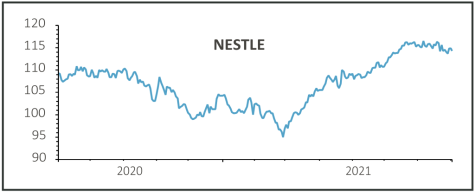

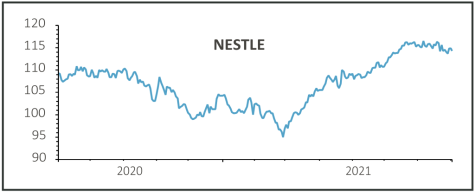

Nestle (NESN:SWX) CHF 114.70

Gain to date: 14.7%

Original entry point: Buy at CHF 100, 4 February 2021

Shares in iconic food and drink-producer Nestle had a bit of a wobble after the firm reported a 10% increase in underlying first-half earnings but a small (0.2%) dip in its operating margin to 16.7%.

Like everyone else, Nestle is experiencing cost inflation in its raw materials but unlike many firms it is able to raise prices to at least mitigate some of the impact.

Organic sales growth was 8.1%, of which 6.8% was what the firm calls real internal growth – higher sales and increased market share – and 1.3% was thanks to higher prices. Moreover, the firm raised its full year sales growth forecast.

Headline sales were only up 1.5% to CHF 41.8 billion, as foreign exchange movements reduced revenues by 3.5% and divested businesses knocked another 3.1% off the total.

True to his promise when he took over, new-ish chief executive Mark Schneider continues to take the firm out of low-margin businesses and into direct-to-consumer markets.

The North American water business was sold for $4.3 billion and the proceeds recycled into buying the core nutrition and supplement brands of The Bountiful Company.

Nestle’s pet food business – makes up 15% of sales – was the biggest growth contributor in North America and Europe, and posted double-digit sales growth in China.

SHARES SAYS: Nestle is a world-class business, we remain buyers.

‹ Previous2021-08-05Next ›

magazine

magazine