Government bonds and gilts

Government bonds and gilts in the UK refer to the same thing – a type of debt security popular among many investors. Learn everything you need to know about the gilt market, including the different types of bonds and why people may choose to invest in bonds.

What is a gilt?

A gilt is a UK government bond. When you buy a gilt, you’re effectively loaning your money to the government that issued the bond. In return, you receive a regular stream of income and get back the face value of the bond at the end of a fixed term.

Gilts are issued by the UK Government Debt Management Office (DMO) on behalf of HM Treasury to raise finance for public spending. They’re issued in units of £100, with a wide range of maturity dates – the shortest being just three months and the longest up to fifty years.

Ever wondered about the meaning of a gilt? The name dates back to the days when paper certificates with gilded edges were issued by the UK government.

To help identify a government bond, a common naming convention is used. This includes their coupon and maturity date, alongside HM Treasury as the issuer. For example:

Treasury 5% 07/03/25

This gilt pays a coupon on 5% per year and has a maturity date of 7 March 2025.

What are the two main types?

Conventional gilts make up around 75% of all gilts.

They pay a fixed coupon (or interest), usually twice per year until the maturity date, when you get back the face (or par) value of the bond you hold (known as the principal).

Conventional gilts have a specific maturity date.

Index-linked gilts have pay-outs linked to the rate of UK inflation, as measured by the Retail Prices Index (RPI). The regular coupon and the amount you get back at maturity is adjusted for inflation, instead of being a fixed amount – as with conventional gilts.

Index-linked bonds tend to have longer maturities than conventional bonds, and their prices can also be more sensitive to changes in interest rates.

Why do people invest in government bonds?

UK gilts and other types of bonds are popular with investors who do not want to have all their money tied up in stocks and shares and who want to earn a regular income from their investments.

They can provide diversification to a portfolio and gilts in particular are categorised as low-risk investments because there is little chance of the UK government defaulting on its repayments.

How to buy UK gilts

The easiest way to buy and sell UK gilts directly is online - we offer a select range that can be dealt via our web platform.

See our list of tradeable gilts

Or, to access our full range, call our dealing services team on 0345 54 32 600. The dealing charge for bonds is £5.00.

If you aren't keen on the idea of holding individual bonds, you could invest via a specialist government bond fund or exchange-traded fund (ETF) instead. These involve a basket of securities that can help to spread risk across your portfolio.

Does the price of a gilt ever change?

Once issued, gilts also have a market price, which indicates their value on the secondary market. This value can fluctuate (much like a share) and depends on market forces such as supply and demand, as well as the outlook for interest rates.

Gilts trading above par cost more now than they did at issue will cost more than the capital returned at maturity. Gilts trading below par will pay you more than their current market value at maturity, with a coupon along the way.

Certain gilts may have an option for the government to buy them back before maturity. There are also rare types of gilt with no set maturity date (‘undated’). If it has these features, it usually affects its level of risk and value on the secondary market.

How do interest rates affect gilts?

The yield on a gilt is effectively the rate charged to the UK government for borrowing money. When the Bank of England increases the base rate – the benchmark for lending rates in the country – this has a direct influence on gilt yields as the government must pay more to borrow.

Are government bonds international?

Governments all over the world issue their own bonds to markets to finance their public spending. Although governments in more stable and developed economies are deemed to be safe and relatively low risk, there are other risks specific to government bonds worth noting.

The main additional risk to consider involves currency. If you buy bonds denominated in another currency, the return you get in pounds will be affected by changes in exchange rates. Emerging market currencies can also be very volatile. And even if an emerging economy issues a bond in US dollars, rather than their local currency, you should still consider the credit worthiness and default risk of that government.

How to calculate potential returns

If you are considering buying a gilt or any other type of bond, one way of measuring its potential return is to calculate its yield to maturity. This is different to the coupon payable, as the yield measures the future income due to the investor adjusted for the current price and the time left until the maturity date.

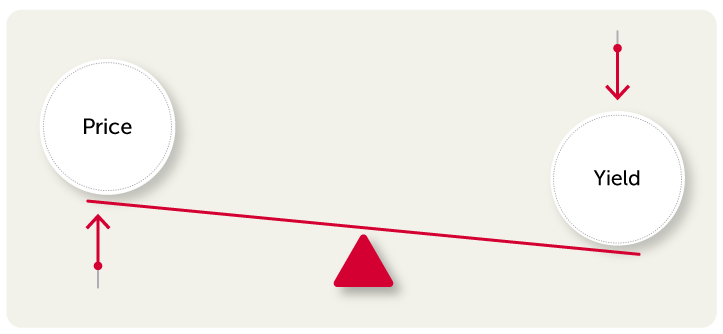

The price and yield of a gilt are related. When gilt prices rise, the yield based on the price will fall, and vice versa. You can read more about this topic below.

What are corporate bonds, and why do investors choose them?

Though considered less volatile, bonds still carry their own risks.

Learn how changes in bond prices can affect your returns.

Choose the right account for you and start investing today

Whether you're a novice or expert, we're here to make investing easier.

-

Low-cost dealing from £1.50, and never pay more than £5.00 per online deal

-

Deal on the go with our free mobile app

-

Invest regularly by putting in as little as £25 per month

-

FREE subscription to Shares magazine for all AJ Bell customers

-

Frequent dealing rate of just £3.50

-

Dividend reinvestment across a range of shares, investment trusts and ETFs

Are you new to investing? If so, you may want to take a look at AJ Bell Dodl. Specifically created for those just starting out, who are happier with a more straightforward range of accounts and investment options.

We'll help you get investing

For over 25 years, AJ Bell has made investing simple and affordable. We’re a 5x Which? Recommended Provider, with an award-winning range of accounts.

Can we help?

If you’d like more information about AJ Bell’s accounts and services, get in touch with our friendly customer services team - we’re here to help.