Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Four market sell-off stocks that are now too cheap

Our best buy ideas in the wake of the global equity shake-out

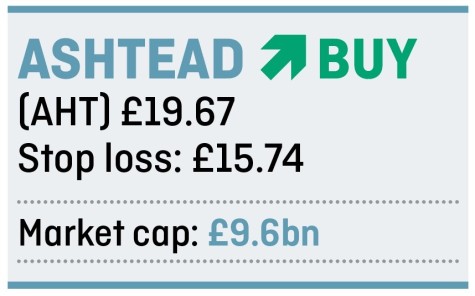

ASHTEAD IS A STOCK TO OWN NOT TO RENT

Plant hire business unfairly affected by the sell off given strong returns and dividend track record

Shares in plant-hire group Ashtead (AHT) have fallen more than 17% in the market rout.

it’s main business is leasing construction and industrial equipment. The US accounts for almost 85% of sales with another 4% coming from Canada and the balance from the UK where it operates the A-Plant brand.

The group recently (11 Sep) reported first-quarter sales up 19%, driven mainly by strong like-for-like rental growth in the US (19%), and raised its full-year profit target.

US construction spending is growing at twice the rate of GDP driven mainly by private non-residential building and big infrastructure projects.

TARGETING BOLT-ON ACQUISITIONS

As the US market remains very fragmented, bolt-on acquisitions can provide a useful kicker to the company’s already strong organic growth.

The company is both investing in its existing business and using funds for these modest-sized deals. It allocated £465m to capital expenditure in its first quarter and spent £145m on M&A. Despite these material levels of investment, the company remains comfortably within its targeted range of 1.5 to two times net debt to EBITDA (earnings before interest, tax, depreciation and amortisation).

Thanks to a high rate of like-for-like growth and the ability to keep taking costs out of the business, most of the increase in sales drops through to operating profit. Ashtead’s operating margin is 30% compared with an average of 10% for companies in the FTSE 100.

Following the fall in its share-price Ashtead now trades on 12 times earnings for the year to April 2019 which seems very cheap for a business with 30% margins and a return on capital of nearly 40%.

A DIVIDEND HERO

The company also yields 19% and strong cash generation underpins an impressive dividend track record. To place this in context, figures from AJ Bell’s latest Dividend Dashboard for the second quarter of 2018 showed that the 2018 yield on the purchase price of Ashtead’s shares ten years earlier was a staggering 44.9%.

Stockbroker Killik & Co comments: ‘We continue to see Ashtead as an attractive investment opportunity. Not only will it be a beneficiary of increased infrastructure spending needed in the US and UK, but it is also playing a secular trend towards increased rental penetration and consolidation of a fragmented market.’ (IC)

CRANEWARE’S NICHE HEALTH SOLUTIONS WILL SEE IT GROW RAPIDLY FOR YEARS TO COME

Customer outcomes and financial performance tick the right boxes for US hospitals

Scotland’s Craneware (CRW:AIM) supplies innovative financial analysis, performance and monitoring tools to hospitals and other healthcare providers.

It may seem something of a curiosity to many investors since nearly all of its business is in the US despite the company being based in Edinburgh. That stems from the private healthcare system across the pond.

What is most important for investors to understand is that this is a fast growing business concentrated on a niche which is itself only starting to embrace new automated technologies, especially important as patient outcomes becomes the benchmark for performance.

Founded in 1999 by Keith Neilson and Gordon Craig, Craneware provides technology solutions through its Chargemaster and Pricing Analyser toolkits that help hospitals and other healthcare providers more effectively price, code, charge and retain earned revenue for patient care services and supplies. Keith Neilson remains the chief executive officer and main driving force.

Today Craneware employs 300 staff, and provides solutions to almost one third of the hospitals in the US. These are significant numbers. Research suggests that the average 350-bed hospital misses out on $22m in revenue capture opportunities every year.

This is where Craneware can help, identifying new income opportunities to healthcare management as well has highlighting operational and financial risks.

TIME TO SHINE

One area where it shines is automating the authorisation code journey. This ensures that each patient gets tracked right through the treatment process, gets the help they need from doctors and healthcare professionals, and vitally for the hospital, ensures that accurate charges are billed to a patient’s insurance company.

If that sounds labour intensive, it is. Yet amazingly, today most of that work is still done by admin staff using spreadsheets. That’s a lot of human resource hours with massive scope for mistakes to creep in.

Craneware has been busy adding extra tools and services to its platform which should help bolster already sticky customers. This is opening up a vast pharmacies market through its fairly new Pharmacy ChargeLink toolkit.

About 85% of the firm’s annual revenue is of a recurring nature while its niche solutions and deep integration into the financial running of a hospital would make it very difficult for existing healthcare providers to ditch Craneware’s solutions for an alternative.

Analysts anticipate 18% revenue growth a year going forward with $79m pencilled in this year to 30 June 2019. That implies pre-tax profit in excess of $24m. It reported $18.9m last year, so 28% growth. But the point is, Craneware looks likely to continue to put up those sort of high teens to 20% growth numbers for years to come.

