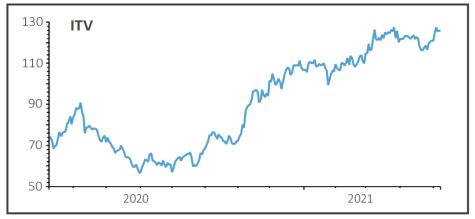

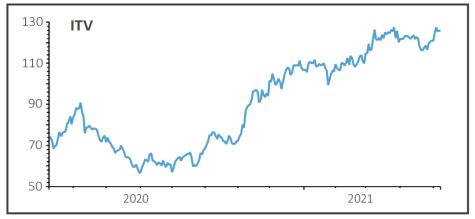

ITV (ITV) 125.4p

Gain to date: 65%

Original entry point: Buy at 76p, 30 April 2020

While the momentum behind ITV’s (ITV) shares may have stalled a little after a strong run around the turn of the year, there are catalysts which suggest there could be further upside in the near term.

In an encouraging first quarter update (5 May) the free-to-air broadcaster said it expected stronger growth in the second half of the year after reporting a 2% uptick in first quarter revenue amid an ongoing rebound in the advertising market.

Advertising revenue was up 68% in April year-on-year, and the company expects further gains for May and June of 85% or more.

This is underpinned by the return of the popular Love Island reality series and the delayed Euros football tournament.

Numis analyst Steve Liechti suggested that the shares are a good play on the improved macroeconomic backdrop through exposure to TV advertising, particularly as numbers are likely to look very strong versus a pandemic-disrupted 2020.

While Liechti sees ‘mid-term structural linear TV challenges that look tough to offset’ for the time being we would expect the market to reward the company’s recovery.

SHARES SAYS: Still a buy for now.

‹ Previous2021-05-13Next ›

magazine

magazine