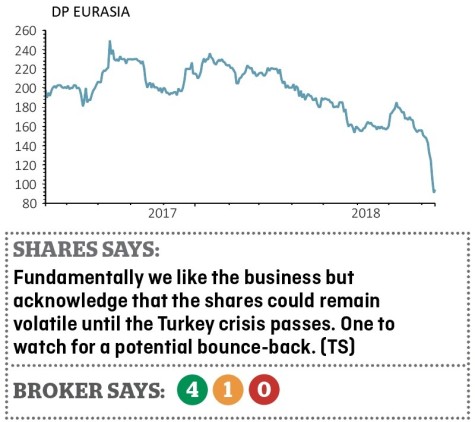

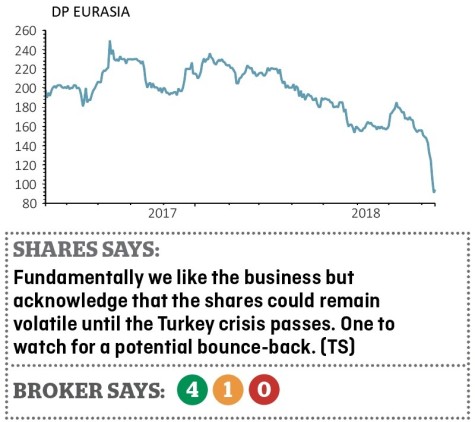

DP Eurasia (DPEU) 92.9p

Loss to date: 35% (stopped out)

Takeaways firm DP Eurasia (DPEU), which operates the Domino’s Pizza franchise in Russia and Turkey, has seen its shares fall heavily as the Turkish lira has been devalued.

DP reports in Turkish lira and its shares are sterling denominated. Put together this is a toxic combination and the shares are now

trading at less than half the level they were at when we highlighted the company’s attractions in November 2017.

To date, trading has held up reasonably well if you put the currency headwind to one side but the currency collapse in Turkey may have an impact on the consumer environment in the country.

As essentially a US brand, the company could also be affected by president Recep Tayyip Erdogan’s anti-American rhetoric in the wake of the crisis.

The company will be able to address these points when it reports half year results on 11 September but for now this looks like a salutary reminder of the risks associated with investing in emerging markets focused businesses.

Our stop loss has been triggered, so DP Eurasia is now removed from our Great Ideas portfolio.

‹ Previous2018-08-16Next ›

magazine

magazine