That it is a highly cash-generative model bolsters the long-run growth appeal. It is already paying dividends, albeit, modest ones right now. The shares have slumped nearly 20% during the recent sell-off yet little has changed in terms of Craneware as a fast growth, high quality investment story. (SF)

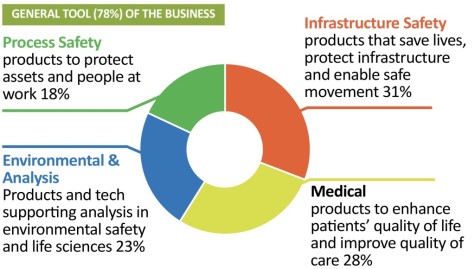

HALMA IS AN EXCELLENT BUSINESS TRADING AT A MORE ATTRACTIVE PRICE

Few companies can rival this companies track record of revenue, profit, cash flow and dividend growth

Periods of indiscriminate market weakness are typically good times to pick up quality businesses at a more attractive price. Down more than 14% since the recent market wobble, health and safety products specialist Halma (HLMA) undoubtedly fits the bill as a top-notch stock to buy now.

The FTSE 100 member has a very good track record of growing revenue, profit, cash flow and dividends. In June it released results which marked 15 consecutive years of record revenue and profit and the 39th consecutive year it had hiked the annual dividend by 5% or more.

The reason Halma’s shares have been so heavily sold off in the past few weeks is probably concern about valuation. The shares were trading on more than 30 times March 2019 earnings ahead of the market correction. Now at 25.9-times it is trading at a more modest premium to its rough earnings multiple of 22 from four years ago, since which the shares have more than doubled.

Buckinghamshire-headquartered Halma makes, and sells globally, a diverse range of equipment required to meet regulations on health, safety and the environment. This can encompass everything from hazard detectors to environmental protection kits and sensors.

FORENSIC FOCUS ON THE RIGHT MARKETS

The company bolsters organic growth with select acquisitions and forensically targets markets which benefit from demographic trends like ageing populations and/or stricter safety rules. The company’s own language around its business model is refreshingly simple.

Its objective is to double every five years. ‘We aim to achieve this through a mix of acquisitions and organic growth. Return on sales in excess of 18% and return on capital employed over 45% ensure that cash generation is strong enough to sustain investment for growth and increase dividends without the need for high levels of external funding,’ says the company.

Under its Halma 4.0 strategy, it is also buying up quality niche businesses which it can help develop within the group.

Assuming half year results on 20 November are the usual model of consistency then we would expect the shares to start recovering. Even if they don’t move up much, we still think this is an outstanding business to buy and hold for the long term. (TS)

BUY SCOTTISH MORTGAGE FOR 15% LESS THAN OTHERS BOUGHT IT A MONTH AGO

Popular investment trust trades at a very appealing price following the recent market sell off

The global market sell-off has presented a good opportunity to pick up shares in popular investment trust Scottish Mortgage (SMT) for 15% less than they were trading only a month ago.

Its shares were caught up in the panic over rising interest rates in the US and slowing global growth, plus the fact that many of its holdings were trading on high ratings which makes them particularly vulnerable to large falls when the market turns.

We do not believe anything has changed to the companies inside its portfolio and so now is a great opportunity to buy a superb investment trust and hold for the long term.

Scottish Mortgage has a bias towards disruptive companies, namely ones with the right ingredients to shake up traditional industries plus create new ones.

Ten companies account for just over half of the portfolio by weighting. At the top of the pile is retailer Amazon which is arguably one of, if not THE, greatest company in the world at the moment in terms of its power and engagement with both consumers and businesses.

You also get exposure to various giant Chinese companies (Alibaba, Tencent and Baidu), plus some better-known names like Gucci-owner Kering and Inditex, one of the world’s biggest fashion groups.

Smaller positions include sports car expert Ferrari, engineer Rolls-Royce (RR.) and Intuitive Surgical, a robotic surgical systems maker.

VOLATILITY TO BE EXPECTED

While Scottish Mortgage has enjoyed a really good run, delivering 23.15% annualised total return over the past decade, it is important to note the trust is likely to go through periods of high volatility, just as it has done in recent weeks.

In addition to backing high-growth stocks on potentially high valuations, some of its holdings are facing political, social and governance headwinds. Disruptive companies tend to get a lot of attention and there are inevitably questions asked from multiple directions as to whether they are good citizens.

For example, Tesla – which is Scottish Mortgage’s fifth biggest holding – has been slammed for the behaviour of its chief executive Elon Musk and his failure to adhere to normal standards of corporate governance. Amazon has been criticised for the way it treats warehouse workers.

Scottish Mortgage’s fund managers benefit from deep relationships with investee companies, and so you can be reassured they have the power to engage with, and hopefully influence, businesses that may have some ‘delicate’ issues.

Fundamentally this investment trust will give your portfolio exposure to strong growth stories around the world, with low charges and a highly experienced fund management team. We rate it as a must-have for anyone in the accumulation phase of their investing career. (DC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine