“Quarterly updates from banks JP Morgan Chase, Citigroup, Bank of America and Wells Fargo, as well as pharmaceuticals giant Johnson & Johnson, airlines United and Delta, retailer Walgreens Boots Alliance and industrial conglomerate Honeywell mean that the third-quarter reporting season in the USA is about to hit top gear,” says Russ Mould, AJ Bell Investment Director. “Analysts’ forecasts continue assume that the second quarter will prove to be the bottom and that aggregate profits will recover strongly from here. The updates for July to September and any management forecasts for the fourth quarter could therefore be crucial if the S&P 500, Dow Jones and NASDAQ are to maintain their strong run through to the end of the year – and where America goes, the rest of the globe tends to follow.

“The S&P 500 is now up by 9% for the year and by 19% from where it was a year ago – even if the most ardent optimist would be hard-pushed to say the world looks like a better place by 19% from last October or 9% since January.

Source: Refinitiv data

“But stock markets are forward-looking mechanisms which try to discount, or price in, future events, not backward-looking ones. Sharp falls amid the panic of February and March tried to factor in the hit to American economic activity and corporate profits and the subsequent rally is now trying to price in the future recovery.

“This is why the forthcoming earnings season is so important, as it will help to set the tone for the rest of the year and 2021. If companies can beat estimates and – even more importantly – restore guidance for Q4 that will show the sort of confidence that investors like to see and frankly may need to see, if US equities are to keep motoring higher.

“Monetary stimulus from the Federal Reserve in the form of Quantitative Easing and fiscal stimulus from the US Government are helping to support America’s economy and financial markets. But at some stage, investors will want to see companies being able to stand on their own two feet again, though further fiscal and monetary measures could stoke further share price gains if the cycle turns up, inflation strikes or investors simply begin to despair of paper money should Government deficits and QE continue to spiral.

“And if there is a genuine cyclical recovery, investors may not need to rely quite so heavily on the crutch of technology stocks to see them through: between them, Facebook, Apple, Amazon, Alphabet, Netflix and Microsoft have seen their market cap increase by $3.1 trillion over the past 12 months, generating two-thirds of the total value gain of the S&P 500 index.

“Put another way, excluding those six stocks, the S&P 500 is flat for 2020 (rather than up 9%), up 8% (not 19%) over the past 12 months and barely 5% higher than it was in January 2018. It would be nice to see the index develop a broader base.

Source: Refinitiv data

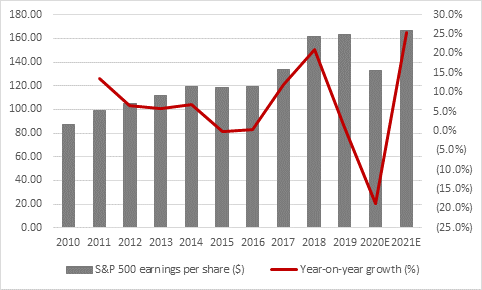

“It would be nice to see the index develop a broader base and solid earnings season could help. According to Factset, analysts are looking for an 18% quarter-on-quarter in earnings per share (EPS) from the S&P 500 in Q3 and a further 10% in Q4, to $33.30 and $36.14 respectively.

Source: Factset Research

“Those numbers, if met, would still leave S&P500 EPS down by 21% year-on-year in Q3 and 14% in Q4, but such momentum could help to give credence to forecasts of a 25% rebound in full-year earnings for 2021, enough to take EPS back above 2018 and 2019 levels. That at least would help to justify why the S&P continues to climb even as the economic and political backdrop seem so uncertain on the face of it.

Source: Factset Research

“That still leaves investors to address the thornier issue of valuation.

“A forward earnings multiple of more than 21 times does not look unduly cheap compared to historical historical averages, although it could be possible to argue that profits would not be near their maximum cyclical potential in 2021 as the world still tries to shake off the pandemic.

“Earnings forecast upgrades could change the picture in a favourable way although less encouragingly the Shiller cyclically-adjusted price earnings ratio (CAPE) still suggests the US equity market is very expensive relative to its history, using inflation-adjusted earnings from the last 10 years as its basis, rather than variable (and dare one say unreliable) analysts’ earnings forecasts.

“The S&P500 has only traded above 30 times earnings using CAPE for any length of time and ten-year compound annual returns from the index were deeply negative after both 1929 and 1999 so there remains the danger that US equities keep rolling in the short term but then do little (or worse) on a longer-term view.

Source: http://www.econ.yale.edu/~shiller/data.htm, Refinitiv data