Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Commodity prices: potential winners and losers in 2018

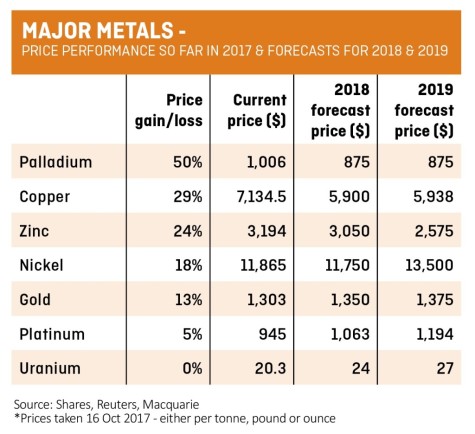

This year’s commodities bull-run could continue well into 2018 for many products, according to investment bank Macquarie. Most of the major metals have risen in price this year and Macquarie believes gold, silver, nickel and uranium have the best prospects over the next one to two years.

For gold and silver, we like Polymetal International (POLY) among the larger London-listed miners. Glencore (GLEN) is a good play on nickel. For uranium, look at Berkeley Energia (BKY:AIM).

Copper prices have recently exceeded $7,100 per tonne and could ease back next year in value, albeit the longer term price outlook remains positive thanks to an expected supply deficit. Kaz Minerals (KAZ) is one of our preferred copper-related

mining stocks.

The longer term losers could be palladium and rhodium, says Macquarie which highlights a potential long-term decline in demand as a result of the electric vehicle industry disrupting the petrol and diesel car sector.

Palladium and rhodium are primarily used to make catalytic converters – which aren’t required in electric vehicles. ‘Without their role in pollution control, what use do they have?’ says the investment bank.

Lithium carbonate prices are forecast to average $11,496 per tonne in 2017, representing a considerable jump from the $8,406 average price in 2016.

However, Macquarie warns of an ‘avalanche of supply’ on its way and believes the metal, closely tied to the electric vehicle industry as a battery component, could fall back to $9,000 on average in 2018 and $7,688 in 2019.

Cobalt has shot up by 82% in price this year but Macquarie thinks its value, as well as lithium, has gone up too far given ‘serious market tightness should not emerge until next decade’.

Longer term, lithium prices could improve once again; so too copper and nickel assuming that electric vehicles hit the mainstream from 2020 onwards.

Oil prices, as measured by the European Brent Crude standard, are currently trading at the same level at which they started the year, being just under $58 per barrel. They fell to $46 per barrel in the summer but have been recovering amid renewed tensions between Kurdistan and Iraq. (DC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine