Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The underappreciated risks to markets in 2021

As we wrote in our 2021 outlook, there are plenty of reasons to be cheerful looking ahead. Several Covid vaccines are in production with a view to mass immunisation over the course of the year, allowing life to get back to normal and the global economy to repair itself, and interest rates are set to remain at historically low levels.

A Biden presidency, and potentially a Democrat-led Senate, brings with it a clear agenda on clean energy and infrastructure spending in the US and potentially an end to tit-for-tat trade disputes with China and other nations.

China, for its part, is expected to power global growth next year and to become an increasing focus for both equity and bond investors.

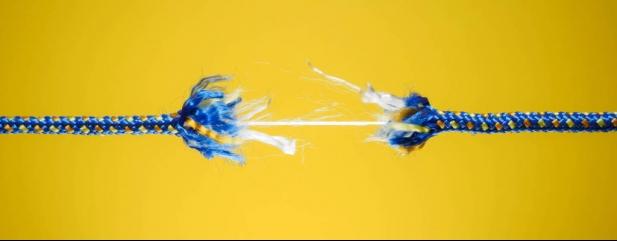

However, if 2020 has taught us one thing it’s to expect the unexpected, so without making any predictions, what could trip us up over the next 12 months?

EXCESS POSITIVITY

One of the biggest surprises is how bullish stock markets have been and continue to be despite the destruction of roughly three years of corporate earnings due to the pandemic.

Part of the reason for this is the extraordinary amount of liquidity injected into markets by central banks to stave off an economic collapse. With $18 trillion of bonds worldwide offering negative yields due to the vast amount of cash swilling around markets, investors have had little option but to chase stocks higher.

With the S&P 500 and the Nasdaq 100 having recently hit new all-time highs, optimism is unbridled. The latest quarterly survey of asset allocators by Absolute Strategy Research, flagged in an article by Bloomberg columnist John Authers, shows a record high in its ‘composite optimism indicator’ and record high probabilities that:

• global equities will be higher

• global earnings will be higher

• stocks will beat bonds

• value will beat growth

• cyclicals will beat defensives

• emerging market stocks will beat developed market stocks

• US investment grade bonds will beat treasuries

• US high-yield bonds will beat investment-grade bonds

• emerging market hard-currency bonds will beat US high yield

Those surveyed also assigned a record low probability to US unemployment rising, the dollar appreciating and US stocks suffering a 20% drawdown.

There are a raft of other indicators which also point to excessive bullish sentiment, such as the American Association of Individual Investors (AAII) Bull to Bear sentiment survey, the ratio of S&P 500 put options to call options – which is at a record low instead of a record high as investors buy ‘upside protection’ instead of ‘downside protection’ – and CNN’s ‘Fear and Greed’ index which last week sat at the ‘Extreme Greed’ level.

The latest Bank of America survey of fund managers found global growth and profit optimism at a 20-year high, with those surveyed favouring a record allocation to stocks compared with bonds and a five-year low allocation to cash. The bank warned markets were close to ‘full bull’ and a sensible strategy might be to sell into strength.

John Templeton described bull markets as being born out of pessimism, growing on scepticism, maturing on optimism and dying on euphoria. On the current evidence we surely aren’t that far from euphoria.

REFLATION RISKS

As Standard Chartered’s head of research Eric Robertson points out, the ‘reflation consensus’ is vulnerable to bad news. He has a list of non-consensual macro-economic and political risks to markets for 2021, starting with a Democrat sweep of the US Senate which would send US tech stocks reeling and yields sharply higher on fears of rising money supply.

His other risks are that China lets its currency appreciate against the dollar to improve consumers’ purchasing power; copper prices surge as it becomes ‘an asset class’; and oil prices collapse as OPEC splits over quotas and cooperation.

Furthermore that the euro collapses as the European Central Bank toys with zero interest rates; the dollar collapses as new treasury secretary Janet Yellen talks the currency down to ease financial conditions; and emerging market debt defaults and sovereign downgrades spark a collapse in emerging market stocks just as the consensus has turned strongly bullish.

BLACK SWANS

For a list of even more non-consensual risks to the consensus view, we turn to Saxo Bank’s chief investment officer Steen Jakobsen whose ‘outrageous predictions’ have become market folklore.

Among his unlikely but under-appreciated events, which could send shock waves through financial markets are: Germany having to bail out France after its banks suffer meltdown; Amazon redomiciling its European business to Cyprus for tax purposes; and a new digital Chinese currency disrupting capital flows.

He also flags a breakthrough in nuclear fusion leading to energy abundance and the dramatic demise of Big Oil; the silver price rocketing on solar panel demand and a supply crunch; and a universal basic income ‘hollowing out’ big cities with catastrophic effects on commercial and residential property prices.

‘The pandemic and the painful US election cycle have brought what might have seemed a distant future a quantum leap closer, accelerating nearly every underlying social and technological super-trend. Simply put, the traumas of 2020 mean that in 2021, the future is now,’ says Jakobsen. [IC]

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

First-time Investor

Great Ideas

- Stock pick for 2021: Alibaba

- Stock pick for 2021: Tracsis

- Stock pick for 2021: Eurofins Scientific

- Stock pick for 2021: JD Wetherspoon

- Stock pick for 2021: BHP

- Stock pick for 2021: Inspecs

- Stock pick for 2021: Convatec

- Stock pick for 2021: RWS

- Stock pick for 2021: PZ Cussons

- Stock pick for 2021: Diageo

- Stock pick for 2021: Qinetiq

- Stock pick for 2021: Ocado

magazine

magazine