Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

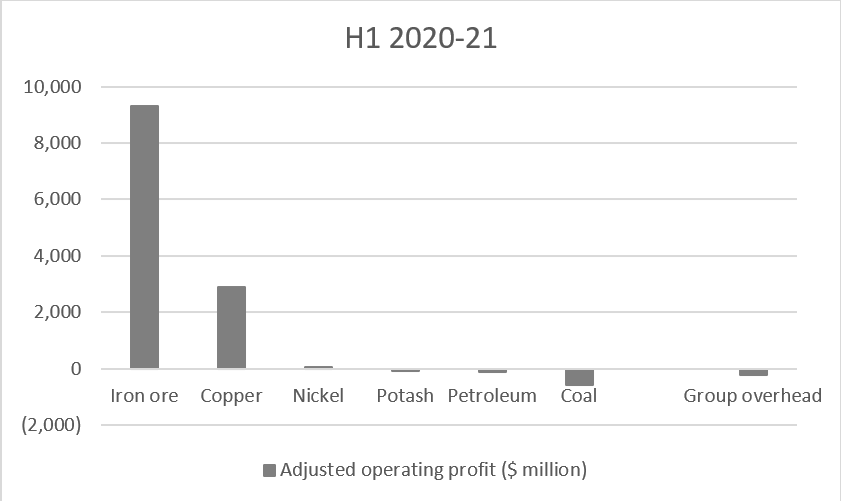

The miner has six main product areas. They are iron ore, copper, petroleum, coal (both metallurgical and energy), nickel and potash but on the basis of the company’s mix of adjusted operating profit from the first half iron ore and copper are the materials that really count.

Source: Company accounts

BHP’s trading update in July outlined production volumes for the year, and also offered guidance for fiscal 2022. In 2021, petroleum beat expectations, energy coal missed and the rest met. For 2022, copper, nickel, iron ore, metallurgical coal and petroleum could all show output growth while thermal coal will show a clear decline.

| BHP Output growth, year-on-year (%) | ||

|---|---|---|

| 2020-21 | 2021-22E | |

| Nickel | 11% | (4%) to 7% |

| Iron ore | 2% | (2%) to 2% |

| Metallurgical coal | (1%) | (4%) to 8% |

| Copper | (5%) | (3%) to 8% |

| Petroleum | (6%) | (4%) to 3% |

| Thermal coal | (17%) | (33%) to (22%) |

Source: Company accounts, management guidance for 2021-22E

In terms of the headline numbers, the analysts’ consensus forecasts are as follows:

- Sales of $59 billion against $43 billion a year ago, and analysts are looking for $63 billion in the fiscal year just begun

- A near doubling of statutory, or stated, operating profit to $30 billion, with a further increase to $35 billion in 2022

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

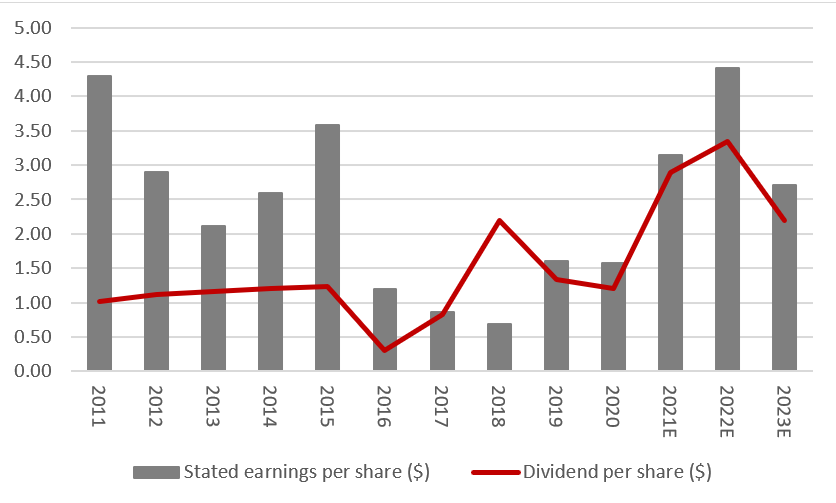

- A doubling of earnings per share (or EPS) to $3.15, with a further one-third advance in the coming year to $4.41

- And a dividend of $2.89 against $1.20 a year ago, with a further increment to $3.34 expected in the coming year. That means BHP is expected to show the greatest dividend growth in sterling terms of any firm in the FTSE 100 between 2020 and 2022 and is enough to leave the stock on a double-digit forward yield. Analysts will also watch out for any comments on share buybacks.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

The question then is whether the current earnings and dividend bonanza can last - and analysts do not appear to be convinced. They have sales, profits, earnings per share and dividends falling in the year to June 2023, which is in keeping with central banks’ view that current price inflation is ‘transitory,’ and the result of a post-lockdown surge in demand, production bottlenecks and shipping shortages. If we do get a really inflationary recovery, though, then consensus forecasts could prove conservative, although a downturn would leave them looking optimistic.

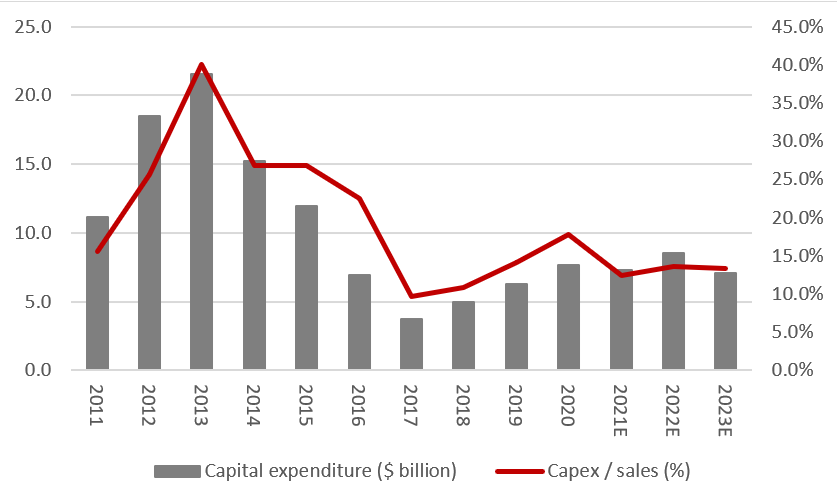

Two final numbers to watch are capital expenditure and net debt. Net debt ended the first half at $11.8 billion, the very bottom of the company’s $12 billion to $17 billion target range. Capex was forecast to be $7.3 billion in fiscal 2021 and the last published budget for 2022 was $8.5 billion.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts, management guidance

Analysts and investors will be watching for signs that capital discipline is being maintained, or not – and BHP has just launched a cash bid for Canadian nickel miner Noront. Shareholders will also seek updates on major new projects such as

- the Ruby oil and gas find in the Caribbean

- the Atlantis oil field in the Gulf of Mexico

- Australia’s South Flank copper mine

- the Jansen potash project in Canada AND

- the option to ramp up and expand the Spence copper mine in Chile

As a final point, BHP has already sold its US shale oil and gas assets. Media reports suggest the whole oil and gas business may up for review, while it is also looking to exit its thermal coal operations, the value of which it wrote down by $1.6 billion in the first half of the financial year just ended. CEO Mike Henry has said the process could take two years and that a sale or demerger were both possibilities.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 15/05/2024 - 16:51

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13