Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Ashtead’s November profit warning means the headlines for the first half and even guidance and forecasts for the full year to April are already being reset, but this set of results should be no less informative for that. Shareholders and analysts will be looking for more details on the reasons for the downgrade to full-year expectations and the extent to which the second-quarter slowdown could linger into the third period (or beyond).

Chief executive Brendan Horgan cited a relatively quiet wildfire and hurricane season in America and the impact of the writers’ and actors’ strikes upon the Canadian, American and British operations as reasons for the shortfall. The rental equipment specialist’s leading product lines include mobile elevating platforms, forklifts, earth movers, power supply units, lighting, scaffolding and barriers, although the business mix does vary across the three geographic units.

Percentage of sales, fiscal year to April 2023 |

|||||||

|---|---|---|---|---|---|---|---|

| USA | Canada | UK | |||||

| Mobile work platforms | 30% | Mobile work platforms | 31% | Accommodation | 16% | ||

| Forklifts | 20% | Lighting, grip and lens | 22% | Mobile elevating platforms | 11% | ||

| Earth moving | 14% | Earth moving | 12% | Earth moving | 11% | ||

| Power and HVAC | 11% | Forklifts | 11% | Barriers | 10% | ||

| Scaffold | 2% | Power and HVAC | 9% | Forklifts | 9% | ||

| Other | 23% | Other | 15% | Other | 43% | ||

Source: Company accounts

Analysts will look for further details and also affirmation of the new full-year guidance from the rental equipment specialist:

- Ashtead trimmed its rental revenue growth forecasts for the USA down to 11% to 13% for the year to April 2024, down from prior guidance of 13% to 16%.

- As a result, expectations for the group-wide numbers are changing by the same degree – the American operations represented 85% of total sales in the first quarter of the year.

- The US also generated 90% of profits in the first three months of fiscal 2023-24 and as a result Mr Horgan shaved 2% to 3% off earnings forecasts for the year, based on the metric of earnings before interest, tax, depreciation and amortisation (or EBITDA).

Before the surprise announcement, analysts had been looking for $5.2 billion of EBITDA in fiscal 2024, up 17% from $4.4 billion in the twelve months to fiscal 2023. A figure nearer to $5 billion now seems more accurate, given the revised outlook.

Source: Company accounts, Marketscreener, management’s revised guidance for 2024E

Attention will then turn to the second-quarter and first-half results. In the first quarter of fiscal 2023-24, sales grew by 19% and EBITDA by 18%, so the new full-year guidance implies a slowdown from that rapid rate, even if it still points to full-year growth in the (non-statutory) EBITDA profit metric of 14%. That is still impressive but the deceleration in momentum may be why investors are fretting, and therefore why the shares trade nearer to their twelve-month lows than their twelve-month highs.

Source: Company accounts

Ashtead’s provision of equipment to such major projects as new silicon chip factories (Intel, TSMC), liquified natural gas plants, electric vehicle and battery factories (Hyundai and Panasonic) and airport terminals, as well as Penn rail station in New York, show that the company is well placed to benefit from Bidenomics and the CHIPS and Inflation Reduction Acts and other major infrastructure and technology initiatives. As such it is tempting to see the profit warning as a blip, but the share price does not seem convinced, as it looks at weakness in the manufacturing purchasing managers’ index and the housebuilding industry.

Source: LSEG Datastream, US Institute of Supply Management

Source: LSEG Datastream, US Institute of Supply Management

Analysts and investors will therefore look for sign of how momentum in the business is developing. By way of comparison, Ashtead’s first-half results of a year ago were as follows:

- Total sales of $4.8 billion ($2.5 billion in Q2 alone).

- EBITDA of $2.2 billion ($1.2 billion in Q2).

- Pre-tax profit of $1.2 billion ($658 million in Q2).

- A dividend per share of $0.15.

One sign of management’s confidence in the future would be an increase in the dividend, since Ashtead’s current streak of increases in its annual distribution stretches back to 2005.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts. Fiscal year to April

Another indicator is the capital expenditure budget. When it released the trading alert last month, Ashtead left its spending plan for the year to April 2024 unchanged at between $3.9 billion and $4.3 billion, which would be a new all-time high, even at the low end.

Source: Company accounts, mid-point of management guidance range for 2024E. Fiscal year to April

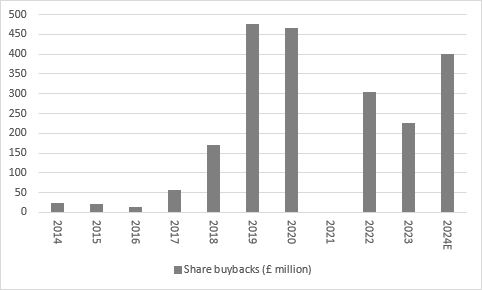

As a final point, Ashtead continues to run a share buyback programme with a value of $500 million, as first announced in May. This forms part of the company’s capital allocation strategy, which prioritises capital investment to grow the fleet, then bolt-on acquisitions and then return any remaining excess cash to shareholders via dividends and buybacks.

Source: Company accounts, management guidance for 2024E. Fiscal year to April

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 15/05/2024 - 16:51

- Wed, 08/05/2024 - 11:46

- Wed, 01/05/2024 - 18:32

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13