Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

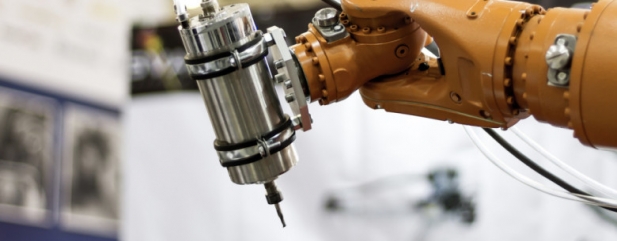

The easy way to invest in the thriving world of robotics and automation

You may have seen the recent news that Flippy the burger-flipping robot was taken offline one day into its job at a burger restaurant because it wasn’t fast enough.

On one hand it acted as a wake-up call that the robotics industry is susceptible to setbacks just like traditional businesses. However, it also reminded the world that the concept of robots in the workplace is now a reality. That presents a significant opportunity for investors.

HOW TO GET EXPOSURE

Robotics technology is becoming more advanced and costs for certain applications are coming down which should drive greater adoption. Although something like Flippy may need an upgrade to work faster, such a task shouldn’t be impossible.

The whole field of robotics is a learning field and, thanks to the way data can easily be collected and analysed electronically, companies are quickly finding ways to make improvements.

One of the best ways to play the space is exchange-traded fund ROBO Global Robotics and Automation ETF (ROBG). It provides diverse exposure to an actively-managed list of robotics experts or companies embracing robotics to improve their business.

The ETF tracks an index of 88 companies involved in robotics and automation. Forty per cent of the index consists of companies whose majority of business has to related to robotics and automation (the ‘bellwether’ stocks); and the remaining 60% of companies with a ‘distinct portion’ of business in this area (the ‘non-bellwether’ stocks).

The index provider, ROBO Global Indices, reweights the index once a quarter so each constituent only represents a maximum 2% holding if they are bellwethers or 1% if they are non-bellwethers.

‘Many people don’t realise how companies are collecting data from robotics and applying this knowledge to their business,’ says ROBO Global chief executive Richard Lightbound. ‘It makes companies more valuable.’

The world of robotics is broad and touches a wide range of industries from healthcare and logistics to security and manufacturing.

Examples include tractor giant John Deere using facial recognition technology to identify plants and determine how much water and fertiliser each one needs, potentially resulting in enormous cost savings and increased crop yields. The technology is contained in equipment pulled by a tractor driving at normal speed.

INTERESTING PORTFOLIO

Stocks being tracked by the ETF include iRobot. Its robot vacuum cleaners take the stress out of housekeeping. They build maps of your home and learn the best way to clean, such as identifying spots that often have more mess than other places.

Another relevant stock is Japan’s Fanuc which makes robots for factories. It delivers labour and operational cost savings as its technology can predict breakdowns long before they can lead to downtime. (DC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- AJ Bell customers given priority access to company’s IPO share offer

- An increasing number of investment trust dividend heroes

- Spring Statement reveals (slightly) improved economic picture

- Gem Diamonds is on a roll with high quality discoveries

- Time is running out for GKN shareholders to vote on Melrose takeover offer

- Labour strike risk could lead to higher copper price

- Why is the dollar struggling?

- Big fall in London house prices

- Aviva under fire for plan to cancel high-yielding shares

magazine

magazine