£8,800 – the average ISA subscription so far this year, leaving plenty of room for further top ups

Women overtake male investors with an average ISA subscription of £9,100

Woodford remains in the top selling funds, despite a run of disappointing returns

GlaxoSmithKline tops the list of most popular shares as high dividend payers feature strongly

Scottish and Scottish Mortgage top the list of most popular investment trusts

The average ISA subscription for AJ Bell Youinvest customers is £8,800 so far this year, leaving plenty of scope for investors to top up their ISAs in the run up to tax year end. Analysis shows that average subscription levels increase with age, so there is a particular opportunity for younger investors to top up their smaller pots.

Age | Average subscription so far this year |

21-30 | £6,561.52 |

31-40 | £8,186.24 |

41-50 | £10,158.56 |

51-60 | £12,620.73 |

61-70 | £13,603.57 |

Interestingly, female investors are slightly ahead of the game compared to male investors, with the average subscription so far this year being £9,100 for women, compared to £8,600 for men.

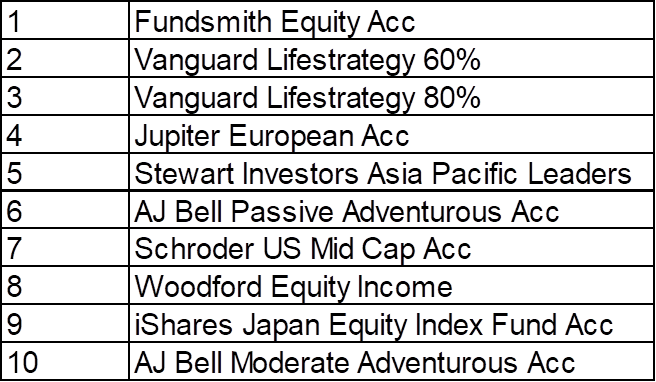

Top 10 selling funds

Ryan Hughes, head of fund selection comments:

“It is clear that investors are focusing on two distinct strategies to invest in, namely low cost passive strategies combined with high quality and experienced active managers. Given the current focus on the cost of investing, this split is not surprising with investors looking to access low cost beta through high quality passive strategies.

“Investors are also seeking proven active managers where they see merit in paying higher fees to access actively managed strategies from highly experienced fund managers with long term track records. Terry Smith at Fundsmith continues to be a popular choice for investors while Alexander Darwell, manager of Jupiter European, is benefiting from improved economic performance in Europe with investors moving back to the region.

“The appearance of Schroder US Mid Cap shows investors have continued faith in the US economy and it’s interesting to note they are focusing on the mid cap area rather than looking at the higher profile large caps. It seems investors are keeping faith with Neil Woodford despite a very challenging period of performance.”

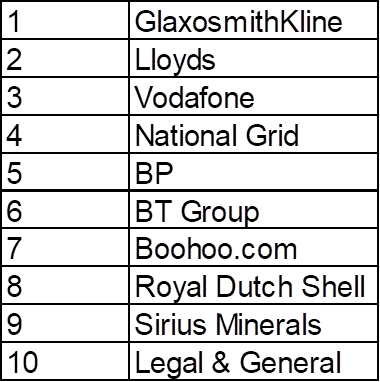

Top 10 selling shares

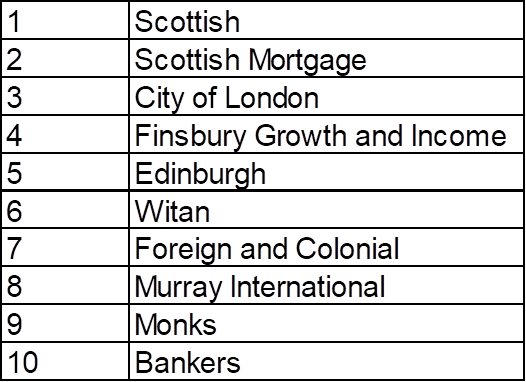

Top 10 selling investment trusts

Russ Mould, investment director comments:

Stocks

GlaxoSmithKline

“A staple of many income-focused portfolios especially after CEO Emma Walmsley committed to paying the 80p-a-share annual dividend again for 2018 (enough for a 6% yield). However drug pipeline concerns persist, the business’ structure is unwieldy and the firm may get involved in the auction for Pfizer’s consumer health unit. A successful, knock-out bid could raise fresh questions over the dividend for 2019.”

Lloyds

“Lloyds will be a core holding for many income-focused portfolios after another increase in the annual dividend to 3.05p with hopes for further increments in 2018 and 2019 (as well as 2018’s buyback). The bank has shrunk itself back to health and if it can cut down on conduct and PPI charges that should help profits and dividends.”

Vodafone

“Another stock with a juicy dividend yield (around 6.5% based on analysts’ consensus forecasts for 2018) and one that has a proud history of annual increases in the payout that stretches back to its mid-1990s flotation. Investors do need to keep an eye on the upcoming 5G spectrum auctions in the UK, which remains a fiercely competitive market, as well as investment in 5G kit, as telecoms stocks tend to perform best when expenditure is falling and cash flow swelling, rather than vice-versa.”

National Grid

“A stock that will be popular more for its forecast 6%-plus dividend yield than its capital growth potential, National Grid’s shares have sagged amid concern over political risk and talk of tighter regulation, or even nationalisation, in the UK. Yet this could overlook the value of its US operations and on the stock is now trading on a lowly valuation relative to its asset base.”

BP

“Oil major BP is yet another favourite of income investors with an unchanged $0.40 annual dividend for 2018 equating to a yield of around 6%. The company’s cost-cutting efforts and a rebound in oil prices means earnings cover for the dividend has improved to around 1.1 times. There is still room for improvement here but BP looks better placed to withstand any fresh reverse in crude, even if a real reversal in oil could still weigh on the share price.”

BT

“Telecom service provider BT suffered a torrid 2017 amid an Italian accounting scandal, earnings disappointments, a weaker result in the auction for Premier League football rights and the abandonment of a plan to grow its shareholders dividend by at least 10% a year. Even allowing for that setback the dividend yield is still above 6.5% although investors may want more clarity on a proposed settlement with employees regarding the £9 billion pension deficit and BT’s capital investment plans before taking this number completely on trust.”

Boohoo

“Online retailer Boohoo.com may appeal to momentum and growth investors seeking capital gains as it looks to add to a terrific record of organic profits growth, which it is seeking to supplement with the acquisitions of PrettyLittleThing and Nasty Gal. The focus on value and fast fashion has served the company well and it has kept marketing expenses low by successfully harnessing social media and customers’ and bloggers’ word of mouth, with the result that profit margins exceed those of ASOS. The shares have, however, lost momentum in the wake of June’s share placing, designed to fund fresh warehousing capacity and the stock’s very high rating – a forward price/earnings ratio of around 50 times for the year to February 2019 – means that even the slightest growth disappointment could put the shares under pressure.”

Royal Dutch Shell

“Oil major Royal Dutch Shell is yet another favourite of income investors with an unchanged $1.88 annual dividend for 2018 equating to a yield of just under 6%. Shell is the single largest dividend payer in the FTSE 100 and the company’s cost-cutting efforts and a rebound in oil prices means earnings cover for the shareholder distribution has improved markedly, even if it is still lower than ideal at around 1.25 times.”

Sirius Minerals

“Sirius Minerals is looking to develop a giant potash mine in Yorkshire. It is still in the development phase and has yet to generate any product or revenues, let alone profit or cash flow so this is a stock best-suited to patient, risk-tolerant investors. The UK’s first fertiliser mine for a generation has huge potential and investors will need to follow this year’s developments closely, with key milestones including a debt guarantee from HM Treasury for the project.”

Legal & General

“Life insurance giant Legal & General offers a dividend yield north of 6%, based on consensus forecasts for 2018 after a run of eight straight increases in its annual pay-out and the company looks well positioned to benefit from demographic trends in the UK, as individuals find they must save more and rely less on the State when it comes to pensions and provision for their old age.”

Investment trusts

Scottish

“Despite its name, Scottish Investment Trust has a global brief and its current popularity is easy to understand in an environment where inflation is rising and markets are looking to price in a synchronised global recovery. This is because Scottish’s mandate is to deliver dividend growth above the rate of inflation and thus protect the real value of its investors’ money. It has a good track record of doing so, too, having increased its annual dividend for more than 30 consecutive years, according to data from the Association of Investment Companies.”

