“The Democrats are getting their wish and the House of Representatives has passed another motion of impeachment against President Trump, following two more in December 2019 but US stock markets seem be taking the news in their stride for three reasons,” says AJ Bell Investment Director Russ Mould. “First, it is unclear whether the Senate will deliver the two-thirds majority required to remove Mr Trump from office, as nearly a third of the Republican in the Upper House will need to support the motion. Second, President-Elect Biden will be inaugurated on Wednesday 20 January to end Trump’s sole term in office anyway. Finally, the three previous impeachment episodes of modern times had relatively little impact upon markets, which were influenced far more strongly by the prevailing economic backdrop and the outlook for corporate earnings and dividends. Ultimately, share prices care more about profit than politics.

“Looking at this political event through the narrow prism of financial markets, there are three precedents.

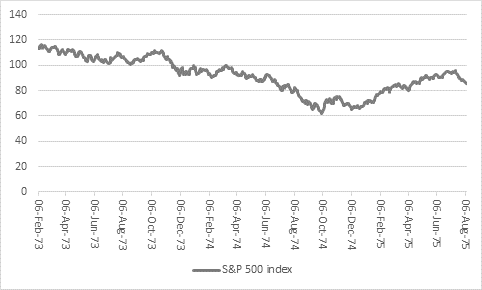

• The Republican Richard Nixon resigned in the second year of his second term in August 1974, after the impeachment process had begun in February of that year and received judicial approval on three counts in July, following the Watergate scandal. The US stock market, as benchmarked by the S&P 500, fell consistently as Watergate unravelled Nixon’s Presidency and the index only bottomed two months after his departure.

Source: Refinitiv data, from one year before Nixon's impeachment (on 6 Feb 1974) to one year after his resignation (on 9 Aug 1974)

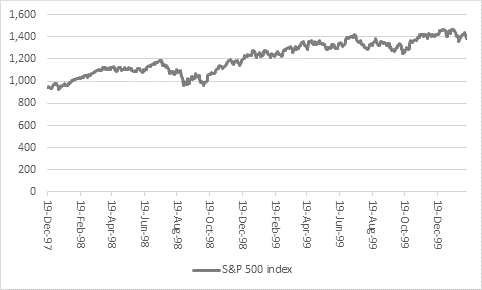

• The Democrat Bill Clinton was impeached in December 1998 on two counts but acquitted by the Senate in February 1999. In a stark contrast to the Nixon era, the US stock market sailed on regardless as Clinton became entangled in the so-called Monica Lewinsky affair and it picked up speed once he was acquitted of perjury and obstruction of justice.

Source: Thomson Reuters Datastream - from one year before Clinton's impeachment (on 19 Dec 1998) to one year after his acquittal (on 12 Feb 1999)

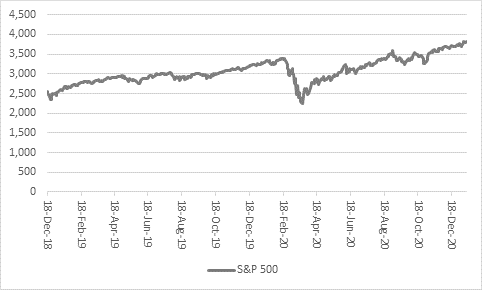

• Trump himself was impeached on two counts on 18 December 2019, only to be acquitted by the Senate on 5 February 2020. The S&P500 did not skip a beat during the proceedings and although it stumbled badly shortly afterwards this was due to the pandemic and subsequent US recession. Even then, US equities quickly resumed their upward march, bought by fresh monetary stimulus from the US Federal Reserve, in the form of more interest cuts and more Quantitative Easing, and fiscal support from the economy from the $2.2 trillion CARES Act.

Source: Refinitiv data - from one year before Trump's impeachment (on 18 Dec 2019) to present day

“However, it therefore looks to be simplistic to assume that politics alone set the tone for markets.

• During Nixon’s second term, the US lurched into recession after the 1973 oil price shock, as inflation rocketed and the US Federal Reserve began to jack up interest rates in response, creating a terrible environment for stocks.

• Under Clinton, the picture could hardly have been different – even allowing for the 1997-98 Asian currency and emerging market debt crisis which ultimately brought down the Long Term Capital Management hedge fund and forced the Federal Reserve to cut interest rates and step in with a bail-out. The economy buzzed along with annual growth rates of more than 4%, inflation was benign at around 2%, oil was falling sharply (putting money in consumers’ pockets) and the markets were perceived to have the backing of the ‘Greenspan put,’ whereby the Fed would act if stocks began to wobble.

• Under Trump, the pandemic and recession ended a long-running bull market but did so only briefly. A new one quickly began, thanks initially to fresh monetary stimulus from the US Federal Reserve, in the form of more interest cuts and more Quantitative Easing, and fiscal support from the economy from the $2.2 trillion CARES Act. The S&P 500 is now up by 70% from its 21 March 2020 closing low of 2,237 as hopes that a vaccination programme will lead to a swift recovery in US economic activity and corporate earnings, dividends and buybacks.

“Perhaps a greater threat to the current bull run in US stocks is therefore an unexpected problem with the vaccination plan, such as side-effects or manufacturing or distribution difficulties, with the result that the economy double-dips, although even then markets would doubtless look to Congress for fiscal stimulus and the Federal Reserve for monetary stimulus for a bail-out of one kind or another.”

|

US equity bull markets since 1945 |

|||||

|

Start |

Finish |

Duration (days) |

Start |

Finish |

Gain |

|

03-Jan-50 |

03-Aug-56 |

2,404 |

17 |

50 |

194.1% |

|

22-Oct-57 |

13-Dec-61 |

1,513 |

39 |

73 |

87.2% |

|

26-Jun-62 |

14-Feb-66 |

1,329 |

52 |

94 |

80.8% |

|

07-Oct-66 |

29-Nov-68 |

784 |

73 |

108 |

47.9% |

|

26-May-70 |

11-Jan-73 |

961 |

69 |

120 |

73.9% |

|

04-Oct-74 |

28-Nov-80 |

2,247 |

62 |

141 |

127.4% |

|

12-Aug-82 |

25-Aug-87 |

1,839 |

102 |

337 |

230.4% |

|

19-Oct-87 |

16-Jul-90 |

1,001 |

225 |

369 |

64.0% |

|

11-Oct-90 |

24-Mar-00 |

3,452 |

295 |

1,527 |

417.6% |

|

09-Oct-02 |

09-Oct-07 |

1,826 |

777 |

1,565 |

101.4% |

|

09-Mar-09 |

19-Feb-20 |

3,999 |

677 |

3,386 |

400.1% |

|

23-Mar-20 |

13-Jan-21* |

296 |

2,237 |

3,810 |

70.3% |

|

Average |

|

1,941** |

|

|

157.9% |

Source: Refinitiv data. *To date. **Excludes current bull run that began in March 2020.