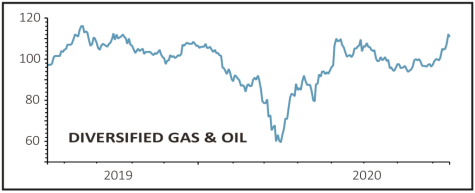

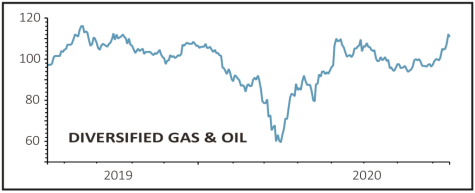

Diversified Gas & Oil (DGOC) 112.4p

Gain to date: 10.2%

Original entry point: Buy at 102p, 21 May 2020

Supported by a recovery in oil prices and robust operating performance, our faith in Diversified Gas & Oil (DGOC) is gradually being rewarded.

A notable feature of the recent first-half results (10 Aug) was the continuing commitment to a generous dividend.

The company’s interests in low-cost US natural gas production enables the business to generate plenty of cash.

Adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) rose 11% year-on-year to $146 million. Average first-half net production was 95,100 barrels of oil equivalent per day, up 26% year-on-year.

The company declared an interim dividend of 3.75 cents per share, up 7%, backed up by the ‘strength and durability’ of its cash flows.

Based on consensus forecast data from Refinitiv the shares trade on a 2021 dividend yield of 10.1%. The company’s strong balance sheet position, with chief executive Rusty Hutson flagging total liquidity of $220 million, should also enable it to take advantage of any opportunities created in the current challenging environment.

SHARES SAYS: The company has demonstrated its ability to buy assets at attractive prices to grow its production and to manage these assets efficiently. These qualities underpin a very generous stream of income.

‹ Previous2020-08-20Next ›

magazine

magazine