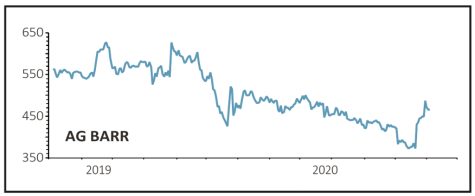

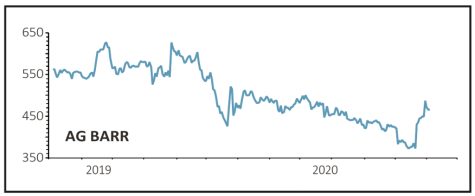

A.G. BARR (BAG) 469p

Loss to date: -6.1%

Original entry point: Buy at 499.5p, 7 May 2020

Having drifted downwards since our bullish call on the stock, AG Barr’s (BAG) shares enjoyed a strong rally in September.

A key catalyst for the rally was the publication of its half-year results (22 Sep), where AG Barr maintained full-year profit guidance and said it expects to resume dividend payments in 2021.

Results for the six months to 25 July reflected the challenges created by the pandemic, yet Liberum Capital upgraded its full year pre-tax profit forecast from £19 million to £30.7 million due to a better than expected sales performance, tight cost control and better gross margins from the IRN-BRU and Rubicon brands owner.

AG Barr is proving its resilience during the Covid-19 pandemic, performing strongly in the ‘take-home’ channel and starting to see sales in the hospitality and ‘on the go’ consumption segments recover as lockdown restrictions ease. Cash continues to build on the balance sheet too.

Liberum insists ‘the resilience shown during Covid-19, the flexibility of management to adapt to the changing trading patterns with a quick shift in product and channel mix underpins our confidence that AG Barr remains a high-quality company with highly resilient cash flows’, while Shore Capital sees the depressed stock rating as ‘an excellent entry point opportunity for such a high-quality equity’.

SHARES SAYS: AG Barr is a long-term compounder with a portfolio of iconic brands. Keep buying.

‹ Previous2020-10-08Next ›

magazine

magazine