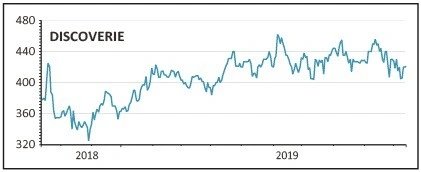

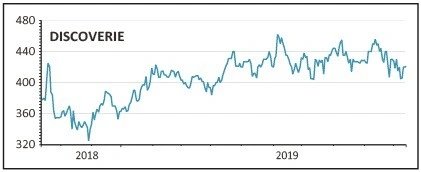

DISCOVERIE (DSCV) 445p

Gain to date: 9.6%

Original entry point: Buy at 406p, 14 February 2019

For electronics engineer DiscoverIE (DSCV) to put up half year revenue growth of 9%, 5% organically, is pretty good going given the prevailing economic uncertainty (10 Oct).

That the order book increased 15% (11% organically) to £153m is further evidence of the company’s success in implementing its strategy revamp.

As we flagged in the original story in February, this involves concentrating on structurally growing markets where equipment specifications are high-performance, reliability, efficiency and regulations driven.

Think medical, aerospace, transport and renewables where it designs and makes kit such as blade controls for wind turbines, artificial intelligence-based telematics and connectivity components, sensing and power systems.

Both the Hobart Electronics and Positek acquisitions secured in April appear to have bedded in well, adding extra high quality, high margin custom equipment designs that can be cross sold to the enlarged customer base.

This year to 31 March 2020 analyst are predicting around £35m of operating profit, although the £28m growth cash call at the start of 2019 will cap earnings growth to single-digits, before accelerating in the 2021 year end. This year’s price to earnings multiple stands at an undemanding 15.2.

SHARES SAYS: DiscoverIE remains an inexpensive way into to niche structural engineering growth. Still a buy.

‹ Previous2019-10-17Next ›

magazine

magazine