Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Dowlais shares worth buying after demerger from careful owner Melrose

The name Dowlais (DWL) may not mean a huge amount to you but there is a good chance something it has made is sitting on your driveway.

An April 2023 spin-out from industrial turnaround specialist Melrose (MRO), Dowlais is effectively the car engineering part of GKN. An institution in the UK industrials and engineering space, GKN was controversially purchased by Melrose for £8 billion in 2018.

Melrose has retained the aerospace assets and the demerged Dowlais encompasses GKN Automotive, whose components are present on 50% of new cars worldwide, powder metal specialist GKN Powder Metallurgy, whose management estimates that every car produced globally has around 23 parts manufactured by the business, and energy storage start-up GKN Hydrogen.

Melrose is sometimes compared with private equity but this is probably unfair (see box: Melrose’s approach). Dowlais is not a case of a company being listed by a private equity firm with significant borrowings on the balance sheet and with all the best assets stripped away. Dowlais has instead benefited from investment and careful management by Melrose and debt is at a sensible level of around one-and-a-half times earnings.

Dowlais’ challenges are different. It must contend with the cyclical nature of the wider automotive industry as well as the structural change of a shift to electric vehicles. Navigating these two tests will be key to whether the company proves a success as a demerged entity.

Melrose’s approach

Melrose’s model is relatively straightforward; it buys poorly managed manufacturing businesses which are suffering from a lack of investment, then looks to drive operational improvements and boost cash generation.

Although this approach has been compared to private equity Melrose can justly point to differences. It typically invests fresh capital in the businesses it acquires rather than simply stripping out costs.

When it achieves the targeted improvements, management will choose what it feels is the appropriate time to sell. Often this comes three to five years post-acquisition but there is a degree of flexibility.

We think there are reasons to be confident in Dowlais’ ability to handle both. Investing now could reward a patient investor, with the shares trading on a price to earnings ratio of just 8.5 times forecast earnings.

HOW DOES DOWLAIS MAKE MONEY?

We can leave GKN Hydrogen to one side in this analysis given it is pre-revenue. GKN Automotive is, no pun intended, the main driver of the group. It will account for more than 80% of 2023 sales and 73% of earnings according to estimates from investment bank Jefferies.

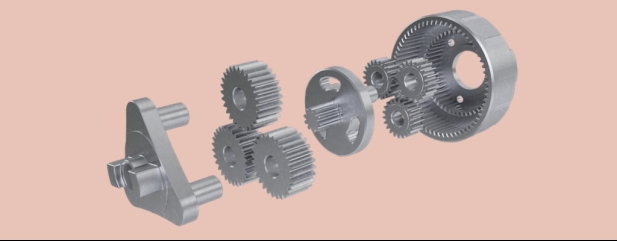

It can be split into two parts. Driveline, the part of a vehicle which transfers power from the engine and transmission to the wheels, where its main products are sideshafts and propshafts; and ePowertrain, which encompasses its all-wheel drive systems and eDrive technology.

The modular eDrive system is available as a complete, fully integrated three-in-one system with inverter, motor and transmission; as a two-in-one combination system; or as single modules and components. The first such system was fitted more than two decades ago and it now powers more than two million electric vehicles across the globe.

GKN Automotive is the market leader in sideshafts and propshafts and has a strong market position in China, having first entered this market 35 years ago. Around 90% of global vehicle manufacturers use GKN Automotive components.

After profitability was badly damaged during the pandemic, GKN Automotive has been rebuilding its margins, with a priority of hitting double-digits on this metric rather than pursuing growth for its own sake.

For the uninitiated, propshafts are the component which connects the gearbox in a car to the mechanical device (differential) on an axle which allows the wheels to rotate at different speeds. Sideshafts provide the connection between a vehicle’s engine or power source and its driving wheels.

While propshafts will be rendered redundant in a shift to an entirely electric vehicle world, EVs require a larger number and size of sideshafts, creating opportunities for Dowlais.

EDRIVE EXPECTATIONS ARE UNDERPOWERED

One sticking point for the market when it comes to the company is the destiny of eDrive, an area which is still requiring relatively heavy investment of around £50 million to £60 million per year.

The perception of this part of the group has been negatively impacted by carmakers themselves producing their own systems in-house. Jefferies quotes a figure of 80% of this process being insourced as opposed to 50% two years ago.

This has led to competitive pressures and raised questions about Dowlais’ strategy of placing so much emphasis on profitability at the expense of market share.

Jefferies is still a believer in eDrive for several reasons. First, capacity issues may see a return to outsourcing, particularly as the number of electric vehicles on the road grows. Second, GKN Automotive has niche components which should be able to command higher margins. Third, the business may bring some of its own function in-house and finally, it argues, moving away from a focus on returns to pursuing unprofitable growth would be misguided ‘at this point in the transformation story’.

What has recent trading been like?

In the four months to the end of April, Dowlais achieved revenue growth of 9% at constant currency with margins above 7%. GKN Automotive posted 11% growth while GKN Powder Metallurgy posted flat revenue and margins of 8.3%.

It is also worth noting that the transition to electric vehicles is not happening as rapidly as some had anticipated. The improvement in GKN Automotive under Melrose means it can deal with this fluid backdrop as its production capacity is relatively flexible.

WHAT ABOUT THE POWDER METALLURGY BUSINESS?

The somewhat higher margin GKN Powder Metallurgy business is still a material contributor to profit and revenue. It is the number one sinter metals supplier and number two powder metals supplier globally. Powder metallurgy refers to an array of processes used to create structural metal parts and components.

Metal sintering is the process of fusing metal powders to create a solid object using heat and pressure. It creates harder, stronger materials and can be used to create more complex parts and shapes. The business produces metal powders and high precision metal parts for the automotive space (around 80% of sales) and other industrial sectors.

Edison estimates around 50% of its sales are at risk if the world’s vehicles go 100% electric thanks to exposure to engine and gearbox components. The big hope is it can expand into producing the magnets required in electric vehicles.

An offer for the GKN Powder Metallurgy division of £1.6 billion in 2018 was considered unacceptable by Melrose at the time and yet the current enterprise value (market cap plus debt) of Dowlais as a whole is only around £2.6 billion.

To place this in context, GKN Powder Metallurgy is expected to account for less than 20% of 2023 sales. Dowlais may test the valuation of the Powder Metallurgy division sooner rather than later, saying it will consider its ownership of the business in the next two to three years.

Who runs Dowlais?

The CEO of Dowlais, Liam Butterworth, previously served as CEO of GKN Automotive and before that was chief executive of US automotive firm Delphi Technologies. He led its demerger from Delphi Automotive in 2017 and subsequent listing on the New York Stock Exchange.

Dowlais is highly cash generative (cash conversion is consistently above 90%) and it generated operating cash of £1.8 billion between 2019 and 2021. This cash flow should underpin dividend payments, with a forecast yield of 3.4%, and enable ongoing investment in the business as well as help fund mergers and acquisitions activity to augment growth too.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Why Vodafone’s marriage of convenience with Three leaves questions hanging

- Cost of UK mortgages breaches 6% while June house prices fall for the first time in five years

- Shares in this US restaurant business more than doubled on its stock market debut

- Motorpoint shares slump as profit wiped out amid a multitude of factors

- Unfavourable exchange rates leave many Japan fund investors lagging Japanese stock rally

magazine

magazine