Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The US stock market is doing well, the benchmark US ten-year government bond yields are barely flickering, and the dollar is barely changed from a year ago, so markets appear unconcerned about the imminent US debt ceiling. But such confidence could be seen as complacency, because the issues behind America’s borrowing mountain are fundamental for the global economy and asset prices,” says AJ Bell investment director Russ Mould.

“Yes, it would be an act of gross stupidity by Republicans and Democrats alike to let America suffer a ninth government shutdown, let alone default, and as such it seems likely the debt ceiling will be raised for the forty-seventh time since 1980. But even if common sense does break out, the question of how America will fund and manage its debt going forward will remain.

“Investors – and politicians – can be forgiven for believing that a compromise will ultimately be found on Capitol Hill and the Democrats and Republicans reach an agreement that raises the debt ceiling. After all, this is a relatively common occurrence.

Source: US Treasury, US Government Publishing Office

“In addition, failure to reach a deal on a new debt ceiling could lead to three immediate repercussions.

“First, the US government would shut down and perform only vital services to protect people and property. Staff would not be paid, nor welfare payments distributed, in a repeat of similar (thankfully brief) interludes in 1981, 1984, 1986, 1990, 1995, 2013, 2018 and 2019.

“Second, that could hit US economic growth at a time when the outlook is uncertain.

“Finally, the US could, conceivably, default on its debt, as interest payments to bondholders would also cease. America could look to prioritise handing over the coupons, but putting cash payments to overseas investors ahead of the interests of US citizens is unlikely to be a vote winner – a key consideration when the next Presidential election is just 18 months away.

“Even a brief interlude could plausibly increase the coupon the US has to pay going forward when it wishes to sell bonds to investors.

“As such, a deal to raise the debt ceiling is the most logical course of action, even allowing for the acts of political brinkmanship which May could witness, and Treasury Secretary Yellen is doing her best to cajole the two parties to come together.

“This may be because she is looking at how US government tax receipts have fallen year-on-year in each of the last five months even as spending has continued to rise.

Source: US Treasury

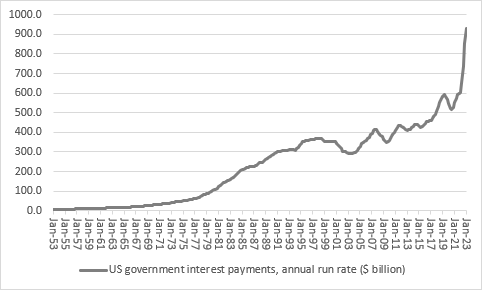

“That suggests the US economy may not be as strong as it appears and if the US suffers an unexpected downturn, wobble in the stock market, or both, the hit to tax income and America’s ability to meet its obligations would come under further duress. Welfare programmes took up broadly $3 billion of the $5 billion received by the US Treasury in tax receipts in the fiscal year to September 2022. They are not going to go down, and interest payments on the federal debt are running at an annual cost now of $928 billion, thanks to Federal Reserve interest rate increases driving up bond yields and borrowing costs.

Source: FRED -St. Louis Federal Reserve database

“Those two figures do not leave much left for anything else – and points to further increases in the annual and aggregate Federal deficit, hence the need to raise the debt ceiling (even if the US economy and stock market keep chugging along to generate income and capital gains tax receipts). The run-rate in the annual deficit is clearly higher than in the pre-covid days, even allowing for the seasonal tax inflow that arrives every April.

| Tax receipts ($ billion) | Spending ($ billion) | Deficit ($ billion) | |

|---|---|---|---|

| 2014 | 3,020 | 3,504 | 483 |

| 2015 | 3,249 | 3,688 | 439 |

| 2016 | 3,267 | 3,852 | 586 |

| 2017 | 3,315 | 3,981 | 666 |

| 2018 | 3,329 | 4,108 | 779 |

| 2019 | 3,462 | 4,447 | 984 |

| 2020 | 3,420 | 6,552 | 3,132 |

| 2021 | 4,046 | 6,822 | 2,776 |

| 2022 | 4,896 | 6,272 | 1,375 |

| 2023* | 2,048 | 3,149 | 1,101 |

Source: US Treasury, US Government Publishing Office. *2023 covers first half, October to March, only

“This adds to the dilemma which faces the US Federal Reserve. It is looking to support jobs and the economy on one hand and battle inflation on the other (while keeping an eye on financial market stability). But America’s burgeoning debts may mean interest rates can only go so far before the strain on the national finances becomes too great and the Fed must either back off or print money. Both, however, point to inflation.

“We have been here before. President Nixon was juggling welfare payments and defence spending, because of the Vietnam war, and pulled the US off the gold standard, with an eye on combatting inflation too.

“The results may have been initially encouraging but inflation (or at least stagflation) followed, as the cost of Nixon’s policies was borne in this way.

Source: FRED – St. Louis Federal Reserve database

“Perhaps this is the choice that faces America now. Austerity on one hand, something for which there is no political (or public) appetite, or inflation on the other, either thanks to lower interest rates, more QE or both. This is why there is a political impasse over the debt ceiling, whether it is resolved quickly or not.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 15/05/2024 - 16:51

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13