Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Can the ‘Magnificent Seven’ ride higher again? The 2024 prospects for Meta, Apple, Alphabet, Nvidia, Microsoft, Amazon and Tesla

Mega-cap tech stocks drove the bulk of US stock market gains in 2023, but can the so-called ‘Magnificent Seven’ repeat the trick in 2024?

While the odds seem stacked against a re-run of last year’s blistering capital returns over the next 12 months, Shares believes that the ‘Magnificent Seven’ will continue to beat S&P 500 rivals and top index averages. If you want high-quality growth in your portfolio, you need look no further.

Tagged the ‘Magnificent Seven’ by a Bank of America analyst, the term has emerged as a byword for the world’s biggest and most important tech stocks – Alphabet (GOOG:NASDAQ), Amazon (AMZN:NASDAQ), Apple (AAPL:NASDAQ), Meta Platforms (META:NASDAQ), Microsoft (MSFT:NASDAQ), Nvidia (NVDA:NASDAQ) and Tesla (TSLA:NASDAQ) – in the same way we used to talk about ‘FANGs’, or Facebook, Amazon, Netflix and Google.

WHAT HAPPENED IN 2023?

AI was born as a mainstream investment theme in 2023. No longer the preserve of venture capital firms and hedge funds, last year saw millions of ordinary investors actively embrace the theme.

Given the sheer scale of the ‘Magnificent Seven’, with a combined market cap of about $11.6 trillion, it means even passive investors were on board with the AI boom, even if they didn’t know it, through S&P 500, Nasdaq and All World ETFs, plus hundreds of other funds.

They’ll be chuffed that they were. Shares of the ‘Magnificent Seven’ rallied between around 50% and 240% in 2023, making them among the market’s most rewarding bets.

By the end of 2023, the valuations of the ‘Magnificent Seven’ had soared to roughly 28% of the total S&P 500 index. This lopsided dynamic meant the S&P 500’s 24% rally last year was roughly double that of its equal-weight variant, the largest percentage-point difference since 1998, according to Dow Jones Market Data.

Data from Apollo showed 72% of the S&P 500’s stocks underperformed the index this year, a record.

AREN’T THEY ALL REALLY EXPENSIVE?

That depends on your point of view. It is fair to say that some ‘Magnificent Seven’ valuations may look stretched, especially based on traditional valuation metrics, like 12-month price to earnings ratios, or PEs, for example. But you must balance this with their faster than average growth, higher profit margins and cleaner balance sheets bulging with more than $260 billion of net cash.

‘On an earnings-weighted basis, the ‘Magnificent Seven’s’ long-term expected earnings per share growth is eight percentage points faster than the median S&P 500 stock,’ says Goldman Sachs’ David Kostin, 17% versus 9%.

On a PEG ratio, or price to earnings growth basis, the relative valuations are in line with the 10-year averages, Kostin says.

‘Analyst estimates show the mega-cap tech companies growing sales at a compound annual growth rate (CAGR, for short) of 11% through 2025 compared with just 3% for the rest of the S&P 500,’ said Goldman Sachs’ David Kostin.

POWERFUL PROFIT MACHINES

‘The net margins of the ‘Magnificent Seven’ are twice the margins of the rest of the index, and consensus expects this gap will persist through 2025,’ Kostin said.

Not surprisingly, fund managers in Bank of America Global Research’s most recent survey said owning the seven stocks was the market’s ‘most crowded’ trade. This extreme concentration of the stock market rally last year should keep investors on high alert, but Goldman Sachs isn’t concerned and expects the gains to continue in 2024.

A Reuters report has also flagged signs that the rally is broadening. The equal-weight S&P 500, a proxy for the average stock, climbed 6.7% in December 2023 against a 4.5% rise for the standard index, after lagging most of the year. Meanwhile, the previously sluggish small-cap Russell 2000 soared 12% in December, its biggest monthly gain in three years.

MEAN REVERSION

A rate hike cycle reversal will help – it was the main reason for the equity market sell-off in 2022, so it stands to reason that easing rates will provide a substantial boost to ‘Magnificent Seven’ stocks and share prices in general.

The sharp outperformance in the mega-cap tech stocks last year came after a brutal 2022 in which many stocks were severely punished by investors. That made 2023’s performance trend reversal rather ordinary to Goldman Sachs’ Kostin.

