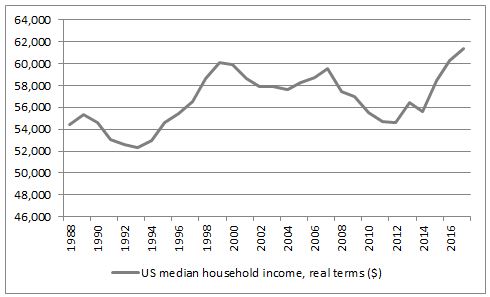

“Data released by the US Census Bureau reveals that the median US household income, in real terms, is finally back at 2007 levels, ten years after the financial crisis began at $61,372. But this could hardly be a bigger contrast to data on US household net worth, which has just crossed the $100 trillion mark for the first time ever and is already nearly 50% higher than at the cyclical high of a decade ago,” says Russ Mould.

Source: US Census Bureau; FRED -St. Louis Federal Reserve database

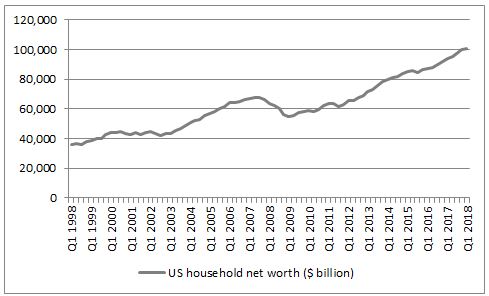

“The difference is likely to be accounted for by the surge in the value of financial and other assets – equities, bonds, property and frankly everything from vintage cars to art to wine to baseball cards – and this is one warning that at some stage another collapse in financial markets will sweep around the globe.

Source: FRED -St. Louis Federal Reserve database

“Household net worth cannot sustainably grow this much faster than incomes (or for that matter US GDP which is 17% higher than it was in Q3 2007, in real terms).

“The combination of zero-interest-rate policies (ZIRP) and Quantitative Easing (QE) in the West has contributed substantially to asset price inflation, as savers have looked for options other than cash in an attempt to generate a return on their money (and protect it from inflation).

“Assets have been bid up (and up) and at some stage there has to be chance that they correct, just as happened in 2000 and 2007, the last occasions when growth in household net worth had outpaced growth in both GDP and household net income for several years in a row.

“The question then is what could trigger this pull-back? History suggests it will be an unknown unknown, as something sweeps in from left field to light the blue touch paper (such as the collapse in the Floridian property market that tipped an over-indebted financial system over the edge in 2007).

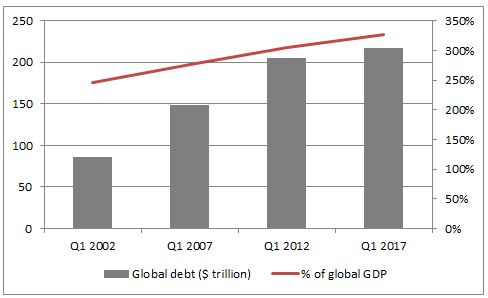

“Lofty valuations and increased debt are both classic preconditions for any financial market calamity and they are in place, judging by the US household net worth figures and figures from the Institute of International Finance which show the global borrowing now massively exceeds the high of 2007.

Source: Bank of International Settlements, Institute of International Finance, Haver Analytics

“That means one possible catalyst for disaster is a classic one – a policy error from a central bank and particularly the US Federal Reserve. This is because higher borrowings, and higher exposure of households to financial markets for their wealth, means the impact of any interest rate hikes and drop in securities’ valuations could be magnified.

“This puts the Fed in a bind. Inflation is ticking up in the US, and frankly across developed markets (and that’s before asset price inflation is taken into account), so chair Jerome Powell and team will want to nip this in the bud.

“They will also want to normalise policy so it can build up some ammunition for the next downturn, since the Fed has cut interest rates by an average of 5.25% since 1970 in response to recessions, once it has embarked upon a down-cycle in borrowing costs. It is hard to cut by that much when the headline Fed Funds rate is 2.00%.

“But even a modest – and slow – increase in US borrowing costs, from 0.25% in November 2014, is starting to do damage to financial markets, especially now the US central bank is withdrawing QE (just as the European Central Bank is about to stop adding to it and even the Bank of Japan is being accused of stealth tapering).

“Cryptocurrencies blew up first, followed by low-volatility strategies and then emerging markets – the currencies of Argentina, Russia, Brazil, Indonesia and India, all among the world’s 25 largest economies, are at or near all-time lows against the dollar, which is responding to tighter policy in the USA.

“The Fed seems determined to press ahead with rate hikes and the danger is that they overdo it, hence Fed policy error remains the most likely candidate for a fresh tumble in markets. It is not for nothing that German economist Rudi Dornbusch noted:

‘No post-war recovery has died in bed of old age – the Federal Reserve has murdered every one of them.’”