How many SIPPs can I have?

As many as you like – there’s no restriction on the number of SIPPs or pensions you can open.

SIPP allowances apply to the amount paid into your pensions, as well as the total value of tax-free cash you can take when you come to access them.

How much can I pay into a SIPP?

If you’re a UK resident and under 75, the government gives you tax relief when you pay into your SIPP.

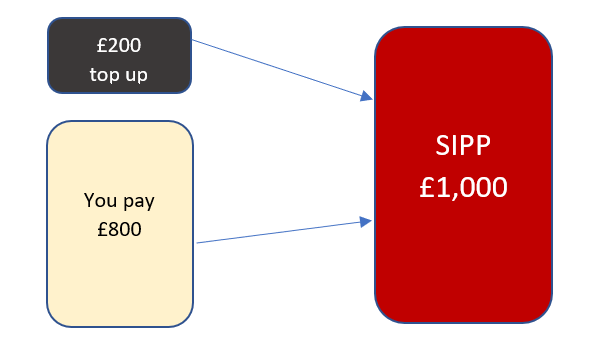

Everyone will get tax relief of 20% on what they pay in personally – so if you paid £800, the government automatically adds £200 giving you a total of £1,000 in your SIPP.

The maximum you can pay in is up to your UK earnings, subject to the pension annual allowance of £60,000.

Sarah earns £50,000 gross (before tax) each year.

If she pays into no other pensions, she could make a maximum SIPP contribution of £50,000 gross and get tax relief on it.

This £50,000 includes the tax relief she gets from the government. Sarah would pay a SIPP contribution of £40,000, and HMRC would automatically add basic-rate tax relief of £10,000, meaning she’s saved a total of £50,000 in her SIPP.

How much can I pay into a SIPP if I’m not working?

Even if you’re not currently working or have no earnings, you have a SIPP allowance of £3,600 each tax year. This would be a payment from you of up to £2,880 plus the 20% tax relief top up.

What is the annual SIPP allowance?

You’ll also need to keep an eye on the annual allowance. For most people, this is £60,000 per tax year.

This isn’t just a SIPP allowance – it applies to all payments into all your pensions. That includes the money you pay yourself, as well as basic-rate tax relief and anything your employer pays in too.

If you pay in more than your annual allowance, you might have to pay a tax charge unless you have unused allowance from past tax years. You can read more about that below.

Let’s go back to the example of Sarah.

She went ahead and paid £50,000 in total into her SIPP. This was a payment of £40,000 from her, and £10,000 tax relief.

This is the maximum she can pay in to receive tax relief, as she earns £50,000 gross.

Your annual allowance will be tapered if you have a high income (usually over £260,000 p.a.). Learn more about this in our guide to annual allowance tapering.

Your allowance will also be reduced to £10,000 if you’ve already accessed and taken an income from your SIPP or another defined contribution pension. Read more about the MPAA.

What happens if I put more than £60,000 in my pension?

If you go over the annual allowance you’ll pay a tax charge, unless you have carry forward available.

As the name suggests, this lets you ‘carry forward’ any unused allowance from up to three previous tax years to reduce or even eliminate any potential tax charge.

To be eligible, you must’ve been a member of a pension scheme in the tax year you want to carry forward from. The earnings and tax relief limits will also still apply.

Want to know more about HMRC’s SIPP rules and carry forward? Read our SIPP carry forward guide.

Tax-free cash allowance

The amount of tax-free cash you can take is usually 25% of the amount you want to access from your pension.

But there’s a maximum tax-free cash limit of £268,275 that applies across all your pensions in your lifetime.

In the past, you could apply for various protections to give you a higher lifetime allowance. If you applied before the deadline and kept to the conditions, you might have a higher tax-free cash allowance. You can whether you already have lifetime allowance protection in place by visiting the government guidance page.

Important information: Remember that the value of investments can change, and you could lose money as well as make it. We don't offer advice, so it's important you understand the risks. If you're not sure, please speak to a financial adviser. These articles are for information purposes only and are not a personal recommendation or advice. Tax treatment depends on your individual circumstances and rules may change. Pension rules apply

An AJ Bell SIPP gives you complete flexibility on how much you save for retirement, and allows you to decide when and where your pot is invested.

You've saved hard for your retirement, but once you get there, what are your options?

Related content

- Fri, 23/02/2024 - 17:03

- Fri, 23/02/2024 - 16:33

- Fri, 23/02/2024 - 15:28

- Fri, 23/02/2024 - 11:59

- Wed, 21/02/2024 - 08:53