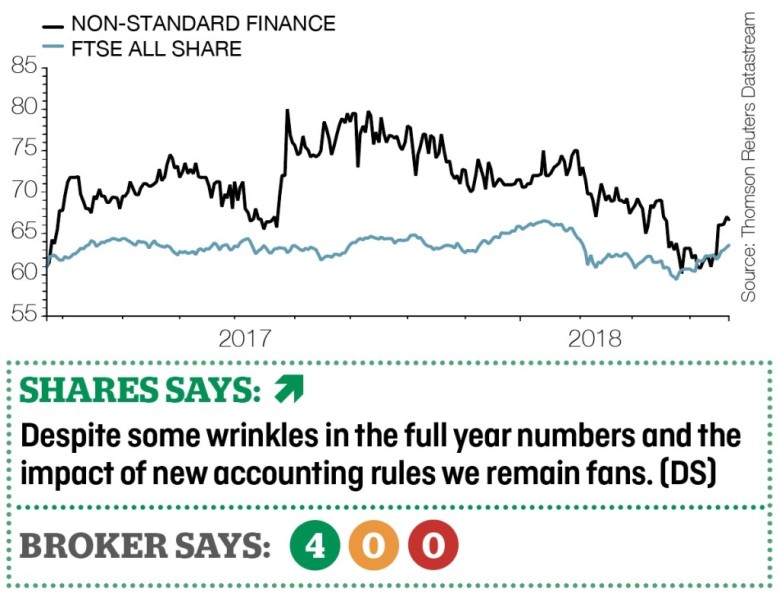

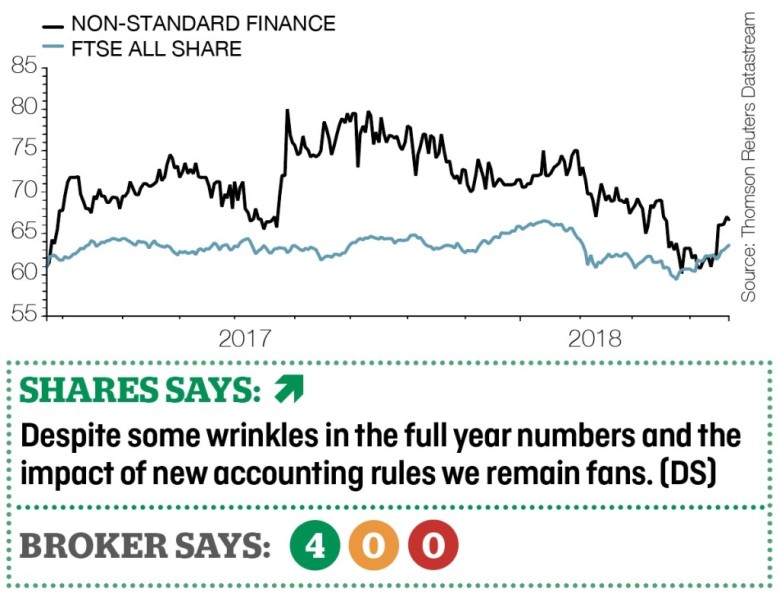

Non-Standard Finance (NSF) 65.4p

Loss to date: 2%

While sub-prime lender Non Standard Finance (NSF) has not yet lived up to our expectations, we continue to believe that this company can deliver over time.

We see the business as a beneficiary of the pressures being felt by larger peer Provident Financial (PFG).

One reason the share price may have been held back is the large discrepancy between its underlying profit, stripped of exceptional one-off items and its reported losses, and the statutory number in its full year results (13 Mar).

On an underlying basis, the company increased its underlying pre-tax profit by 35% in 2017 to £16.4m. On a reported basis, it made a pre-tax loss of £13m.

Portia Patel, analyst at Liberum, is still positive on the company despite cutting the price target to 83p from 94p and trimming earnings forecasts to reflect new accounting standards.

Patel has cut earnings per share by 28% and 16% for 2018 and 2019 respectively, now at 4.1p and 7.1p. This is largely due to the company adopting IFRS 9 accounting standards although higher costs for its Loans at Home business have also impacted earnings forecasts.

‹ Previous2018-04-26Next ›

magazine

magazine