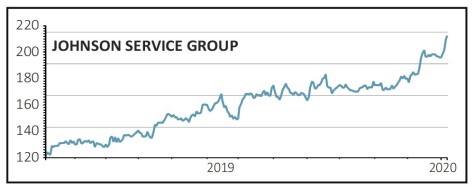

Johnson Service (JSG:AIM) 212p

Gain to date: 64.3%

Shares in Johnson Service Group (JSG:AIM) started the year strongly, hitting a 10-year high after chief executive Peter Egan raised earnings guidance for 2019 for the third time.

Thanks to strong trading and ‘consistent organic growth’, results for the year to 31 December are seen ‘slightly ahead of market expectations’. Moreover Egan remains optimistic on the business’s future prospects.

According to the consensus compiled by Reuters Eikon, revenues for the year to 31 December were seen at £347m, an increase of 8% on the previous year, while pre-tax profits were seen at £47m, an increase of 11%.

In response, analysts at Investec nudged up their pre-tax earnings forecasts for 2019 by 1% to £47.2m and raised their 2020 and 2021 forecasts by between 1% and 2%.

Peel Hunt raised its 2019 pre-tax forecast to £47.1m but was more generous with its 2020 forecast primarily due to the inclusion of Fresh Linen, which was acquired last November and which adds the capacity to process an additional 900,000 items of linen per week.

Together with the new high-volume plant opening in Leeds this spring, this additional capacity gives Johnson Service plenty of room to continue growing.

SHARES SAYS: Despite its strong performance JSG remains an attractive, low-volatility growth stock. Keep buying.

‹ Previous2020-01-09Next ›

magazine

magazine