‘From their peak, Meta fell more than 70%, Nvidia dropped more than 60%, and Amazon’s share price was cut in half in 2022,’ he says.

DRIVING THE MAGNIFICENT SEVEN IN 2024?

In short, more AI. But where 2023 was about laying foundations and working out corporate strategies, 2024 promises to see a rapid rise of use cases that should directly bolster profits.

‘We believe AI is the biggest transformation in the tech sector in the last 30 years and is a “1995 Moment” not seen since the start of the internet in 1995,’ says Dan Ives, the respected technology analyst at Wedbush. Ives calculates that AI could make up 8% to 10% of IT budgets in 2024, which would be up from less than 1% of budgets in 2023. The AI sector could see over $1 trillion in spending over the next decade.

UNIQUE PLAYS ON AI

UBS believes that the investment outlook for AI will not only persist but also strengthen in 2024. They say that the integral role of ‘Magnificent Seven’ stocks in the ongoing development and dissemination of AI positions them favourably to continue driving innovation, efficiency, and profitability in the evolving landscape of the tech sector.

‘When we launched our AI industry revenue estimates last year, we expected growth from $28 billion in 2022 to $300 billion by 2027. That translated into a compounded annual growth rate of 61%,’ said UBS Americas chief investment officer Solita Marcelli. But just days into the New Year and UBS analysts upgraded their estimate, with the greatest risk being that we are ‘too conservative’.

UBS now forecasts AI industry revenues of $420 billion by 2027, a 40% hike to its projection that represents 72% annual growth and a 15-fold increase in just five years.

‘While these numbers may appear ambitious, they align with historical trends seen in earlier phases of the computing cycle, including mainframe, PC, and smartphone shipments.’

WRAPPING UP

‘We see a multi-country, multi-sector AI-centred investment cycle unfolding,’ says BlackRock, throwing its hefty hat into the debate. While concerns may arise regarding potential headwinds, such as a slower practical implementation of AI or a strategic shift in investor portfolios away from the previous year’s leaders, UBS believes that the investment outlook for AI will not only persist but also strengthen in 2024.

Phil Haworth, head of equities at Aegon Asset Management believes the ‘Magnificent Seven’ may continue to perform well, especially those like Nvidia and Microsoft, which are driving the development of AI, although he also thinks equity performance will expend in breadth in 2024.

Combined with the fact that the recessionary risk is not where it was, there are reasons to believe this new bull market is here to stay. Armed with tonnes of cash on the balance sheet, strong cash flows and excellent leadership, the ‘Magnificent Seven’ are well-positioned to continue leading their respective markets in 2024.

Wedbush’s Ives reckons ‘Magnificent Seven’ stocks will have another ‘robust year in 2024’ and lead tech higher, and he would not be surprised to see these stocks clock up gains of 30% in 2024 with AI front and centre.

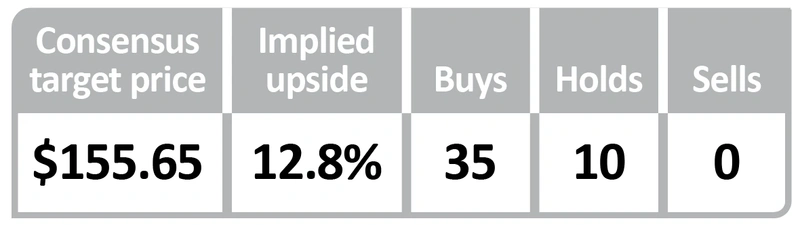

Alphabet

(GOOG;NASDAQ) $138.04

What does it do?:

Its core subsidiary is Google which encompasses the eponymous search engine and YouTube video sharing platform which generate significant advertising revenue, as well as its artificial intelligence and cloud computing arms. It also has more nascent ventures in areas like self-driving cars and quantum computing.

What to watch in 2024:

The internet search giant continues to fall under the watchful gaze of global regulators concerned about its market power and the impact on reasonable competition. There has been talk of slapping curbs on the company, although nothing likely to dent the share price very much. More meaningful is its emerging cloud computing business, and signs that growth here is being clipped could dampen investor enthusiasm, while if a recession does emerge, advertising usually gets it in the neck, so that would be bad news.

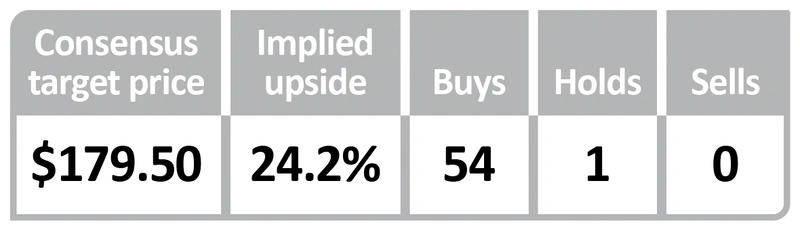

Amazon

(AMZN:NASDAQ) $144.57

What does it do?:

While its e-commerce arm is more prominent and longstanding, its Amazon Web Services cloud computing division is the more profitable part of the business. The company also has a strong position in TV, film and music streaming.

What to watch in 2024:

Consumer spending and cloud computing will dominate Amazon’s year, and recent speculation that TikTok is looking to steal online shopping market share has tainted the stock’s start to 2024. Amazon has always had fierce competition to deal with, while dimming chances of recession are positive, and its distribution scale and consumer trust are great defensives qualities. Most investors would rather it focused increasingly on its real source of profit – cloud arm Amazon Web Services. This is an area that could really see AI pay-off this year.

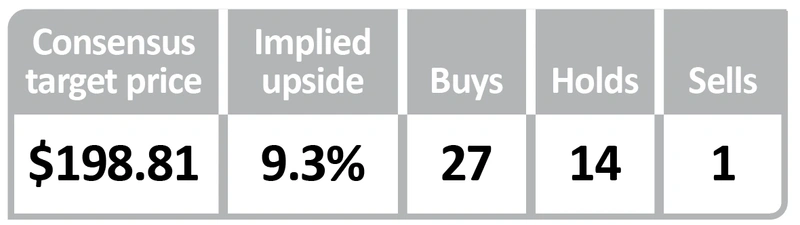

Apple

(AAPL:NASDAQ) $181.91

What does it do?:

The company behind leading consumer electronics brands like iPhone and iPad has a burgeoning services division offering financial, entertainment and data management platforms and tools.

What to watch in 2024:

Quite where AI fits in at Apple is a poser for investors, with chief executive Tim Cook cagey on details, a source of criticism from some quarters. That said, a rough billion iPhones worldwide ready to embrace whatever the company does is an exciting prospect. An AI-powered Siri is one obvious option, and speculation suggests Apple is deliberately taking its time to make sure it gets its AI projects right. Outside of that, eyes will fall on handset sales in China and high-margin services revenues growth, which have gone from a tiny to a multi-billion-dollar part of the operation in recent years. There was talk last year of Chinese government departments slapping bans on iPhones, although there’s limited evidence of that to date.

Excitement is also building around the company’s mixed reality Vision Pro headset which is set to launch on 2 February.

Meta Platforms

(META:NASDAQ) $347.12

What does it do?:

For all the talk of the metaverse – Meta remains a social media business at heart with several of the world’s leading platforms including Facebook, Instagram, WhatsApp and the recently launched Threads. Advertising accounts for a substantial proportion of revenue.

What to watch in 2024:

The Facebook-owner has plenty of AI ideas – language translation, Instagram users reimagining their photos, for example – but many seem unlikely to generate meaningful revenue, so advertising will remain key, so as with Alphabet, a recession would be ugly. Longer term, Meta wants to make the world increasingly ‘connected’. Meta’s development on a product that integrates an AI assistant with augmented reality, allowing users to do things like learn how to cook, play tennis, or create pottery, could be extremely exciting for users and a potentially massive revenue driver.

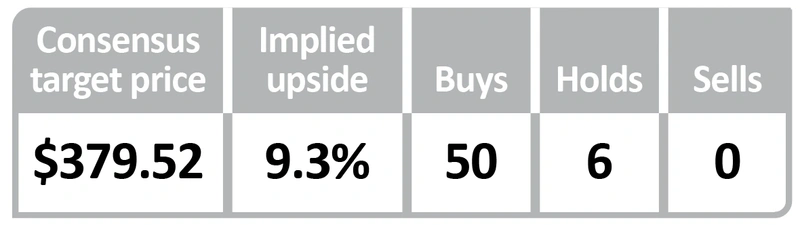

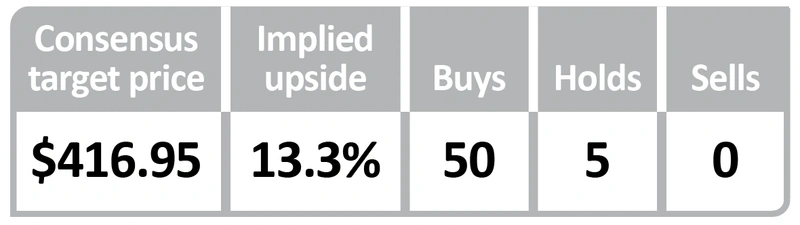

Microsoft

(MSFT:NASDAQ) $367.94

What does it do?:

Cloud computing has been a big driver for a business which at one time looked to have been left behind by its rivals. Microsoft has been remarkably successful at selling its main products – the Windows operating systems, Microsoft 365 suite of productivity applications, Azure big data analytics, etc – as cloud-hosted subscriptions rather than upfront licences. It has also taken a big step into AI through its partnership with Open AI – the developer of ChatGPT.

What to watch in 2024:

Seen by most as the AI software play, its apps are already critical to millions of businesses so wrapping into Windows, Microsoft 365, Azure, and more, through its Copilot tools offers immense potential. As an upsell to existing subscriptions, it should seed the ground for what looks likely to reap big rewards, with revenues that should prove extremely sticky too. Another target for global watchdogs, although as with most of the tech giants, analysts suggest there is little to fear beyond the few fines here or there. Investors should also look out for news on how Microsoft will harness its much bigger gaming footprint, after finally getting the green light to buy Activision Blizzard.

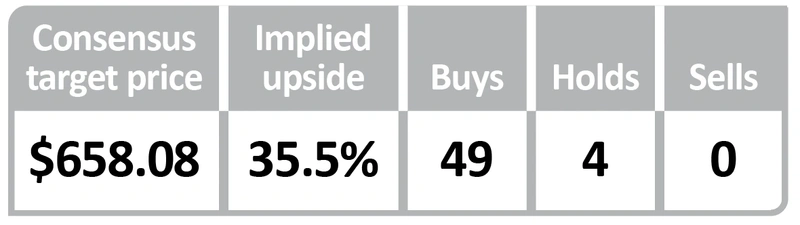

Nvidia

(NVDA:NASDAQ) $485.26

What does it do?:

It designs microchips and hands over manufacturing to third parties. It was a specialist in the gaming market and designed advanced graphic processing units. These are better able than traditional computer processing units to handle the massive volumes of data involved in AI at speed and increasingly it is pivoting towards serving this fast-growing market.

What to watch in 2024:

The AI hot stock of 2023, Nvidia’s graphics processing units have emerged as the must-have bits of kit to power global AI initiatives. The scale of the AI opportunity is becoming increasingly forceful and accepted by market participants, and assuming they are right, the key for Nvidia is innovation, making sure its designs stay at the bleeding edge of AI development. Plenty think is can, and will, which is why the most bullish analysts think the stock could blast past $1,000 in time, perhaps even this year. The obvious risks are more competition, which it can do something about, and that future revenue growth from China may be hurt by Washington’s advanced tech exports impasse with Beijing, which it can’t.

Tesla

(TSLA:NASDAQ) $237.78

What does it do?:

A leading manufacturer of electric vehicles which has a head-start on many traditional car makers, Tesla also has a footprint in battery and electric storage technology.

What to watch in 2024:

A savage electric vehicles price war instigated by Elon Musk is starting to look like backfiring as Tesla’s 20%-plus gross margins of the past slump. In theory, this should have shaken out many of the loss-making EV makers and led to a spike in demand, but neither seems to have happened, at least not to the extent Tesla might have hoped. Competition remains as fierce as ever, particularly from China’s BYD, which overtook Tesla as the world’s top EV seller in the fourth quarter of 2023. Perhaps it is still too early to come to conclusions, we’ll know more as Tesla reports sales through this year, with the now launched Cybertruck an intriguing prospect. Plans to launch a sub-$30,000 EV and its fast-growing recharging network look like milestones if Tesla shares are to rally back to $400 peaks of the past, although many analysts are sceptical.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Next raises guidance after strong Christmas sales

- US March rate cut bets pared back after stronger than expected December jobs report

- What it might take to revive the UK IPO market as M&A frenzy continues

- What completion of game-changing YouGov GfK deal means for the business

- JD Sports Fashion shares take a bath as consumers feel the cost-of-living squeeze

magazine

magazine