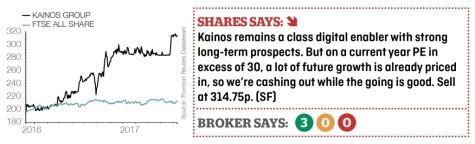

KAINOS

(KNOS) 314.75p

Gain to date: 59.0%

Original entry point:

Buy at 198p, 19 January 2017

Half-year results from Kainos (KNOS) are more exciting than the figures may first suggest. However, the valuation is looking a bit excessive, so we’re taking profit on our Great Ideas trade.

Headline revenue and pre-tax profit were virtually flat, at £41.4m and £7.1m respectively, the company’s lowest growth since floating on the stock market in July 2015.

We’ve known NHS investment in digital systems and services has been weak for a while. It remains so, but there are hints of improvement, such as seven new hospitals going live in the six month period for the firm’s Evolve clinical automation platform.

But Kainos’ enterprise digital transformation services, including the Workday resales, could barely be doing better. New orders nearly doubled to £54.9m between April and September, promising a much stronger second half.

Cash conversion was a little weak because of the timing of staff bonuses. Management remain comfortable with typical 80% to 85% averages for the full year.

‹ Previous2017-12-14Next ›

magazine

magazine