Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Trade War: How could it impact your portfolio?

Talk of escalating trade tensions is widespread and this is very important to investors. There is increasing concern that tariffs imposed on a swathe of overseas goods by US president Donald Trump, and Chinese retaliation, threaten a bruising time for a range of shares, funds and other assets owned by investors around the world including the UK.

TRADE WAR:

IMPACT ON INVESTORS IN A NUTSHEL

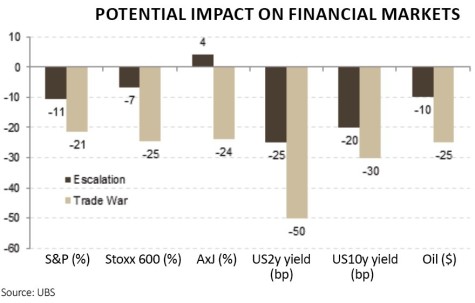

Stock markets are not yet fully discounting a trade war scenario, says UBS.

It envisages more than 20% downside for major markets in the US, Europe and Asia.

It suggests an all-out trade war would lead to a decline in global growth and a rise in global inflation. Corporate earnings could fall and therefore stock markets would be hit.

As the US and China hurtle toward a fully-fledged trade war, so the spectre of stagflation, rapidly rising interest rates and even recession will loom increasingly large in the minds of investors as doubt is cast over corporate investment and global consumption in the months ahead.

For now, the UK stock market is refusing to play ball. At 7725 (24 July) the FTSE 100 index gives the impression of rude health. At current levels the leading benchmark is trading as high as at any time during 2017, and is just 53 points, less than 1%, off its 7778 all-time high hit in January this year.

But against a backcloth of rising US interest rates, slowing European Central Bank stimulus, Brexit chaos and more, this is an extra problem investors do not need.

So what does the fall-out over global trade mean for investors and their portfolios, what measures can be taken to protect yourself, and where might pockets of opportunity emerge?

In this article we have surveyed the opinions of several economists, market strategy and portfolio management experts to answer these questions.

THE STORY SO FAR

Fresh from the US starting to impose tariffs on $34bn worth of Chinese goods on 6 July, and China responding in kind, the two countries attempted to negotiate a solution but failed.

The attempt instead resulted in Washington proposing fresh tariffs on another $200bn of Chinese imports and China saying it had no choice but to ‘fight fire with fire’.

The situation keeps escalating. Trump last week threatened to impose tariffs on all $500bn of Chinese goods entering the US.

What started out as controls on steel and aluminium has now been expanded to include an array of consumer goods, from vaping devices and mattresses, to handbags and digital cameras.

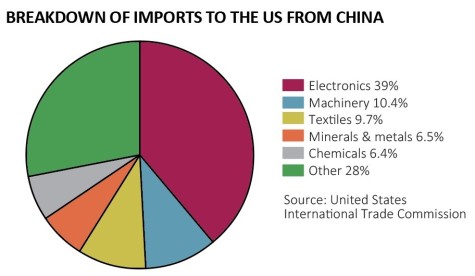

Electronics, machinery and textiles are some of the most popular US imports from China by value, according to 2016 statistics from the United States International Trade Commission.

DOES THE POLITICAL AND ECONOMIC CHAOS MATTER?

It’s incredibly hard to know how the economic and political events around the world will play out. What we do know is that this is a very complex issue because trade statistics can be bent to fit any agenda, leaving room for possible manipulation of the data.

According to Saxo Bank, global trade has grown by an average

4.2% a year during the past

215 years, a 6,437-fold increase. That’s in spite of a whole host of awful events unfolding that set back trade, not least the two world wars.

‘The long-term trend underscores what economists have known for centuries – free trade

increases wealth and forces countries to specialise and divert resources to industries with comparative advantages,’ says Saxo Bank’s Peter Garnry.

When a country runs a trade deficit on a particular item, such as steel, it is because the country’s steel industry is not competitive on the global stage, presuming there are no other factors to tip the scales. This is the basic principle behind free trade.

By importing items produced more cheaply in another country, the home country can divert its resources to those sectors where they have a competitive advantage, adding to overall wealth.

In Garnry’s view, this is exactly why Trump and the US protectionist stance over steel production is folly. ‘The vast wealth increase [in the US] over the past three decades has come from industries such as semiconductors, software, biotechnology, healthcare equipment and finance,’ he says.

NO WINNERS FROM A TRADE WAR

‘Tariffs and protectionism benefit no one, especially given the global nature of business,’ says Miles Eakers, chief market analyst at fintech company Centtrip.

This is a widely held view among economists, investment analysts and fund managers because the downside to the global economy is stark.

‘We expect this will have a meaningful impact on US consumer inflation as well as a meaningful drag on US GDP growth,’ says UBS economist Robert Martin, citing the Chinese government’s pledge to retaliate against new US duties. ‘China is by far the largest provider of consumer products to the US.’

Following the enactment of 1930 Smoot-Hawley Tariff Act, the US saw its imports and exports collapse by more than 60% between 1929 and 1933.

‘This arguably made the Great Depression worse, and had considerable geopolitical consequences in the following decade,’ says Tai Hui, chief market strategist at JP Morgan Asset Management.

It didn’t do stock market returns any good either. Between 1928 and 1953 the S&P 500 index returned an average 1.3% a year (excluding dividends), according to Bloomberg data. That’s a very low return for equities historically, and ‘even including dividends, the return is around half of the historical trend,’ says Saxo’s Garnry.

History also suggests that restrictions on trade tend to really hurt the countries that impose them. For example, tariffs slapped on Japanese auto exports by the Ronald Reagan administration in 1981 led to 60,000 job losses in the US. However, that episode avoided escalating into a full-blown trade war and the impact on the US stock market was minimal.

LITTLE DAMAGE SO FAR

So far the negative consequences of the trade war posturing has

had a limited impact on growth, although it is early days.

Prolonged tit-for-tat actions could affect economies in two ways. First is the impact on confidence, which could lead companies to delay investment and spending. Second is the direct impact of tariffs as they push up costs and depress end demand. The breadth and depth of global supply chains will amplify this impact.

‘We observe that the prices of some US imports have increased significantly, such as washing machines, whose prices have increased by 20% over the past two months, but the overall effect is still marginal,’ says Christopher Dembik, head of macro analysis at Saxo Bank.

Mirabaud’s best/worst stocks for a trade war

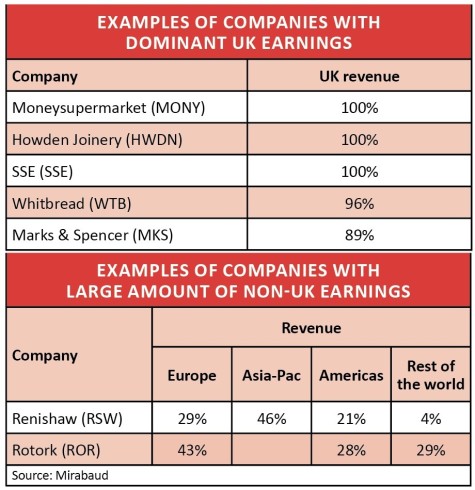

Buying or selling stocks based solely on their exposure to some future disaster that has yet to materialise is not a terribly sensible way of investing. But understanding the scale of exposure a stock might have to any escalation in trade war manoeuvres could come in handy.

The strategy team at banking group Mirabaud have cast their screening tools over the entire Stoxx 600 index of UK and European companies. The exercise is designed to highlight what Mirabaud believes are safer haven stocks if trade war guns really start blazing, thanks to their home market focus, inexpensive valuation and, ideally, providing services rather than goods.

It has a second list of companies with high overseas markets, largely selling goods and currently trading on ‘punchy valuations’ which can be considered as stocks to fear.

‘If international trade clogs up, then simple common sense favours domestic businesses involved in providing a service over those with a broad global footprint selling stuff,’ says the Mirabaud strategy team.

FTSE 100 VS FTSE 250

Although the FTSE 100 is currently close to record highs, the UK has actually been one of the worst performing developed markets in the two years since the Brexit referendum given weak macro and political uncertainty. What’s clearer is that the FTSE 100 is far more international, reliant on exports and overseas revenues, and complex international supply chains to manage.

The UK blue-chips are also massively exposed to commodity markets, where the FTSE 100 index is heavily populated by oil, gas and mining at the upper end of the market cap spectrum.

This situation arguably favours more domestically concentrated FTSE 250 companies in the short-term, which makes them more insulated from global trade wars, albeit not all immune.

‘We expect the FTSE 250 to offer more upside opportunity given the ongoing political uncertainties surrounding trade tariffs,’ says WisdomTree associate director Aneeka Gupta.

NIPPED IN THE BUD

‘On trade, it is difficult to read Trump’s intentions, but forthcoming mid-term elections, his love for a deal, and the fact that US corporations and unions are starting to grumble about the negative consequences for US jobs seem to suggest there should be a desire on all sides to de-escalate tensions over the summer,’ says Ed Legget, who runs the Artemis UK Select Fund (B2PLJG0). That inspires hope for investors, and eases the pressure of trying to second-guess the future.

‘We are especially sceptical of anyone trying to position for these events in advance as it rarely adds value to portfolio returns,’ says Cyrique Bourbon, multi-asset portfolio manager for Morningstar Investment Management.

The bigger opportunity seems to be in assessing valuations in equity and bond markets in a world where investor sentiment can appear complacent.

‘It’s always difficult to predict the timing and catalyst for any strength or weakness but we are not forecasting some imminent or catastrophic decline,’ says Bourbon. Avoiding recession is in everyone’s interest.

Mid-Wynd: Hoping for the best, anticipating the worst

The investment team at Mid-Wynd International Investment Trust (MWY) have been prepping for a scaling up of trade war tensions for a while, assuming the worst as a prudent measure.

‘Though it is a risk-off market at the moment, we have generally seen improving cash flows in many of our holdings and we want to avoid selling shares merely because markets may be taking a cautious short-term view,’ says Simon Edelsten, manager of Mid-Wynd.

Over the last few weeks the trust has run the rule over its entire portfolio to assess first order effects. That means stocks that could see demand directly affected by recently- announced tariffs.

‘About six portfolio investments are directly affected, making up less than 10% of assets, so we are less exposed than equity indices which contain traditional industrial and automotive stocks,’ says Edelsten.

European companies such as PerkinElmer, Siemens Healthineers and IPG Photonics all featured, yet were considered to be robust enough to withstand serious hits. Mid-Wynd did top-slice its stake in Agilent, which sells food testing equipment to China.

Second order effects of the current trade dispute were also assessed. This refers to portfolio companies that could see reduced business confidence from a very high level, a slowing Chinese economy (against a background of emerging market weakness and a strong dollar) and, perhaps least discussed, US businesses losing Chinese demand medium-term, possibly to the benefit of Japan.

Consumer products giants Procter & Gamble and Unilever (ULVR) bore the brunt of the trust’s exits.

‘The market regards these as defensive stocks, but they could equally be seen as quite expensive equities seeing low growth when emerging market currencies fall,’ rationalises Edelsten.

Mid-Wynd remains very keen on microchip companies, including industry giant Intel, which sells globally but may benefit from an ‘America First’ purchasing policy. The trust also continues to like Cadence and Synopsis, which are seeing a boom in design, and ASML, which makes the semiconductor fabrication plants.

‘The ASML share price has been weak during the trade dispute and we have added to our holding as the company may ultimately be a winner,’ says Edelsten.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Aequitas

Big News

- Sosandar is a rare retail success story in 2018 with soaring shares

- Asset valuation concerns cloud Hammerson as it seeks £1.9bn disposals

- Shareholders rally to block excessive pay packages

- Can Jack’s work its magic as Tesco’s new discount chain?

- Renewed speculation that GlaxoSmithKline could spin off consumer division

magazine

magazine