“Maybe it is not just movie buffs who remember 1975’s Rollerball, which portrays a world where corporations are so powerful they dominate entire industries, run the globe’s most popular sport and even dictate who plays for the teams to ensure no-one is bigger or more popular than they are,” says Russ Mould, AJ Bell Investment Director. “The US Federal Trade Commission’s decision to investigate every acquisition made by Google’s parent Alphabet, Amazon, Apple, Facebook and Microsoft since 2010 on anti-trust grounds suggests the US authorities are wary of companies establishing too powerful a grip.

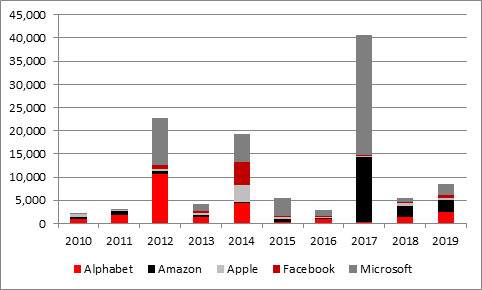

“Since 2010, these five firms have spent $114.3 billion on acquisitions in cash between them – and that sum excludes deals where they used stock as a currency.

Source: Company accounts. Figures in $ million.

“Some of these deals were designed to cement their positions in their initial fields of operation, such as Amazon’s $1 billion purchase of GoodRead and Alphabet’s $625 million swoop for analytics expert Apigee or Facebook’s $1 billion buy of Instagram.

“The FTC investigated Facebook’s purchase of Instagram on monopoly grounds in 2012 but did nothing, even if the regulator has already publicly pondered whether a fresh review of how the company ingrates both WhatsApp and Instagram into its services would be merited.

“The regulator is now looking at whether a host of smaller deals were designed to snuff out would-be rivals or competitive threats.

“But the investigation could – and probably should – go further than that because many of the acquisitions made have taken the quintet of technology giants into areas that may be tangential to their existing operations or even entirely new.

“Notable deals here include Microsoft’s $26.2 billion buy of LinkedIn, its purchase of Nokia’s mobile phone business and the $2.5 billion swoop for games developer Mojang. Facebook acquired virtual reality developer Oculus Rift for $2 billion, Apple bought Beats for $3 billion, while Amazon bought bricks-and-mortar retailer Whole Foods for $13.7 billion and Alphabet has snapped up Motorola’s mobile phone business for $12.5 billion, home automation firm NestLabs for $3.2 billion and bid for Fitbit.

“This is quite different from Rollerball, where the corporations dominated just one industry – the Houston team’s backer controlled energy and Tokyo’s telecommunications, for example, although it was not made clear where the Madrid, New York, Rome and Paris companies were all-powerful.

“This move from strong positions in one vertical to a land-grab on a horizontal basis – covering telecoms, gaming, data storage, consumer electronics and artificial intelligence – is very different, and leaves the US Federal Trade Commission with big job on its hands.

“The technology firms are likely to argue that all of these businesses are interconnected and complimentary to what they already do. They will also be able to point out that not all of the deals worked out. Microsoft took a $7.6 billion write-down on Nokia’s mobile phone unit, a sum that exceeded the original $7.2 billion purchase price as the strategy here simply failed to work.

“And there can be no more glaring example of how merger and acquisition (M&A) activity is no guarantee of success than IBM’s woeful record in the past decade.

“IBM’s shares have gained just 17% since 1 January 2010, while the S&P 500 has advanced by 201%, and that is despite $57 billion of cash spend on acquisitions and $88 billion in share buybacks.

“’Big Blue’s’ $136 billion market cap is actually smaller than the combined outlay on acquisitions and buybacks over the past 10 years and that is because the spending spree has done nothing at all to stem the steady slide in the company’s revenues, earnings or book value. Worst of all, net debt has soared from $17 billion to almost $54 billion over the same period.

|

$ million |

|||||

|

|

Sales |

Operating profit |

Net asset value |

Acquisitions |

Buybacks |

|

2010 |

99,870 |

19,304 |

23,172 |

5,922 |

15,046 |

|

2011 |

106,916 |

21,434 |

20,236 |

1,811 |

15,375 |

|

2012 |

104,507 |

21,518 |

18,860 |

3,722 |

11,995 |

|

2013 |

99,751 |

19,599 |

22,792 |

3,056 |

13,859 |

|

2014 |

92,793 |

19,986 |

11,868 |

656 |

13,679 |

|

2015 |

81,741 |

15,945 |

14,262 |

3,347 |

4,609 |

|

2016 |

79,919 |

12,330 |

18,246 |

5,679 |

3,502 |

|

2017 |

79,139 |

11,400 |

17,594 |

496 |

4,340 |

|

2018 |

79,591 |

11,342 |

16,796 |

139 |

4,463 |

|

2019 |

77,147 |

10,166 |

20,841 |

32,630 |

1,361 |

|

|

Change 2019 vs 2010 |

Total since 2010 |

|||

|

|

(22,723) |

(9,138) |

(2,331) |

57,458 |

88,229 |

Source: IBM’s company accounts

“Whether such arguments throw the FTC off the scent remains to be seen and it is also unclear whether users of the services and products offered by Alphabet, Amazon, Apple, Facebook and Microsoft actually care whether they dominate or not, judging by how their customer bases and revenues continue to grow. This may be the quintet’s strongest card of all and consumer groups will doubtless be unhappy to see the FTC appoint itself as all-powerful judge of what is right and what is not.

“The muted share price responses suggest that investors are relatively relaxed about the outcome of any investigation. Facebook and Microsoft fell by more than 2% but Apple slipped only marginally, Alphabet was unchanged and Amazon rose in trading in the US on Tuesday.”