Bunzl shares bounce as results display distributor’s virtues

Archived article: Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Bunzl’s shares are nearing their all-time high and the full-year results help to explain why, as they emphasise the specialist distributor’s key virtues: a strong competitive position; the careful use of acquisitions to add to the company’s organic momentum; and a consistent record of increased dividend payments,” says AJ Bell investment director Russ Mould.

“These attributes result in the stock trading on a big premium to the FTSE 100 on an earnings basis and a discount on a yield basis, according to consensus analysts’ forecasts, as investors seem prepared to pay up for the relative dependability that it offers.

“Bunzl trades on around 20 times forward earnings and a yield of 2.1% for 2023, compared to 11 times earnings and a 4% yield for the FTSE 100 overall.

“That may be due to Bunzl’s business model. It supplies the things that other firms need in order to do business, but not items they would sell to their customers. For example, it supplies disposable coffee cups to cafes, food wrap to supermarkets, hard hats to builders, cleaning materials and bandages and rubber gloves to hospitals. The required nature of the products it provides may shelter the firm from the vagaries of the economic cycle, at least to some degree, and also provide Bunzl with pricing power, a key ingredient during inflationary times.

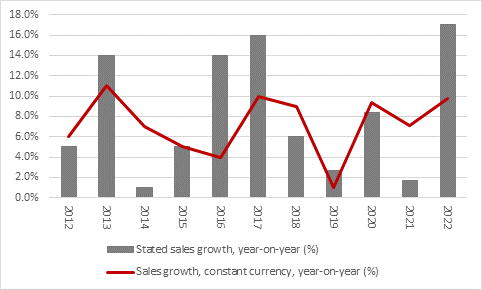

“These facets have enabled chief executive officer Frank van Zanten to unveil strong numbers for 2022, despite an understandable decline in covid-19 related orders at the cleaning and hygiene business unit. Revenues rose by 17% year-on-year in 2022, by 9.8% on a constant currency basis and by 6.6% using constant currencies and excluding acquisitions.

Source: Company accounts

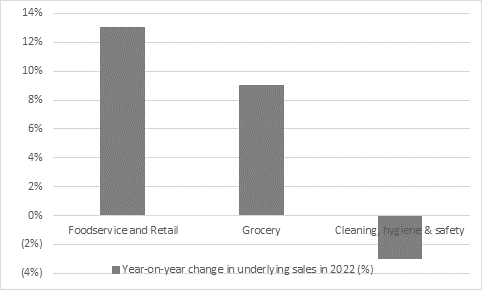

“Foodservice and retail sales led the way, with a 13% gain and grocery sales were up 9%, while the cleaning and hygiene businesses suffered a 5% drop thanks to a decline in covid-19-related activity.

Source: Company accounts

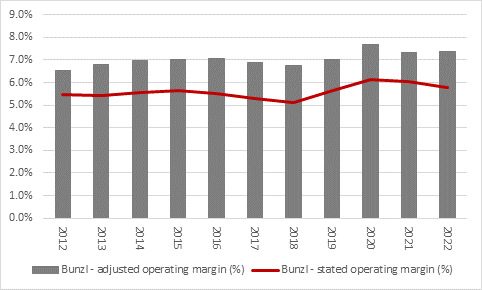

“Mr van Zanten flagged inflation as a key driver of sales and Bunzl’s ability to hold margin has again come to the fore.

Source: Company accounts

“Bunzl expects another good year for margins in 2023, when it sees returns on sales still coming in above historic averages, on an adjusted basis, in a testament to the power of the company’s competitive position and the importance of its position in its clients’ supply chains.

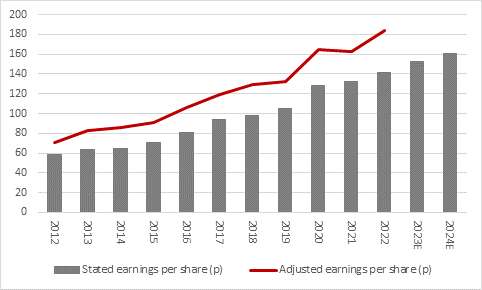

“However, Mr van Zanten and the board expect revenues will only be ‘slightly higher’ in 2023 than in 2022 and that earnings per share will be ‘moderately lower’, owing to higher interest and tax charges – Bunzl ended 2022 with £1.6 billion in net debt (although that is not an undue burden or cause for concern, when set aside 2022’s interest cover of eight times and £2.7 billion in shareholders’ funds).

Source: Company accounts, Marketscreener, analysts’ consensus forecasts

“The progression over time in earnings per share looks pretty consistent, so investors may be prepared to forgive a year of slower growth, although Bunzl does tend to be fairly cautious with its outlook statements and the firm has a handy knack of under-promising and overdelivering. The use of bolt-on acquisitions to supplement organic momentum is also a welcome facet. Too many firms use deals to try and create momentum that is not there with purchases that are billed as ‘transformational,’ whereas Bunzl goes for smaller deals, which lowers the associated risks.

“Bunzl firm spent £508 million on 14 acquisitions in 2021 and £322 million on a dozen deals in 2022. Two more purchases have already been confirmed for 2023, one in Germany and one in Canada, adding around £50 million to annual sales.

“These select moves bolster sales and earnings momentum and help to drive Bunzl’s excellent track record of dividend growth, with which only covid-19 has managed to interfere in the past three decades.”

Source: Company accounts

These articles are for information purposes only and are not a personal recommendation or advice.