Another boo-boo from Boohoo as retailer warns on profits again

Archived article: Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

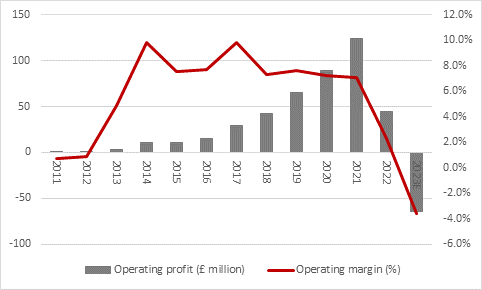

Increased costs, higher product returns and ongoing investment in warehousing and distribution meant that Boohoo issued profit warnings in December and May and lower-than-expected sales have now added to the tale of woe and forced the online retailer to issue another trading alert, this time alongside its first-half results.

Analysts had already been expecting a drop in profits for the year to February 2023 but that will now be deeper than expected, not least because forecasts of sales growth look wide of the mark as online fast fashion confronts the cost-of-living crisis and slumping consumer confidence.

As a result, Boohoo’s shares are sliding to fresh all-time lows, well below March 2014’s initial public offering price of 50p. The shares are, at least, still trading above the early-2015 all-time low of 22p, but anyone who bought at the top in summer 2020 at the high of 415p will find this scant consolation.

Source: Refinitiv data

Handling product returns via a physical shop is relatively easy, if a bit disappointing for the retailer. For an online service working to relatively thin profit margins that are supported by high turnover of stock, low costs and seamless logistics, a product return is a much bigger nuisance. And all the more so when sales are starting to slow.

Faced by the impact of the increased cost of living on consumers’ spending patterns, chief executive John Lyttle now fears that the first half’s 10% year-on-year drop in sales could extend across all of Boohoo’s fiscal year, through to February 2023.

Source: Company accounts, Marketscreener, management guidance on 28 September 2022

On Boohoo’s preferred metric of adjusted earnings before interest, tax, depreciation and amortisation (EBITDA), Mr Lyttle now believes the return on sales will drop to between 3% and 5%. That compares to 6.3% last year and management’s previously expected outcome of 4% to 7%.

At the mid-point that implies an adjusted EBITDA figure of around £70 million, down from £125 million in the year to February 2022.

Boohoo lost money in the first half of the year using statutory, not adjusted profit measures, and the new guidance for EBITDA suggests the firm will stay in the red for the whole of the year to February 2023. This is based on management’s guidance for depreciation and amortisation costs of £60 million, £10 million in interest costs and £60 million to £65 million in supposedly exceptional costs such as share-based payments.

Source: Company accounts, Marketscreener, management guidance on 28 September 2022

Management is keen to emphasise that inventory levels are low and under control, to lessen the risk of discounting to shift excess stock and thus further margin pressure down the line.

Mr Lyttle also emphasises ongoing investment in brand, logistics and warehousing capabilities, as well as management and IT at Debenhams, acquired in early 2021. The CEO clearly believes that those near-term investments will bring long-term returns and boost profits.

However, shareholders still must ponder the issue of supply-chain management and whether Boohoo’s review of its sourcing will lead to increased costs on a sustained basis, adding to the near-term pressures created by commodity prices, fuel prices, haulage shortages and product returns.

The company’s first-half statement flags a big increase in sourcing from what it terms ‘near-shore’ markets in fiscal 2023 to date and it seems logical to assume that this is bringing increased costs. Boohoo’s operating margins have done nothing but slide since the first allegations in 2020 surrounding the firm’s use of sweated labour, even in the UK.

Ultimately, online-only retail models are based on high volumes and thin margins.

Weakening demand and consumer confidence are now challenging the former.

Slower sales, increased input costs including freight, and higher product return costs are jeopardising the latter, even as Boohoo makes the investments that are necessary to stay competitive in a crowded marketplace.

It may look easy but online retail is not just a matter of someone pressing a button at one end the gear arriving from the other the next day, with the retailer making a profit in between.

After Wednesday’s heavy early falls, Boohoo’s market capitalisation is down to £395 million. That compares to estimated annual sales of some £1.8 billion, so the market now seems to be wondering just how thin the company’s margins will be going forwards and questioning whether prior highs can be recaptured.

These articles are for information purposes only and are not a personal recommendation or advice.