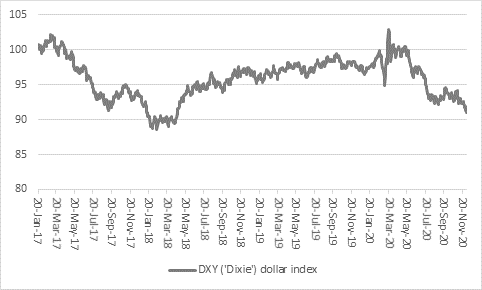

“Copper and iron-ore trade at seven-year highs, bids for G4S on this side of the Atlantic and Slack on the other and the planned multi-billion dollar listings of Airbnb and DoorDash all make this look and feel like a roaring bull market, despite the pandemic and the uncertain economic outlook,” says Russ Mould, AJ Bell Investment Director. “Another sign that animal spirits are starting to run high is the ongoing slide in the dollar to two-and-a-half year lows, using the trade-weighted basket of currencies that makes up the DXY (or ‘Dixie’) index as a guide.

“Given its status as the world’s reserve currency, which is backed by the world’s biggest economy, biggest stock and bond markets and only real global military superpower the greenback is usually seen as a haven asset during times of stress.

“That also means demand for it can wane when investors are confident that better times are ahead, so both financial markets and Donald Trump may be united in their pleasure at seeing the dollar decline – the President of the USA has, after all, spent much of administration railing against dollar strength and the currency is now down by 10%, based on the DXY index, since his inauguration in January 2017.

Source: Refinitiv data

“A loss of value in the globe’s reserve currency, and a major haven asset, has potential implications for range of markets, and not just foreign exchange, especially as there are many possible reasons for the dollar’s slide beyond growing optimism about vaccines and the economic outlook for 2021.

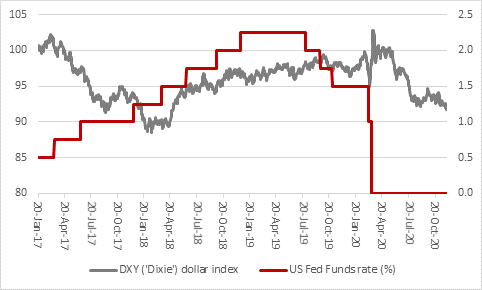

• The President regularly complained about the US Federal Reserve’s monetary policy, arguing that chair Jay Powell and the Federal Open Markets Committee were running it too tight. Whether they listened to the President, heeded stress in the financial markets in autumn 2019 or took other data on board, Mr Powell and colleagues had begun to push through interest rate cuts even before the global pandemic pulled the rug from under the US economy in 2020.

Source: US Federal Reserve, Refinitiv data

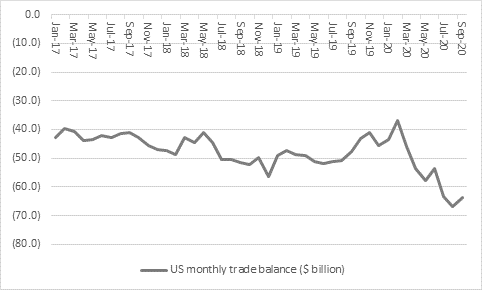

• President Trump’s trade war with China unsettled markets and seemed to bring no great economic benefit. The US trade deficit has surged back toward its all-time highs, with the result that dollars are flowing out of America to pay for the overseas-produced goods that consumers are sucking in to the country.

In some ways this can be seen as a good sign. Way back in 1960, Professor Robert Triffin argued that America would always have to run a trade deficit, and out more in dollars than received, to ensure the world had enough of the reserve currency to go around. The alternative would be a painful liquidity squeeze on the globe’s economy and financial markets alike as dollars flooded home.

Source: FRED – St. Louis Federal Reserve database

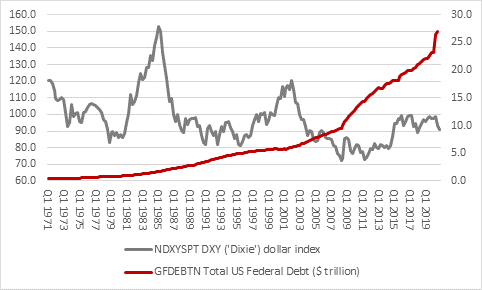

• President Trump has overseen a huge increase in the Federal deficit. When he took office America’s national debt was $18.9 trillion. It began to surge even before the pandemic and has soared in its wake to $27 trillion and although Republicans and Democrats have failed to agree upon a further round of another round fiscal stimulus, the debate centres on how the degree of further borrowing, not whether there should be further debt creation or not.

Source: FRED – St. Louis Federal Reserve, Refinitiv data

“The issue of growing debt is not unique to America – something which may be sparing the dollar a few more blushes – but it will surely continue a trend of ever-higher Government debt ceilings. That really dates back to the early 1970s, when Richard M. Nixon took American off the gold standard so he could pay for welfare programmes and the Vietnam War, but the trend is clearly accelerating. Remember that Moody’s downgrade of America’s credit rating, and summer of turmoil in financial markets, came after 2013’s debt ceiling suspension, when the limit was $16.7 trillion. It had taken America 237 years to get there but Uncle Sam has taken just seven years to overspend by a further $9.3 trillion.

“Anyone who takes the view that American debt is not a sustainable path will be wary of the dollar.

“Anyone who feels that the COVID-19 can be contained and the world build a reliable recovery will also fight shy of the buck, especially if they buy into Triffin’s theories, which imply that a weak dollar is the natural result of a strong US economy and robust global trade flows – both of which would logically benefit emerging markets and commodities, asset classes that traditionally do well when the dollar is weak.

“The dollar is likely to hang tough for a while yet, not least as suitable candidates to replace it as the world’s reserve currency are in short supply: China's renminbi is not fully convertible, a return to gold will impose disciplines which no politician or central banker will accept (or can afford) and cryptocurrencies do not have universal acceptance.

“But any attempt to reset currencies – and debts – could yet be spearheaded by central bank-backed digital currencies (CBDCs), a trend which must be closely watched.”