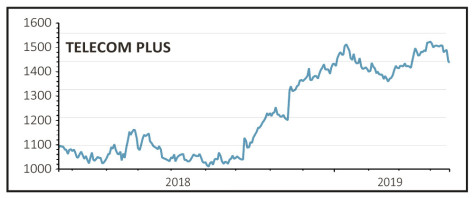

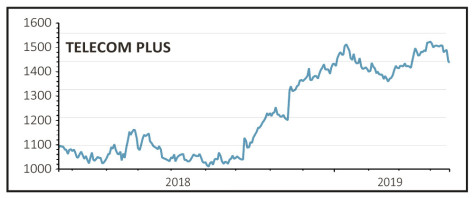

TELECOM PLUS (TEP) £14.26

Gain to date: 4.5%

There was good and bad news with Telecom Plus’ (TEP) full year trading update. Positive news about growth with customer and service numbers has been offset to a degree by circa £56m pre-tax profit being at the lower end of previous guidance.

Earnings were hit by a very mild winter which reduced energy revenue. It also incurred modest losses from expanding into other business areas and it looks like competition is heating up again.

Telecom Plus’ firm refusal to use existing customers to supplement discounted rates for new ones can hamper growth at times. The expectation is that stricter rules on new suppliers will lower the number of entrants running at a loss in a desperate customer land grab, helping Telecom Plus.

But perhaps more importantly, the company is helping itself, cleverly tearing up its wholesale supply deal with nPower to nail down a new, more flexible one.

Wholesale supply deals can be a profit driver and this is reflected in pre-tax profit forecasts for this year of £60m to £65m, implying up to 16% growth. Investors can also look forward to high single-digit increases to dividends.

SHARES SAYS: This is a great company to own for the long-term.

Keep buying

‹ Previous2019-04-25Next ›

magazine

magazine