Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

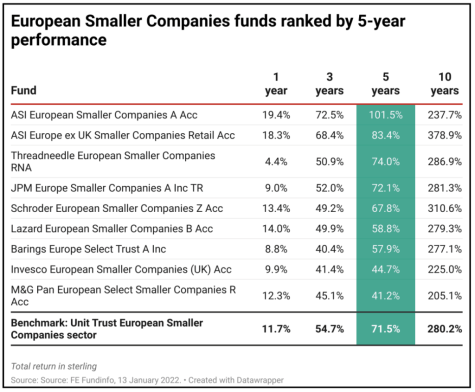

The best performing European small cap funds

Investment trusts investing in smaller companies on the continent have performed better than their open-ended counterparts

Thursday 20 Jan 2022 Author: Tom Sieber

magazine

magazine