Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Oil remains a vital component of the economies and financial markets of the Middle East and a sliding crude price is pressuring growth and welfare spending programmes in the region.

These concerns, coupled with warfare in Yemen, Syria and Iraq, are potential deterrents to investment in the area, despite the potential offered by its demographics and scope for financial market reform.

The gradual opening up of the Saudi market is a potential driver for more capital to flow into the Middle East’s financial markets but instability and violence could offset this in the short term, even if a youthful and growing population could bring long-term economic advantages.

Politics

Conflict in Yemen, the ongoing civil war and Russian involvement in Syria and the conundrum posed by the Islamic State of Iraq and the Levant (ISIL) mean little seems certain politically in the Middle East, especially as tensions between predominantly Sunni Muslim Saudi Arabia and Shi’a stronghold Iran remain elevated.

July’s nuclear programme deal between Iran and the West may be the start of a thawing of relations and could lead to a lifting of economic sanctions against Tehran.

This is weighing on the oil price, as traders speculate over the scope for increased flow of crude into the global market.

According to research from BP, Iran has the world’s largest gas reserves and fourth-largest oil reserves and plans to increase production of crude by some two million barrels a day by 2020, against 2014’s output of around 3.3 million barrels – a 60% increase.

Iran has the world’s fourth biggest oil reserves

Source: BP Statistical Review of World Energy, June 2015

Economics

In crude terms, it is possible to break the Middle East’s economies into three main categories.

- The first are the labour-abundant countries which are producers and exporters of oil and gas and have large native populations, which represent almost the totality of their residents. This group of countries includes Iraq, Syria and Yemen.

- The second are labour-importing countries which are producers and exporters of oil and gas and have large shares of foreign or expatriate residents, who represent a significant percentage of the total population, even the majority in some cases. This includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

- The final group is those countries which are small producers or importers of oil and gas. These countries include Jordan, Lebanon and the Palestinian Authority.

OPEC’s strategy to hold its output into an already over-supplied oil market is a gambit by dominant member Saudi Arabia to protect its market share from the USA, where the rise of shale is a potential threat.

OPEC’S oil production remains at high levels ...

| 2013 | 2014 | Q1 2015 | Q2 2015 | Q3 2015 | |

| Algeria | 1,159 | 1,151 | 1,112 | 1,107 | 1,109 |

| Angola | 1,738 | 1,660 | 1,746 | 1,716 | 1,766 |

| Ecuador | 516 | 542 | 551 | 546 | 541 |

| Iran | 2,673 | 2,766 | 2,779 | 2,828 | 2,860 |

| Iraq | 3,037 | 3,265 | 3,454 | 3,875 | 4,156 |

| Kuwait | 2,822 | 2,774 | 2,748 | 2,726 | 2,721 |

| Libya | 928 | 473 | 382 | 450 | 381 |

| Nigeria | 1,912 | 1,911 | 1,886 | 1,814 | 1,861 |

| Qatar | 732 | 716 | 679 | 667 | 659 |

| Saudi Arabia | 9,586 | 9,683 | 9,809 | 10,253 | 10,266 |

| UAE | 2,741 | 2,761 | 2,817 | 2,838 | 2,877 |

| Venezuela | 2,389 | 2,373 | 2,367 | 2,376 | 2,367 |

| OPEC TOTAL | 30,321 | 30,075 | 30,330 | 31,197 | 31,566 |

Source: OPEC, according to secondary sources. '000 barrels per day.

... even though global oil output growth is outstripping increases in demand

Source: International Energy Agency

As a result Riyadh is running a significant budget deficit and is having to use its foreign currency reserves and debt to plug the gaps.

As of August 2015 Saudi Arabia had used almost $62 billion of its foreign currency reserves, although this still left it with some $660 billion in the coffers.

The Saudis borrowed $4 billion from local banks in July as they issued first bonds for the first time since 2007 to try and meet some of the oil income shortfall.

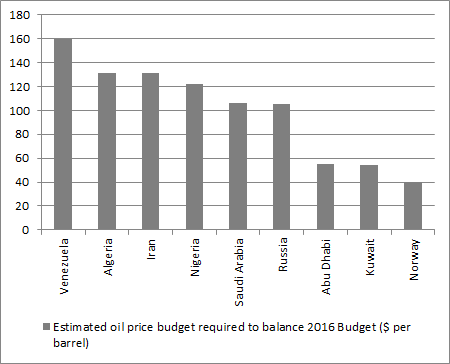

Oil producing nations would welcome a rise in the crude price

Source: International Monetary Fund

Markets

Markets in the Middle East are far less mature than those in the West but Iran and Saudi Arabia are now both progressing plans to reform and open up their financial markets to overseas investors.

According to data from fund manager Ashmore, Saudi Arabia is the seventh largest emerging equity as ranked by capitalisation and the Tadawul exchange oversees trades worth an average of $2.4 billion a day across its 162 listed companies.

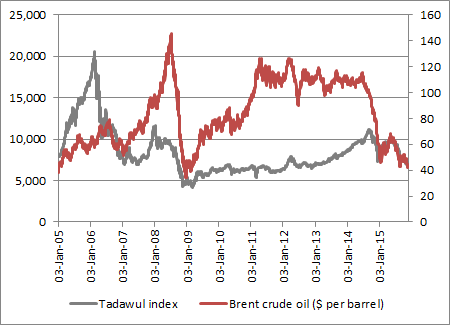

Riyadh is hoping for inclusion in the MSCI Emerging Markets index by 2017, a development which could attract overseas capital flows and re-rate the market, if the experiences of Morocco and Qatar are a guide, although the influence of oil on the Tadawul index cannot be overlooked.

Saudi Arabia’s Tadawul index looks to have some correlation to the price of oil

Source: Thomson Reuters Datastream

Oil is also important to Iran, even once its $140 billion stock market is opened up to foreign investors.

Ashmore estimates current trading volumes on the Tehran exchange come to around $100 million a day and the Iranian equity market trades on a forward price/earnings ratio of around six times, a discount to the ten times rating attributed to Emerging and Frontier markets overall.

AJ Bell’s top tracker for the Middle East

AJ Bell’s free investment guidance service is based on our list of sixteen Top Trackers. One of these covers the Middle East, although not in a direct way.

The UBS Emerging Markets tracker has the EPIC code of UB32 and a SEDOL of B76HL88. It comes with a 10% weighting toward Africa and the Middle East in total as part of a broad basket of Emerging Market stock market assets.

The tracker puts greater emphasis on Asia and Latin America, with weightings of 69% and 13% respectively.

This tracker does not feature in the Cautious portfolio but represents 7% of the Balanced and 15% of the Adventurous portfolios.

These articles are for information purposes only and are not a personal recommendation or advice. All data shown is correct at the time of writing.

View all World Investment Outlook articles