Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Glasgow’s COP26 summit will again remind policymakers and the public of where the world is now, in terms of its energy consumption and carbon footprint, and where it needs to be by 2050 according to 2016’s Paris Agreement but the resurgence in oil and gas prices – and therefore fuel and heating costs – means that a lot of consumers and corporations will be looking with concern at how the transition period is going to be managed,” says AJ Bell Investment Director Russ Mould.

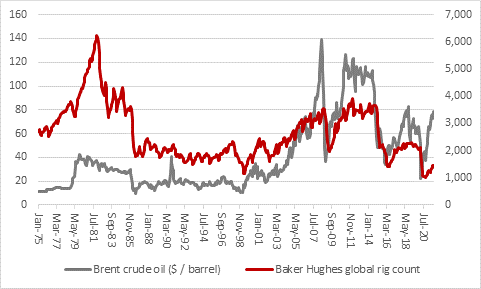

“Demand for energy is rising yet supply growth does not seem to be keeping pace. The last time Brent crude oil traded at $86 a barrel, in November 2010, over 3,000 oil rigs were active worldwide but only half that figure is drilling and producing now, according to data from Baker Hughes.

Source: Baker Hughes data, Refinitiv data

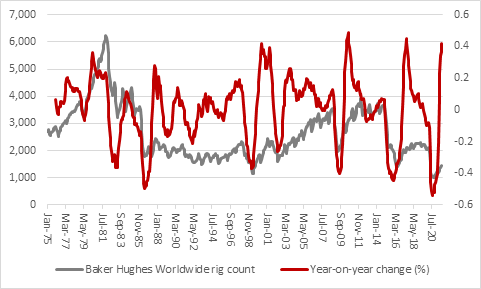

“The global rig count in September was up 42% year-on-year but activity still seems very subdued compared to prior surges in oil and gas prices.

Source: Baker Hughes data, Refinitiv data

“Environmental campaigners will view this as a good thing and as evidence that the globe is working hard to wean itself off its addiction to hydrocarbon-based fuels, in favour of more renewable alternatives, even allowing for technological improvements in productivity per rig.

“Baker Hughes’ data goes back to 1975 and on the 25 occasions when oil ended a month trading between $75-90 a barrel the worldwide rig count has only been lower twice. Both of those instances came this year, in June and July.

| Month | Brent crude oil ($ / barrel) | Baker Hughes global rig count |

|---|---|---|

| Nov-07 | 88.66 | 3,161 |

| Apr-10 | 86.28 | 2,676 |

| Nov-10 | 86.26 | 3,233 |

| Oct-21 | 86.24 | TBC |

| Oct-14 | 84.45 | 3,657 |

| Sep-18 | 82.79 | 2,258 |

| Oct-10 | 82.6 | 3,165 |

| Sep-10 | 81.23 | 3,122 |

| Mar-10 | 81.01 | 2,879 |

| Sep-07 | 80.84 | 3,166 |

| Jun-18 | 79.44 | 2,152 |

| Sep-21 | 78.56 | 1,448 |

| Aug-18 | 77.66 | 2,278 |

| May-18 | 77.65 | 2,096 |

| Dec-09 | 77.4 | 2,509 |

| Jul-07 | 77.35 | 3,144 |

| Jul-10 | 77.31 | 3,032 |

| Feb-10 | 76.87 | 2,982 |

| Nov-09 | 76.7 | 2,409 |

| Jul-21 | 76.47 | 1,380 |

| Oct-18 | 75.71 | 2,271 |

| Aug-10 | 75.33 | 3,127 |

| Oct-09 | 75.32 | 2,271 |

| Jun-21 | 75.25 | 1,325 |

| Apr-18 | 75.02 | 2,087 |

Source: Baker Hughes data, Refinitiv data

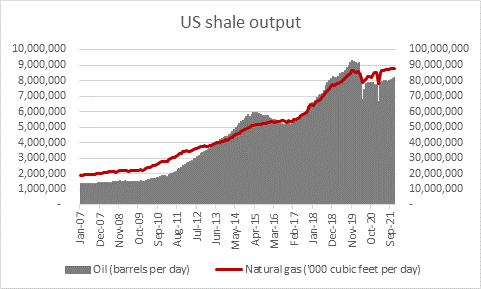

“Nor is American output from its shale oil and gas fields taking up the slack. The huge surge in US onshore output that helped keep a lid on oil and gas prices for much of the last decade has fizzled.

Source: US Energy Information Administration

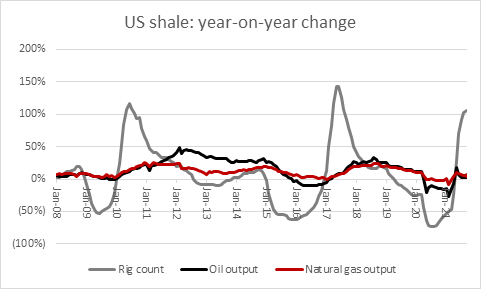

“According to the US Energy Information Administration, the aggregate number of active rigs on the Anadarko, Appalachia, Bakken, Eagle Ford, Haynesville, Niobrara and Permian shale fields is just 466. That may be double where it was a year ago, but it is barely 40% to 50% of the levels seen in 2007 and 2010 when oil was last in the $86 range.

“US shale production is barely growing at the moment, either, so it will be interesting to see if output does ramp up in the coming months as those rigs get cracking, especially as production per rig is so much higher than it was a decade and more ago, although questions do still remain over depletion rates and how quickly rigs may need to shift from well to well.

Source: US Energy Information Administration

“From the narrow perspective of financial markets (an angle unlikely to feature at all in Glasgow, where bigger issues will be the only consideration), investors must now consider why supply does not seem to be responding to higher prices, because this is what would usually happen, especially in the case of oil and gas where demand is fairly price inelastic. It could be because

- Oil executives still remember 2020’s oil price collapse and are wary of relying too much on the current boom

- Oil firms may be watching OPEC and its allies very carefully as they gradually increase supply, in the view that they could bring more oil and gas to market if they so choose (although not everyone believes this to be the case)

- Many oil firms, especially the US shale drillers, have substantial debts and they are preferring to reduce their liabilities rather than commit to fresh capital investment. According to the last Oil Patch Bankruptcy Monitor from Haynes Boone only 12 North American oil and gas producers filed for bankruptcy in the first half of 2021, the lowest total since 2015.

- Political opposition to new drilling is becoming ever fiercer, as evidenced by reports that the UK has denied Royal Dutch Shell permission to develop the Jackdaw natural gas field in the North Sea.

- In the face of political and public opinion, banks and financing institutions are become ever-more wary of providing funds to oil and gas firms for the development of new fields

- Oil executives are aware of this pressure and the opprobrium that any major new work could bring (along with the danger that making a return which compensates for the huge investment and risks involved could become more difficult, if taxes are increased or consumers and corporations are offered incentives to use alternative forms of energy).

“The end result could be that energy demand continues to rise but oil and gas supply is constrained and output from other sources such as wind or solar or hydroelectric is not quite ready to take up the slack (let alone the political hot potato that is nuclear).

“The logical corollary of that is what we have now – higher oil and gas prices, something that will make not just investors but consumers and corporations nervous if they last too long. Higher fuel and heating bills for consumers, and input costs for companies, are effectively a tax on their ability to spend and invest.

“Environmental campaigners may welcome higher energy prices, as the necessary catalyst for changes to behaviour and energy consumption and generation patterns and greater focus on the Paris Agreement’s goals. But whether the resolve of politicians and the public is as strong could now be tested.

“President Biden’s call for increased OPEC+ output of oil will hardly please campaigners as the world looks toward COP26 but politicians and central bankers will be aware of how oil price spikes in 1973 (after the Yom Kippur war) and 1979 (after the Iranian Revolution) played a key role in driving inflation higher, with damaging results to the global economy.

“And higher costs of living and working are already preoccupying consumers and companies as producer and consumer prices move sharply higher, developments which continue to concern both bond and stock markets as they ponder whether tighter monetary policy will be the result in the developed world.

“Financial markets’ attentions will therefore switch very quickly from Glasgow to Washington and London as the Federal Reserve and the Bank of England made their latest monetary policy pronouncements on 3 and 4 November respectively.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 15/05/2024 - 16:51

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13