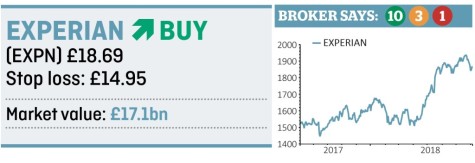

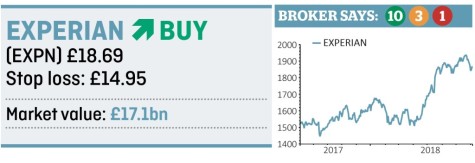

While fretting about your credit score, take a moment to think about the companies that hold the information. Experian (EXPN) is one of the largest.

Even with the emergence of free to use credit rating companies (Experian now also provides such a service) this company has been growing at a steady click.

We believe there is further for this company to go as it has a vast geographical footprint, operates in 37 countries and offers crucial services to clients including the UK Government.

DATA IN DEMAND

When listening to business leaders, asset managers and banking executives, they often say that data is the new currency. If this is the case, then Experian is a great play on this trend as it collates and uses data in a variety of ways.

The company helps businesses make decisions about their customers by providing financial information to determine their creditworthiness. For individuals, it can help protect against fraud and identity theft.

Robin Speakman, analyst at broker Shore Capital, says the core driver of its strong 2018 results was ‘the strength in demand for data based services from the group’s wide variety of clients across all regions’.

For the 12 months to the 31 March 2018, the company increased its revenue by 5.7% to $4.58bn and adjusted pre-tax profits by 3.4% to $1.2bn. These results were ‘slightly above’ Speakman’s forecasts and he now predicts a 6.5% increase in Experian’s 2019’s adjusted pre-tax profits to $1.24bn.

LOWER RISK GROWTH

Experian is highly liquid with a copper-bottomed balance sheet. Its first quarter trading update released on 13 July showed organic revenue growth of 8% for the whole company.

This was led by both its North American and EMEA/Asia Pacific businesses where both regions experienced organic revenue growth of 11% where new contracts were the driving force.

This growth rate was brought down by the UK and Ireland only hitting 3% and Latin America where Brazil’s economic woes impacted the growth of the business.

GOING FORWARD

Aside from organic growth, Experian is also on the acquisition trail with ClearScore in the UK being one of its main targets.

For a quality company with this much growth potential, a multiple of 20.1-times 2019’s $1.02 of earnings looks attractive.

‹ Previous2018-08-09Next ›

magazine

magazine