Scottish Mortgage

“This giant, £6.5 billion cap trust is run by Baillie Gifford and – despite its name – lies in the Global sector. Its mandate is to maximise total returns for investors through a combination of capital and dividend growth. Fund managers James Anderson and Tom Slater own just 36 stocks and the top 10 represent more than half of the portfolio so this is a focussed fund and it is one where growth stocks are preferred – 45% of the assets are in technology and healthcare companies.”

City of London

“City of London is a member of a very select club indeed, in that it has increased its annual dividend for 50 consecutive years, according to data from the Association of Investment Companies. Run by global asset management giant Janus Henderson the trust has over £1.5 billion in assets and its puts this money to work in the UK stock market with a mandate to provide long-term growth in both capital and income. It pays out dividends on a quarterly basis and offers a yield of more than 4%.”

Finsbury Growth & Income

“Finsbury Growth & Income seeks to provide a mix of capital and income growth by investing in UK-listed stocks. Fund manager Nick Train has built up a formidable performance record, focussing on companies which have strong competitive positions, pricing power and the returns on capital to match. Patience is the key here, not least as the yield is relatively modest at 1.9% and the trust trades broadly in line with its net asset value rather than at the discount that is typical of many of its peers.”

Edinburgh

“Run by Invesco Perpetual’s Mark Barnett, Edinburgh will be a core holding for many investors who are seeking income. The trust focuses mainly on UK stocks and offers a dividend yield north of 4%. Key holdings include tobacco, big pharma and oil stocks, all contrarian picks from sectors that have been out of favour for some time, so this trust is best suited to contrarian, patient income accumulators, especially as the shares currently trade on a 10% discount to net asset value.”

Witan

“Witan seeks to provide long-term growth in capital and income by investing globally across global stock markets but it seeks to do so via other fund managers rather than picking the companies itself. Some £2 billion of assets have been allocated to a range of leading fund managers, including Lansdowne Partners, Crux and Lindsell Train. The result is a very well diversified global portfolio that yields around 2% and can point to over 40 straight years of dividend growth.”

Foreign & Colonial

“Foreign & Colonial offers a varied portfolio of publicly-listed stocks, unlisted securities and private equity as it seeks to fulfil its mandate and generate long-term capital and income growth for shareholders. With nearly £4 billion in assets, Foreign & Colonial is one of the biggest investment companies and it is also the oldest, having been established in 1868. The UK represents barely 5% of the portfolio so this trust offers diversification by geography as well as asset class, investing in over 500 companies across 35 countries, with US stocks the dominant allocation at nearly half of the portfolio. The yield is around 1.6% and dividends are paid quarterly.”

Murray International

“Run by the newly-merged Standard Life Aberdeen money management giant, Murray International’s mandate is to beat its benchmark and maintain an above-average yield, providing both income and capital growth to investors. Murray International lies in the Global Equity Income category and at the moment it offers a dividend yield north of 4% which is paid in four quarterly instalments. Its £1.7 billion in assets are spread across stocks and bonds on a global basis with emerging markets in particular focus as manager Bruce Stout feels valuations are more attractive than those on offer in developed arenas, where he argues stocks are currently over-valued.”

Monks

“Run by Edinburgh-based money manager Baillie Gifford, Monks targets capital growth over income as it invests its £1.7 billion portfolio on a global basis, as suggested by the modest 0.2% dividend yield. The UK is just 5% of the portfolio so this trust can provide geographic diversification for those who want it. The focus in on growth stocks and manager Charles Plowden and team operate on a time horizon of around five years for their selections. The managers pay no heed to indices and usually hold around 100 stocks, with the US, emerging markets and Europe the largest current geographical exposures.”

Bankers

“Bankers is another member of the elite grouping of investment companies which can point to 50 consecutive years of growth in its annual dividend. Run by Janus Henderson it seeks to deliver capital growth in excess of its benchmark, the FTSE World Index and annual dividend growth in excess of the retail price index (RPI). The £1.1 billion portfolio is invested across global stock markets with the UK, UK and Asia-Pacific representing some two-thirds of the assets.”