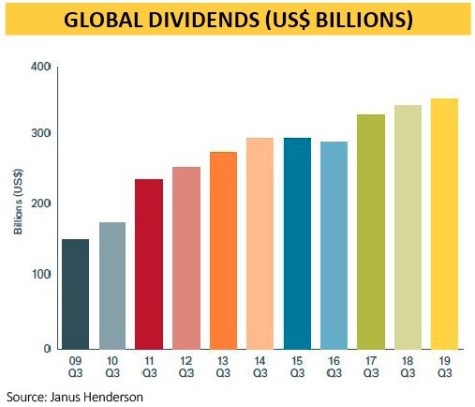

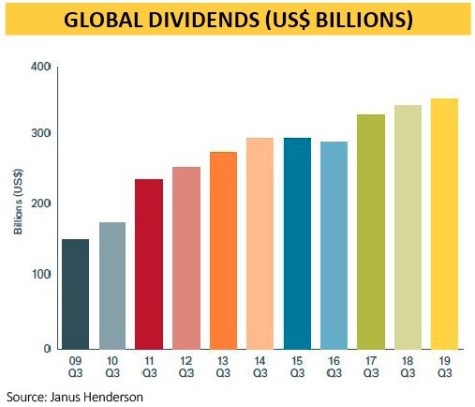

Global dividend payments grew by 2.8% in the third quarter to $355bn, the slowest rate of increase for several years according to research by asset manager Janus Henderson.

Its Global Dividend index measures how much income firms are paying their investors on their capital and is calculated in US dollars with a base year of 2009 and a base value of 100.

At the end of September the index hit 193.1, meaning that over the past 10 years global dividend payments have increased by just over 93%.

US dividends hit an all-time high of $124.7bn in the third quarter, equal to a record 35% of the total global amount. Underlying dividend growth was 8%, but as profit growth slows fewer US companies are raising their payout.

UK dividends rose by 2.9% to $34.3bn including large special payouts from mining firms, but regular dividend payments rose by just 0.6%.

Australia, another big source of dividends, was weak with total third quarter payouts down 5.9% to $18.6bn.

The report forecasts a further slowdown in dividend growth this quarter and into next year.

‹ Previous2019-11-21Next ›

magazine

magazine