As the third quarter reporting season for the banks draws to a close there is room for some optimism over the prospects of a sector which has been out of favour in 2018.

The updates from Barclays (BARC), Lloyds Banking (LLOY) and HSBC (HSBA), in particular, were well received, with Royal Bank of Scotland (RBS) faring rather less well.

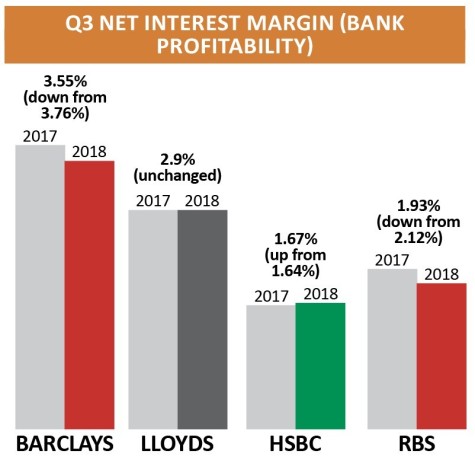

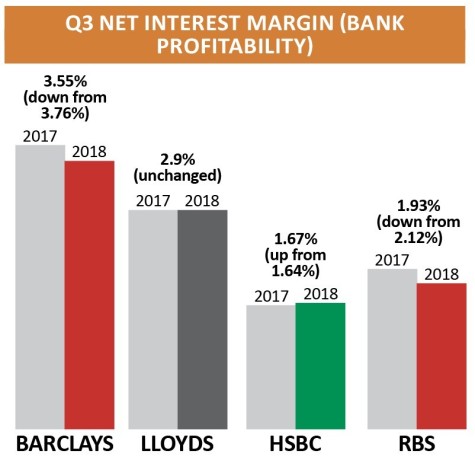

The question of why banks have underperformed – despite an increase in interest rates which should have supported the industry – has been partially answered by this set of releases which reveal how strong competition in the mortgage market is pressuring rates.

Mainstream banks have retreated from riskier areas of banking and mortgages have been seen as an increasingly attractive way of making money, while several challengers have emerged in this market too.

Barclays’ numbers looked robust, mainly thanks to a big reduction in impairments. Lloyds’ results saw quarterly earnings beat expectations at £1.82bn, benefiting from areas like credit cards, insurance and wealth management.

Neither firm increased their provision for PPI claims – unlike RBS which increased its provision in this area by £200m and, also in a departure from its peers, earmarked £100m to deal with the impact of Brexit.

In share price terms HSBC was the star performer after showing as it was set to put negative jaws – comparing income to operating expense growth trends – behind it. However, its figures were flattered by the absence of big restructuring costs incurred in 2017. (TS)

‹ Previous2018-11-01Next ›

magazine

magazine