Most people will be familiar with the term emerging markets but what about frontier markets? These are the countries like Sri Lanka and Croatia which sit in the category just below ‘emerging’.

Markets are placed in one of three categories – developed, emerging, or frontier – based on criteria such as the level of economic development, the size and liquidity of their capital markets plus how accessible they are to international investors.

According to index provider MSCI levels of economic development are not used to distinguish between frontier and emerging markets (with this measure only used to delineate developed markets) ‘given the very wide variety of development levels within each of these two universes’.

Status is instead determined by a series of other tests. As at May 2020 to achieve ‘frontier’ classification, alongside other metrics, a market had to include two companies with a valuation of at least $700 million, have at least some openness to foreign ownership with some capacity for capital inflows and outflows.

By comparison an emerging market had to have at least three companies with a market cap of $1.4 billion and have ‘significant’ openness to foreign ownership.

Companies do graduate from the frontier to emerging classification, the latest example being Kuwait which achieved its ‘promotion’ in November 2020.

MSCI aims to set the bar high, noting the intention is that such movements are ‘irreversible’. However, there are examples of markets going the other way. In 2013 Morocco moved from emerging to frontier status.

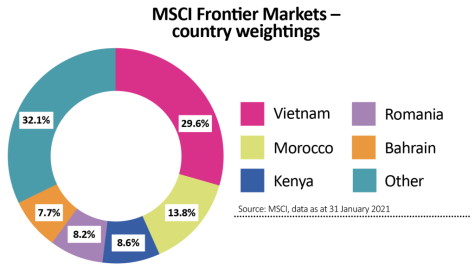

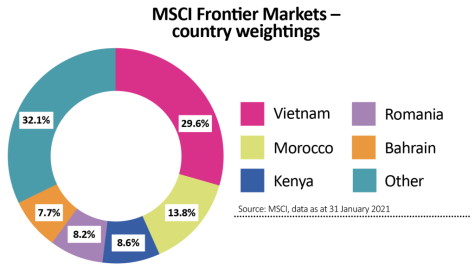

The pie chart shows the MSCI Frontier Markets index is dominated by Vietnam which has a weighting of nearly 30%.

‹ Previous2021-02-25Next ›

magazine

magazine