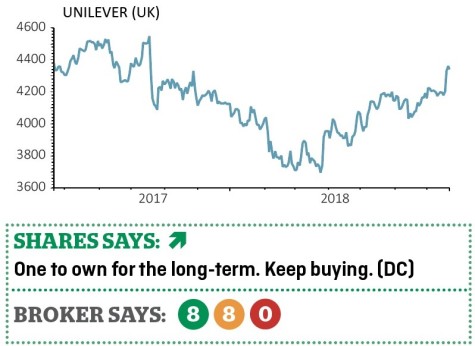

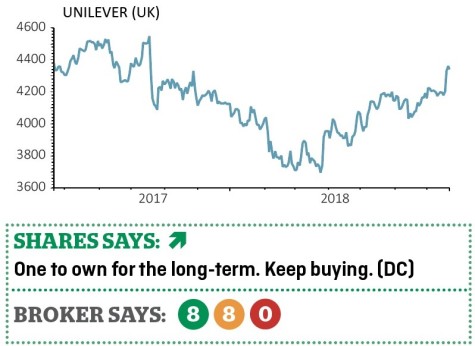

Unilever (ULVR) £43.40

Gain to date: 2%

Shares in Unilever (ULVR) hit a nine-month high after second quarter results beat expectations and there was confirmation that it would buy back €3bn of shares between 20 July and the end of 2018. It has already spent the same amount on share buybacks in the first half of its financial year.

A 7.8% rise in underlying earnings per share to €1.22 was approximately 3% higher than forecast thanks to modest sales growth and a better operating margin.

‘With 2.2% volume growth in the first half, Unilever’s volume growth is firmly ahead of the market and global peers,’ says investment bank Berenberg.

‘We think Unilever has taken the biggest steps among peers to increase its agility, reduce costs, embrace digital channels and future-proof its portfolio, which is not reflected in the valuation. The 24 acquisitions since 2015 have added €3.5bn sales and are on track to boost organic growth by 100 basis points by 2019.’

Shareholders will be called to vote in late October on the Anglo-Dutch company’s plan to scrap its dual-headed legal structure. If approved, the company is widely expected to leave the FTSE 100 index as a result of basing itself in the Netherlands as a Dutch entity.

‹ Previous2018-07-26Next ›

magazine

magazine