Coming just six weeks after shares in food takeaway platform Deliveroo (ROO) dropped more than 30% on its first day as a public company, the negative reaction to chip designer Alphawave IP’s (AWE) market debut – down 10% in a day – has lead to wider concerns about London’s merits as a listing destination and the quality of new companies joining the market.

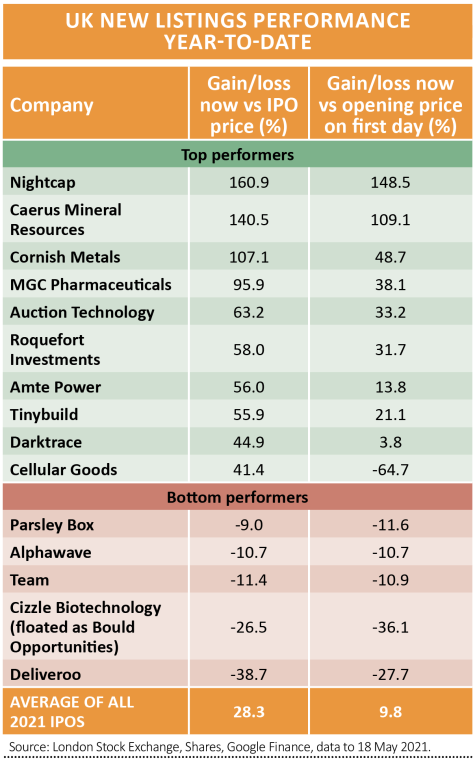

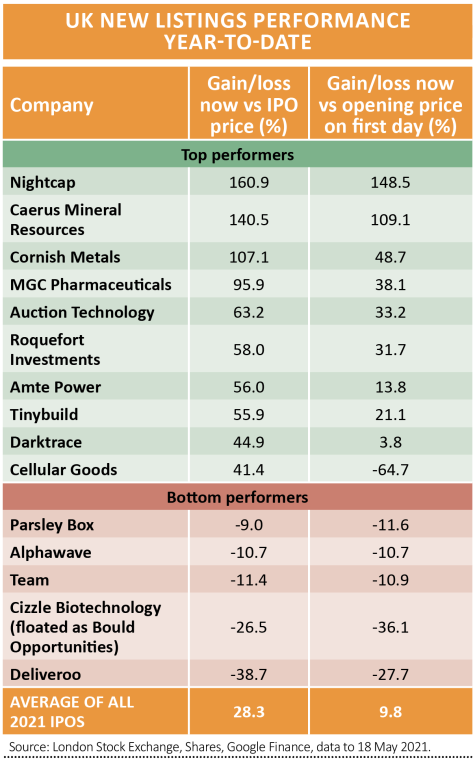

However, these prominent disappointments do not reflect a wider picture of decent gains for recently listed firms. Shares has crunched the numbers on those firms that conducted a London IPO (initial public offering) since the beginning of 2021 and there has been an average 28.3% gain on the price at which the shares were first offered to investors.

Retail investors had to wait for most of these stocks to start trading before they could buy, but even if you take each stock’s opening price on day one the average subsequent gain is close to double digits at 9.8%. That is good, but it also shows how retail investors are still at a disadvantage to institutional investors.

Hopes were high for Alphawave’s listing given the similarities between the business and former market darling ARM, which was snapped up for £23.4 billion by Japanese investor Softbank in 2016, and the strong dynamics behind the global microchip industry as supply struggles to keep up with demand.

Like ARM, Alphawave licences out designs which other chipmakers use as the basis for their products and it then earns a royalty every time a device is sold. This asset-light model, with few demands on capital, should enable strong margins and cash generation and if ARM is any guide be rewarded with a premium market valuation.

However, Alphawave may have priced itself too high ahead of its debut. At the issue price of 410p the business was valued at £3.1 billion. This compared with the latest annual sales of $44 million, operating profit of $24 million and cash flow of $15 million.

The company was also a victim of poor timing – its first day of dealing on 13 May coincided with a bad day for technology stocks as market fears over inflation began to spiral.

‹ Previous2021-05-20Next ›

magazine

magazine