“Investors will approach technical analysis – the study of asset price charts as a means of working out where they may be going – with varying degrees of enthusiasm, ranging from ‘none’ to ‘lots.’ But even the most-hardened sceptic may have to admit that if ever a chart suggests an asset class is breaking a multi-year downtrend then the one belonging to the S&P GSCI Agriculture index could be it,” says Russ Mould, AJ Bell Investment Director.

Source: Refinitiv data

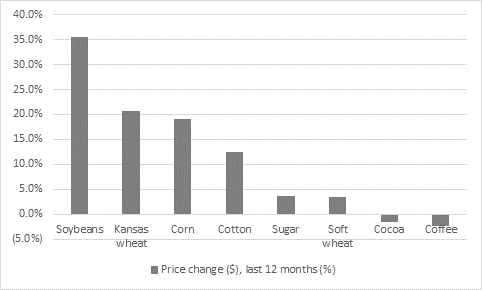

“This benchmark follows the price of eight crops, or ‘soft’ commodities – two types of wheat, corn, sugar, soybeans, coffee, cocoa and cotton. Of this octet, is soybeans, Kansas wheat and corn seem to be making the biggest gains.

Source: Refinitiv data

“La Niña’s impact on the unusually dry weather in the US Midwest is one possible reason why soybeans are so bouncy, along with Chinese buying amid US trade tensions as the country looks to rebuild pig herds after a bout of swine fever. Dry weather in the UK, Ukraine and Romania many explain the strength in wheat prices and the same, La Niña-related phenomenon underpins corn prices as Brazil and Argentina wait on late-developing crops.

“All of this suggests that prices could soften as fast as they firmed, especially if the dollar starts to strengthen. Based on the DXY (‘Dixie’) trade-weighted index, the buck is trading near three-year lows at the 90 mark, but if it rallies this will make dollar-priced soft commodities more expensive to buy for countries which do not use the greenback or whose currencies are not linked to it.

“Yet there could be another reason why ‘soft’ commodity prices are firm in so many cases. Trade friction between the US and China and the US and Europe (among others) could be on the verge of reversing the globalisation trend which has facilitated the smooth and increased movement of agricultural products around the world. Foodstuffs may not have been the main reason for the tensions but tariffs have been applied in many cases all the same and those levies and taxes have presumably served to increase end-market prices, too. In this context, Tesco’s warning that food prices could have increased by some 5% on average (and by a lot more in some specific cases) in the event of a no-deal Brexit means that the Christmas Eve accord between London and Brussels is welcome.

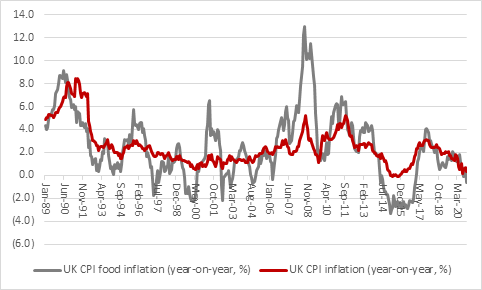

“Even allowing for the Brexit deal, the break in the downward trend is global food prices is eye-catching all the same. The good news is that in the latest UK inflation figures (15 Dec) food prices fell by 0.6% on average year-over-year, helping to anchor the headline consumer price index (CPI) inflation rate at 0.3%. But if food prices do suddenly take off, history suggests that the headline rate could catch light on both sides of the Atlantic, a development which neither central banks nor financial markets seem to be expecting.

Source: Office for National Statistics

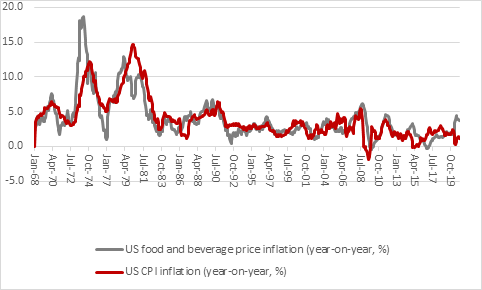

“Intriguingly, however, the latest food and beverage price inflation rate in the USA was 3.7%, miles ahead of the benign headline figure of 1.2%. Looking at the long-term US data, which has a longer available history than the British version, it could be argued that where food price inflation goes then the headline US consumer price index inflation rate looks pretty sure to follow.

Source: FRED – St. Louis Federal Reserve database

“This might be a nasty surprise to US consumers (and British ones if they end up with the same trend), whether this is down to La Niña, nationalism, tariffs or something else. It could be the sort of trend that triggers demand for higher wages. Whether labour feels sufficiently empowered to put its foot down right now, as unemployment ticks higher thanks to the pandemic and the economic damage wrought by lockdowns, is admittedly debatable.

“Any historian will tell you that food prices may not be the cause of revolutions or public uprisings, but they can be the trigger for them, with France in 1789, Tiananmen Square in 1990 and the Arab Spring in 2011 as examples of this.

“This is not to suggest that geopolitical turbulence will result from the nascent upward trend in global food prices but from the narrow perspective of financial markets any sustained bout of inflation could be a major revolution of a different kind.”