Spotlight back on gold miners with latest mega-merger news

Archived article: Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Whenever a major piece of M&A activity is announced, the single most important pieces of information are the price paid and the valuation this implies. This is because it can determine whether the buyers or potential sellers are getting the better part of the deal and also whether the shares of peers in the same industry or sector are looking cheap or not (and therefore whether they could find themselves next on the block),” says AJ Bell Investment Director Russ Mould.

“The latest proposed big deal involving gold miners – American producer Newmont’s $17 billion, all-stock deal for Australia’s Newcrest – suggests that the UK’s small remaining list of gold producers could indeed be cheap.

“Newmont’s lunge for Newmont will be seen by sceptics as another attempt to manufacture growth and momentum where little or none exists, since gold output grows only slowly and right now all-in sustained costs (AISC) are rising quickly, in no small part due to surging energy and staff costs, trends which rather dent gold miners’ perceived status as a hedge against inflation.

“Gold bugs, however, will argue that the proposed Newmont-Newcrest deal is simply further evidence that gold company executives see value that the stock market is overlooking, as gold mining shares flounder, despite fresh advances in the price of the precious metal: the price of gold is up by a quarter since the start of 2020 and the NYSE Arca Gold Bugs index, known as the HUI, is all but unchanged over the same time frame.

Source: Refinitiv data

“Barrick Gold swallowed up Randgold Resources and Newmont snapped up GoldCorp in 2019, while Agnico-Eagle and Kirkland Lake Gold merged in 2021 and Agnico-Eagle and Pan American Silver are now in the process of buying and divvying up Yamana Gold.

“Among the few remaining UK gold miners, Chaarat Gold took a look at Shanta Gold last autumn and although nothing came of that it did suggest that someone, somewhere thought there was value on offer.

“Newmont’s offer puts Newcrest on at almost 1.5 times book value, a small premium to the 1.3 times average that prevails across the major US-listed producers and the 1.1 times aggregate upon which the London market’s gold diggers trade.

US-listed major gold miners |

|||||

|---|---|---|---|---|---|

| Q3 2022 | 2023E | 2023E | 2022 output* | 2022* | |

| Price/book (x) | PE (x) | Yield (%) | (‘000 ounces) | AISC ($) | |

| Novagold Resources | 28.88 x | (77.5 x) | 0.0% | n/a | n/a |

| AngloGold Ashanti | 1.97 x | 11.2 x | 1.4% | 2,675 | 1,350 |

| Newmont Corp | 1.87 x | 27.7 x | 3.7% | 6,000 | 1,271 |

| Alamos Gold | 1.57 x | 31.3 x | 0.9% | 460 | 1,215 |

| Agnico Eagle | 1.48 x | 22.3 x | 3.1% | 1,782 | 1,051 |

| Newcrest Mining | 1.45 x | 23.4 x | 1.3% | 1,956 | 1,082 |

| B2Gold | 1.37 x | 13.1 x | 4.2% | 1,208 | 1,030 |

| Barrick Gold | 1.00 x | 21.8 x | 2.6% | 4,760 | 1,269 |

| Yamana Gold | 1.05 x | 22.9 x | 2.1% | 1,000 | 1,299 |

| Kinross Gold | 0.87 x | 20.9 x | 2.7% | 2,000 | 1,240 |

| Equinox Gold | 0.55 x | (34.8 x) | 0.0% | 540 | 1,600 |

| Eldorado Gold | 0.55 x | 21.7 x | 0.0% | 460 | 1,259 |

| Total | 1.34 x | 22.7 x | 2.60% | ||

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. *Based on company guidance for the year or last reported figure

UK-listed gold producers |

|||||

|---|---|---|---|---|---|

| Q3 2022 | 2023E | 2023E | 2022 output* | 2022* | |

| Price/book (x) | PE (x) | Yield (%) | (‘000 ounces) | AISC ($) | |

| Pan African Resources | 1.48 x | 6.5 x | 5.1% | 200 | 1,284 |

| Chaarat Gold | 1.19 x | (2.7 x) | 0.0% | 59 | 1,362 |

| Centamin | 1.15 x | 10.8 x | 3.9% | 441 | 1,399 |

| Resolute Mining | 0.99 x | 26.1 x | 3.8% | 353 | 1,498 |

| Shanta Gold | 0.88 x | 13.0 x | 0.0% | 65 | 1,270 |

| Hummingbird Res. | 0.19 x | 1.6 x | 0.0% | 81 | 1,782 |

| Total | 1.08 x | 11.4 x | 3.7% | ||

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. *Based on company guidance for the year or last reported figure

“In many cases, the US-listed miners and producers do look to offer greater scale (and lower all-in sustained production costs) than their UK-listed equivalents, but the relative valuations appear to at least partly reflect that and also the differing jurisdictions in which the miners operate.

“In addition, gold bugs will argue that junior miners can offer greater leverage into any upside in gold prices.

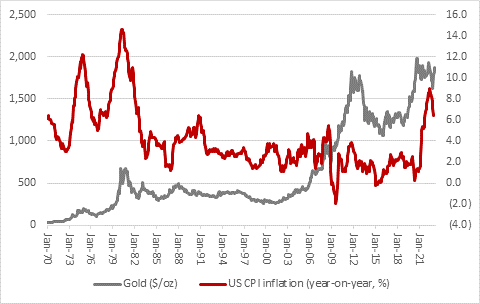

“The opposite to that holds true, too, and those who share Warren Buffett’s view that gold is simply an inert pet rock which generates no cash will just shrug and maintain their studious indifference, especially as gold’s perceived function as an inflation hedge looks a little tarnished. The metal failed to register new highs in 2022 even as inflation surged to 40-year peaks on both sides of the Atlantic.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“However, the metal is not really retreating even as the prevailing inflation starts to decelerate, so perhaps commodity traders are either fearing a second-wave of inflation (as happened in the 1970s) or taking the view that the combination of tattered government finances and a recession will force central bankers to cut interest rates and even return to Quantitative Easing (QE) to provide the necessary cheap funding.

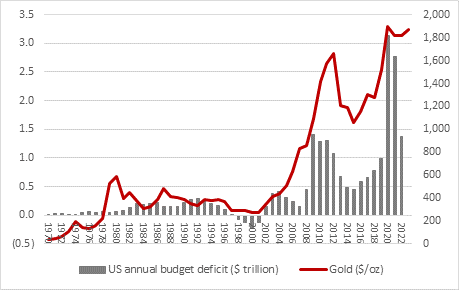

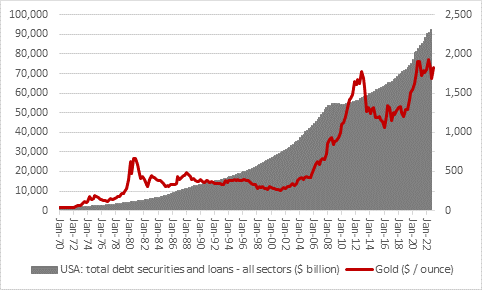

“Gold did respond strongly to the ultra-loose monetary and fiscal policy with which central bankers, Presidents and Prime Ministers sought to combat covid-19 and there seems to be little public appetite for austerity.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“A fresh fiscal splurge either to fund necessary welfare programmes during a downturn in 2023 (which would also eat into taxation revenue) or buy votes ahead of elections in 2024 could yet bring gold back into the spotlight - debt issuance continues to accelerate in the most alarming way, after all - and persuade investors that gold mining executives are being shrewd with their latest round of consolidation.”

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

These articles are for information purposes only and are not a personal recommendation or advice.