Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The fall-out from first rate rise in a decade

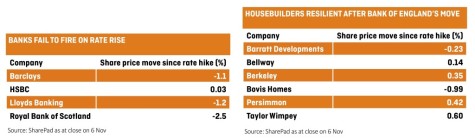

The market is taking the first interest rate hike in more than 10 years in its stride. At its 2 November meeting, the Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 7-2 to increase rates from 0.25% to 0.5%.

Failure to act would have implied governor Mark Carney and his colleagues had suffered a severe loss of confidence in the UK economy and would have probably resulted in a negative reaction from investors.

The expected rally in the pound and financial stocks did not materialise amid indications there may only be two more rate rises in the next three years.

This also helps explain why the housebuilding sector, which could in theory be negatively impacted by higher rates if homebuyers are put off by more expensive mortgages, has largely shrugged off an initial negative response.

Ratings agency Fitch reckons the Bank of England is unlikely to approve a rate rise in the next 12 months due to the impact of Brexit uncertainty.

There has been some speculation the Bank of England is simply giving itself some leeway to cut rates again if UK economic conditions deteriorate.

What are the experts are saying?

Sanlam investment analyst Matthew Brittain comments: ‘The UK has not seen an increase in its base rate for over 10 years, so while the hike doesn’t come as a surprise, it marks a significant moment.

‘The UK remains in a precarious economic position with high levels of consumer debt and the Brexit negotiations delaying investment decisions, so we think that low interest rates are helpful in keeping the economy strong.

‘Assuming the inflation outlook stabilises, we think this is the first, and last, interest rate hike we will see for a while.’

Strategists at investment bank UBS reckon the Bank of England may have erred by increasing rates at this point given they expect the economy to ‘slow persistently through 2018 as the Brexit process weighs increasingly heavily on sentiment and confidence’.

‘We now think the hike – which, in our view, is not without risk – may come to be seen as a mistake unless a range of important data indicators start to improve soon,’ they add. (TS)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Loss of confidence in UK IPO market

- Sweet and sour from ABF

- UK challenger bank in £1.1bn takeover

- Is GVC clearing the decks for Ladbrokes bid?

- Scottish Mortgage pleads for patience

- The fall-out from first rate rise in a decade

- Merry Christmas for Morrisons

- Why Indivior’s opioid addiction treatment is likely to be approved this month

magazine

magazine