“Most post-match analysis in football now seems to focus upon tedious whingeing about the television replay system so some of the classic clichés are being sadly neglected but one of them applies to financial markets in 2020, because it has been a year of two halves for investors,” says Russ Mould, AJ Bell investment director. “This can be seen in the performance data from global asset classes, the major stock markets, worldwide sectors and specific stocks. The key now for investors is to work out whether the shifts in trend in the second half – some subtle, some not – continue to shape portfolio performance and therefore influence asset, country, sector and fund or stock selection in 2021 and beyond.

1. Global asset classes

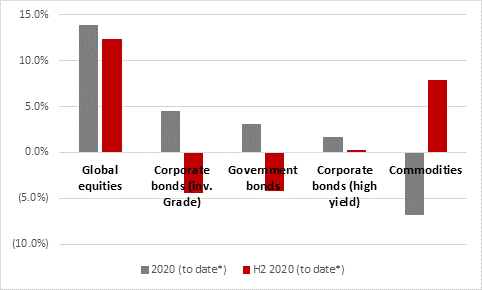

“Hard to believe as it may be given the pandemic, market chaos in March and subsequent recessions across many countries, equities were the best place to be in 2020. As benchmarked by the MSCI All World index, global stocks beat corporate bonds, Government bonds and high-yield (or junk) bonds, with commodities dead last.

“Equities benefitted from Government fiscal and central bank monetary policy support schemes and hopes that vaccines would prompt a strong economic recovery in 2021 and bonds did well as a haven in the first half, when commodities, especially oil, were crushed owing to the recession.

Source: Refinitiv data. Total returns in sterling. * To the close on 11 December. ** From 30 June to the close on 11 December.

“The figures for the second half show a slightly different pattern, though. Equities still came out top but commodities shot up to second and high-yield came in third. That suggests investors were moving away from fears over the pandemic and recession and toward pricing in a recovery, thanks to vaccines, fiscal and monetary stimulus and central bank promises, notably from the US Federal Reserve, to let inflation run a little hot, if it got the chance.

2. Major stock markets

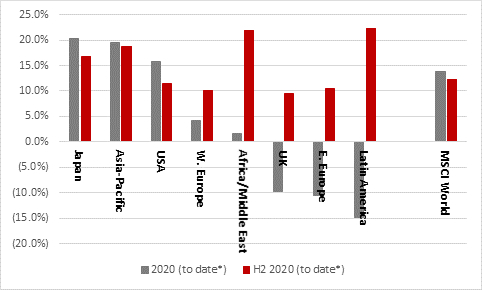

“This ‘game of two halves’ can be seen in our second chart, which looks at the eight major geographic options available to stock market investors.

“America was the best performer for much of 2020 but both Japan and Asia-Pacific slipped past it late on in the year.

“The UK was a turgid performer, weighed down by its sector mix and heavy exposure to banks and oils and limited exposure to technology, as well as Brexit and perceptions (fair or unfair) that the pandemic has not been handled that well.

Source: Refinitiv data. Total returns in sterling. * To the close on 11 December. ** From 30 June to the close on 11 December.

“In fact the UK was the worst performer in the second half of the year when Latin America, the Middle East/Africa and Asia were the best.

“This switch toward emerging markets again hints at investors looking for cyclical growth – value for want of a better turn of phrase – rather than secular growth – or more reliable, almost defensive progress – as well as global export and inflation plays.

3. Global sectors

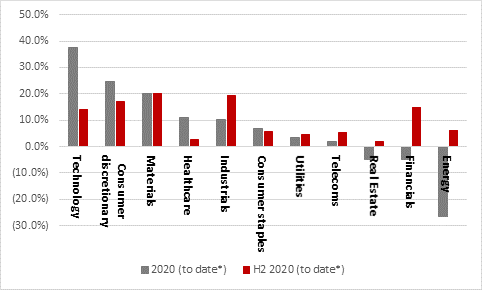

“This switch can be seen in trends in global equity sectors, too, as benchmarked by the S&P Global 1200 indices.

“It is no shock to see Technology romp home as the top sector of the year and financials and energy emerge as the biggest losers.

“So many tech stocks were seen as pandemic winners, helping companies or individuals cope with lockdowns, recessions and the effects of the virus and supplier of earnings growth even at a time of great economic difficulty.

“Tech did well as a result in the second half, too, but by then it wasn’t the only game in town.

“Materials (miners), industrials, consumer discretionary and financials all outperformed tech after June, raising issues of valuation and fears of regulation within tech, and also that apparent switch in investors’ affections from secular to cyclical growth.

Source: Refinitiv data. Total returns in sterling. * To the close on 11 December. ** From 30 June to the close on 11 December.

4. UK stocks

This switch in investors’ affections from expensive defensives to cyclicals, from growth to value and from havens to recovery plays can also be seen within the narrow confines of the UK stock market and its FTSE 100 headline index.

|

Top 10 |

2020 to date* |

|

Bottom10 |

2020 to date* |

|

Scottish Mortgage |

96.5% |

|

HSBC |

(31.3%) |

|

Fresnillo |

70.4% |

|

Standard Chartered |

(32.0%) |

|

Ocado |

68.1% |

|

Melrose |

(33.6%) |

|

Flutter |

60.8% |

|

NatWest |

(34.3%) |

|

Antofagasta |

55.5% |

|

Informa |

(34.5%) |

|

Polymetal |

38.2% |

|

Royal Dutch Shell |

(39.4%) |

|

Ashtead |

37.0% |

|

BP |

(40.4%) |

|

Spirax-Sarco |

27.9% |

|

Lloyds |

(42.7%) |

|

Ferguson |

26.6% |

|

Rolls-Royce |

(48.4%) |

|

Hikma |

24.5% |

|

IAG |

(60.9%) |

|

FTSE 100 |

(13.7%) |

|

FTSE 100 |

(13.7%) |

|

|

|

|

|

|

|

|

H2 2020 to date** |

|

|

H2 2020 to date** |

|

RSA |

65.0% |

|

AstraZeneca |

(8.5%) |

|

Evraz |

58.8% |

|

BP |

(9.0%) |

|

Antofagasta |

51.9% |

|

Hargreaves Lansdown |

(9.0%) |

|

Entain |

44.4% |

|

National Grid |

(11.5%) |

|

Whitbread |

40.6% |

|

Reckitt Benckiser |

(11.9%) |

|

Flutter |

40.0% |

|

GlaxoSmithKline |

(14.3%) |

|

Melrose |

39.8% |

|

Sage |

(14.3%) |

|

Glencore |

39.5% |

|

Pennon |

(16.1%) |

|

Scottish Mortgage |

38.8% |

|

Homeserve |

(16.5%) |

|

3i |

36.5% |

|

DCC |

(18.2%) |

|

FTSE 100 |

6.4% |

|

FTSE 100 |

6.4% |

Source: Refinitiv data. Total returns in sterling. * To the close on 11 December. ** From 30 June to the close on 11 December.

“The best-performing stocks in the year to date include Scottish Mortgage, the investment trust whose portfolio is packed with potential long-term growth winners, silver and gold miners Fresnillo and Polymetal, as well as lockdown beneficiary and gambling services provider Flutter (also seen to be a long-term winner thanks to betting deregulation in the USA).

“The losers are banks – hammered by recession, dividend payment bans and a flat yield curve; oils, hit by a recession, plunge in demand and public pressure for a move away from hydrocarbons; and travel-related plays such as IAG and Rolls-Royce.

“But in the second half, recovery plays came into their own – commodities play Evraz, hotelier Whitbread, miner Glencore and engineer Melrose – while Steady Eddies such as National Grid, Reckitt Benckiser, Pennon, DCC and even the big pharma plays AstraZeneca and GlaxoSmithKline began to flag.

“Again, this seems to be the market looking to price in a recovery – and perhaps inflation – in 2021. The danger for investors is that markets like to climb a wall of worry but can sometimes slide down the slope of hope if things do not then go according to plan.

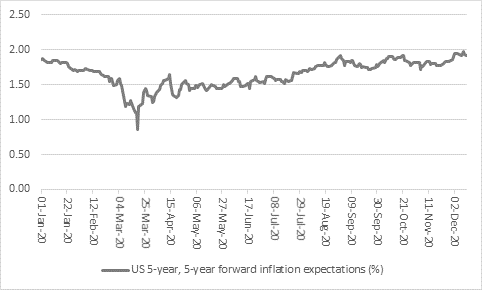

5. Inflation expectations

“And it is inflation expectations that hold the key to the two halves of 2020 and markets in 2021 and beyond.

“Inflation expectations collapsed in spring as the pandemic reared its head and investors feared the worst. But that they have surged from the panic-stricken lows of March to suggest markets are wondering again whether the combination of dollops of fiscal and monetary stimulus will lead to inflation, especially when coupled with perhaps more regional rather than global supply chains and also supply-side destruction, as companies go broke or cut back on investment.

“This is by no means certain – the pandemic could lead to huge government and corporate debt piles and demand destruction thanks to corporate failures and rising unemployment, as well as possible changes to how we live on a longer-term basis, especially if working from home becomes a widespread, more permanent trend.

“At the moment, markets think inflation in the USA will be 1.92% in five years’ time – bang on the US Federal Reserve’s 2% target. Normally Fed chair Jay Powell would be pretty pleased with that but his statements at the annual central bankers’ symposium at Jackson Hole, Wyoming in the summer suggests he is happy to tolerate some degree of overshoot, letting the economy run hot, to help growth and inflation average or even out, after a period of sub-trend progress from both.

“Only time will tell whether the Fed can conjure the inflation it craves after a decade of struggling to do so and then exercise sufficient control if it does. It also remains open to debate whether inflation averaging is the right policy – undercooking and then overcooking a turkey hardly generates the best results and nor does giving a patient too little medicine and then too much, relative to the prescribed dose on the bottle.

Source: FRED – St. Louis Federal Reserve database

“Ultimately, no-one knows which will prevail – inflation, deflation or the worst of all worlds stagflation. If central bankers knew, they would not still be using ever-more extreme versions of policies that were described as temporary or emergency measures a decade ago. But the range of outcomes requires a range of asset allocation strategies, at least if history is any guide. But then if all we needed was history then, as Warren Buffett put it, the librarians would be the best investors.

“Some investors may take the view that central bank money printing and Government deficit creation will lead to a melt-up in markets whatever happens.

“Some may fear markets are too exuberant, frothy or complacent and therefore worry that a stumble is coming.

“One things if for certain – investors have much to ponder as they prepare for the year ahead and perhaps the best solution remains keeping a balance portfolio that caters for all of the possible outcomes, rather than taking a strong view on one, owing to the wide number of economic, political and medical factors which could influence markets’ performance in the coming year and beyond.”