Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Investment trust bargains created by the market sell-off

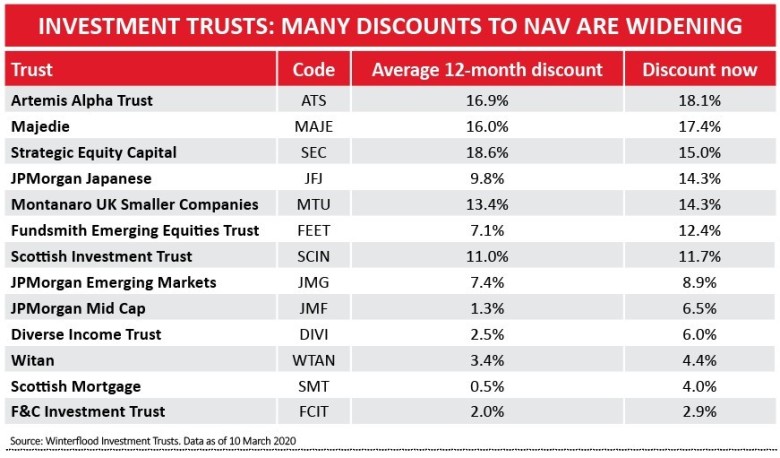

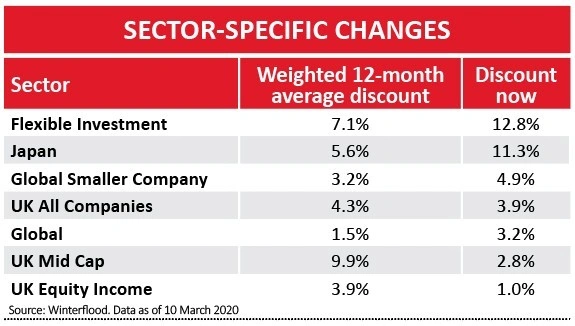

The global markets sell-off has more than doubled the average discount to net asset value on investment trusts, moving from 3.8% at the end of 2019 to 9.3% at the end of February, according to the AIC. That presents an opportunity for investors with an appetite for risk to consider buying trusts that interest them at much cheaper prices.

Several sector discounts have widened by a greater amount, notably commodities and natural resources, as well as Asia-focused sectors and growth-oriented ones including private equity, UK smaller companies and technology. In contrast, the average premium of biotechnology and healthcare has risen by 1.5 percentage points on hopes the sector will profit from products to combat coronavirus.

TRUSTS ON SALE

The AIC’s analysis uses data that is now two weeks old. Markets have subsequently seen more wild swings so we’ve run the numbers again using data from Winterflood on a selection of trusts (as of 10 March) to get a more up-to-date picture. You can get the latest numbers by checking the AIC’s website and looking at individual trusts.

According to Winterflood, Scottish Investment Trust’s (SCIN) discount has widened out from a 12-month average of 11% to 11.7%. Managed by contrarian investor Alasdair McKinnon, this diversified portfolio of international equities seeks to achieve dividend growth ahead of UK inflation and it has grown the regular dividend for 36 successive years.

Elsewhere within the sector, the sell-off has also hit the Nick Train-managed Lindsell Train (LTI), where the massive average premium of 47.4% over the past 12 months, heavily influenced by the perceived undervaluation of the holding the trust has in the asset manager Lindsell Train Limited, has narrowed to 4.6%.

In the UK All-Companies universe, Artemis Alpha Trust (ATS) is trading on a steep 18.1% discount. The trust’s portfolio has been repositioned toward higher quality companies which enjoy competitive advantages in industries with supportive dynamics and are steered by excellent management teams.

Among small caps, Montanaro UK Smaller Companies (MTU) trades on a 13.4% NAV discount that belies its track record and generous dividends, while the discount on the River and Mercantile UK Micro Cap (RMMC) has widened out from a 12-month average of 15.1% to 18.9%.

OVERSEAS INVESTMENTS

The coronavirus sell-off has also affected funds that put money to work away from UK shores. For instance, the discount on country specialist India Capital Growth (IGC) has widened out from 15.9% to 23%, while investors seeking broader exposure to names in developing economies should note Fundsmith Emerging Equities (FEET), where the discount has more than doubled from 7.1% to 12.4%.

The discount on JPMorgan Japanese (JFJ) has widened out from 9.8% to 14.3%. Its holdings include Uniqlo-owner Fast Retailing, factory automation equipment maker Keyence and iconic gaming name Nintendo.

Multi-manager investment trust Witan (WTAN) has seen its discount widen to 4.4% from a 12-month average of 3.4%. Its nearest peer, Alliance Trust (ATST) has over the past year traded on a small discount, averaging 5.8%, however that’s now narrowed to 5.3%.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine