Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Inflation, deflation or stagflation: how to prepare your portfolio

Doubt is not a not a pleasant condition, but certainty is absurd,’ is a valuable insight from 18th century French writer Voltaire and right now investors have much to consider.

No-one knows what is coming next, not even central bankers. If they did, the monetary authorities would hardly still be running policies that were described as emergency measures when they were launched in the wake of the Great Financial Crisis.

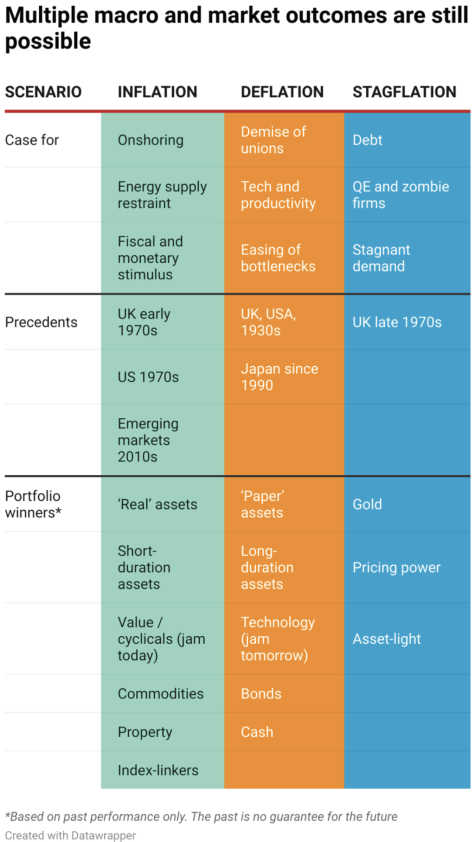

Possible outcomes include an inflationary boom, a deflationary slump or a stagflationary swamp and the hard part is that each scenario potentially requires a different portfolio solution and asset allocation strategy, at least if history is any guide.

Possible scenarios

It is easy to make a case for any one of those three scenarios:

1. Inflation

– Onshoring will mean more expensive, Western labour;

– Soaring energy prices as supply of hydrocarbons is restrained to meet zero-carbon targets even as demand grows;

– Monetary and fiscal stimulus that are boosting overall demand for goods and services even as supply chains remain brittle, even fractured.

2. Deflation or disinflation

– Technology continues to drive productivity and automation reduces the need for staff and workers;

– The erosion of the power of trades unions keeps a lid on wage demands;

– Supply-side bottlenecks and temporary dislocations in supply start to ease.

3. Stagflation

– Global debt levels stand at record highs and interest payments suck cash away from other, more productive investment and

hold back growth;

– Quantitative easing and zero interest rate policies keep alive zombie firms which are hogging capital that could perhaps be allocated more effectively elsewhere;

– Demand starts to stagnate after an initial post-pandemic boom, should central banks and governments start to offer less, or even withdraw, stimulus.

Possible outcomes

There are precedents for all three and investors can look back on those episodes for guidance as to which asset classes did best then – albeit in the knowledge that the past is no guarantee for the future.

1. Inflation

Inflation has in the past seen ‘real’ assets outperform. Governments can print money, but they cannot print oil, gold or property, and those ‘real’ assets may therefore offer some degree of wealth preservation in the face of rampant money creation.

Index-linked bonds may offer some protection and investors may also be tempted to gravitate toward cyclicals.

If inflation is running hot, then nominal GDP will look good, so will nominal sales and possibly profits. In that case, investors will be able to buy earnings and cash flow growth now – jam today – and do so at firms that have underperformed and are potentially cheap. This contrasts to the long-term growth stocks which have done so well for so long, offering jam tomorrow at much higher multiples as a result.

The caveat here is that UK equities started their post crack-up boom recovery in the mid-1970s after a crushing bear market which left stocks trading on an average of barely five times forward earnings.

The UK now trades on a mid-teens-earnings multiple and the US is on the low-20s, so the starting points are very different on this occasion.

2.Deflation or disinflation

Deflation, or at least disinflation, would lean towards cash and bonds, uncomfortable as that may sound, especially given where yields are right now.

If prices start falling, even those modest (or even negative nominal) returns would look appealing, given the capital preservation they would offer.

In the case of deflation, the odds on central banks returning to aggressive quantitative easing and negative interest rate policies must be good, creating a price insensitive buyer for fixed-income instruments, especially government bonds.

A repeat of the last 10 years’ low-growth, low-inflation, low-rates environment could also lead investors to stick with another asset class that has worked so well for the last decade, namely growth stocks, such as tech, biotech and social media.

These firms are considered capable of generating earnings growth almost regardless of the economic conditions and as such are highly prized and enjoy premium valuations as a result.

The caveat is that it is unusual for the globe to remain in a steady state for too long – change is the only constant.

It is tempting to extrapolate our most recent experiences and base our future expectations upon them but from an investment point of view this often leads to trouble.

Anyone who bought Japan in 1990, tech media and telecoms in 2000 and China and mining stocks in 2010 – all after a decade of stunning performance – would have suffered terrible returns for the next decade and more.

3. Stagflation

Stagflation is much the rarest scenario and we only have the 1970s to lean upon. It is possible to argue there are clear parallels between then and now – governments scrabbling to find money for welfare programmes, easy money in the form of fiscal stimulus, a potential energy shock and heightened geopolitical tensions – with the result that we could yet have to face the worst of both worlds: limited or negative GDP growth and sticky or rising prices.

In the 1970s, gold was the best performing asset by a mile, as it surged from $35 an ounce to a peak above $800. The caveat is that we are starting off at $1,800 an ounce this time around.

Think about the future

No-one knows what is coming. But we do know what the markets are pricing in, because equities (‘paper assets’) have outperformed commodities (‘real assets’) hands down for a decade, with growth and tech stocks leading the way.

That implies markets still have faith in central banks, see the current inflationary spike as transitory and believe the formula for the last decade will remain the same in the next one.

That could come to pass. But if nothing else, investors know that any deviation from that path, in the form of inflation or stagflation, could cause volatility and see different asset classes come to the fore.

A portfolio that prepares for all three scenarios through diversified asset allocation might be a plan to consider, complete with some cash for downside protection and scope to buy amid any wider shakedown, even if the investor may then choose to tilt that allocation to the scenario they feel is most likely.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

- XP Power lining up M&A drive

- Time to buy into SAP’s cloud shift before the market catches up

- Small cap consumer goods firm shrugs off supply chain issues

- Disney still a great long-term investment despite film delays

- Buy wholesaler Kitwave which is firmly in the driving seat

- QiniteQ sell-off represents a good buying opportunity

News

- What to expect in the latest updates from UK banks

- Life sciences property investor to break new ground

- Bitcoin ETF optimism feeds latest cryptocurrency rally

- Uranium’s glowing performance amid energy crisis

- ProCook and Stelrad plot main market flotations

- China could export inflation to the rest of the world

magazine

magazine