and trade plans have failed to staunch imports and boost exports,” says Russ Mould, AJ Bell Investment Director. “America’s renewed tendency to buy more than it sells also means dollars are flowing out of the country and this helps to explain the buck’s latest bout of weakness. Incoming Treasury Secretary Yellen may rail against China and what she terms ‘currency manipulators’ who try to massage their currencies lower to more competitive levels but history suggests the world needs a weak dollar, not a strong one, so at least in this respect Trump may have done financial markets a favour.

Source: FRED – St. Louis Federal Reserve database

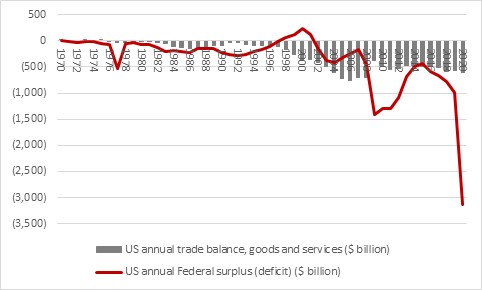

“America has run a trade deficit every year since 1976 and a federal budget deficit every time since 2002, although the latest deterioration in both cannot be laid entirely at Trump’s door, as no-one could have expected the pandemic or its impact. Stimulus cheques have enabled Americans to keep consuming, dragging in imports of durable goods and electronic gadgets, and contributed to the ballooning federal deficit, as the March CARES Act and supplementary bill in December pumped $3.1 trillion into the US economy. Even so, the outgoing President’s trade war and tariff tactics were hardly helping before the virus hit home.

Source: FRED – St. Louis Federal Reserve database

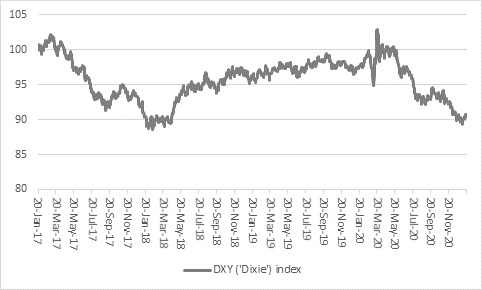

“This increase in the twin deficits is beginning to take its toll on the dollar. As measured by the trade-weighted DXY index, known as ‘Dixie’, the buck is lurking near three-year lows at 90.

Source: Refinitiv data

“Owners of dollar assets might not initially be thrilled by Janet Yellen’s argument that the USA should ‘go big’ on fiscal spending and stimulus as you could argue that the Trump regime’s tax cuts and fiscal laxity (even before COVID-19) had begun to weigh on the US currency. It took America until 2010 to accumulate a $13 trillion total federal deficit and it has taken just ten years to double that.

“But dollar weakness, bizarre as it may seem, greases the wheels of the global economy and financial markets, so investors may not be too worried to see the buck bend a little. Janet Yellen may be taking other nations to task for their efforts to weaken their own currencies but she does not seem to be openly advocating a ‘strong dollar’ policy, even if she is unlikely to follow the Trump administration’s frequent public calls for a weaker currency.

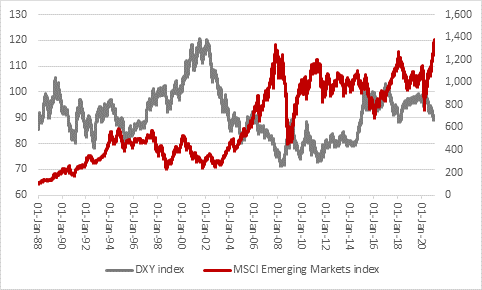

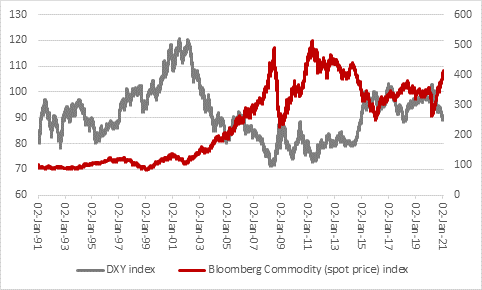

“A strong buck is traditionally seen as deflationary – it increases both the costs of (dollar-priced) commodities and the interest costs of those nations who borrow in dollars and not their own currency, a particular facet of emerging markets. Increased raw material costs eat into corporate profit margins and cash flows (and potentially dividends) while coupon payments to bondholders simply crimp Governments’ scope to invest and therefore potentially economic growth.

“It may therefore be no coincidence that the latest bout of dollar weakness is coinciding with a rally in commodity prices and emerging equity markets. Trump’s failure to rein in the trade deficit, and the latest surge in American federal borrowing levels, means the supply of dollars is plentiful and that is a good thing, at least if recent financial market action is any guide.

Source: Refinitiv data

Source: Refinitiv data

“The dollar is the world’s reserve currency so what happens to it matters, both for the financial markets and the real economy.

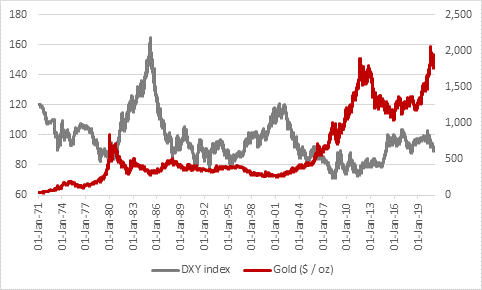

“The current world monetary system was set up in 1971, when then US President Richard M. Nixon and Treasury Secretary John Connally took America off the gold standard. That killed the Bretton Woods system set up toward the end of the Second World War. Bretton Woods had pegged currencies to gold, which countries could then exchange for dollars at a pre-determined rate.

“The idea was that countries could not engage in competitive currency devaluations and that America, the world’s economic superpower, could not easily run a cheap dollar policy and export its way to total dominance or be fiscally imprudent at home. A soaring gold price (or tumbling dollar) would be the sign that the US was printing – and in effect devaluing – dollars.

“In 1971, US President Richard M. Nixon took America off the gold standard and the dollar effectively became the world’s reserve currency. Yet Professor Robert Triffin had already seen the catch in this in a book he produced in 1960, Gold and The Dollar Crisis: The Future of Convertibility, as he argued that the greenback’s global reserve currency status would come at a cost – either to America or the world.

“Triffin asserted that to provide the world with enough dollars, America would always have to run a trade deficit and import more than it exported, paying out more in dollars than it received, and run an ever-growing budget deficit for good measure.

“So it has proved, and this has generally been all well and good while confidence in the dollar has held firm, lenders have been content to hold US Treasuries and the US has been happy to run a trade deficit.

“But there could be trouble ahead if lenders lose faith in American assets (as they did briefly in 2008), are put off by a surfeit of Treasuries or America’s trade policy is changed. Trump’s trade attacks did spark an initial rally in DXY as the trade deficit shrank, dollars returned to America and emerging markets, commodity prices and inflation all slumped.

“This is the Triffin Dilemma. America can either run a strong dollar policy and puncture the globe’s economy and its financial markets, or it can continue to run twin trade and fiscal deficits to provide enough greenbacks to keep the show on the road. Yellen does not seem to be calling for a strong dollar and her cries for more fiscal stimulus suggest she is hardly likely to be a fiscal hawk and rein in dollar supply, either.

“But this has implications for the value of both the dollar and the assets which investors can hold to hedge against ongoing weakness in the greenback, such as gold (or dare one say it, bitcoin).

Source: Refinitiv data