Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What should investors do with Scottish Mortgage?

For the first time in years Scottish Mortgage Investment Trust (SMT) investors are contemplating selling up and moving on. Over the past month, it is the most sold investment trust on the AJ Bell platform, accounting for 14.6% of all trust sales.

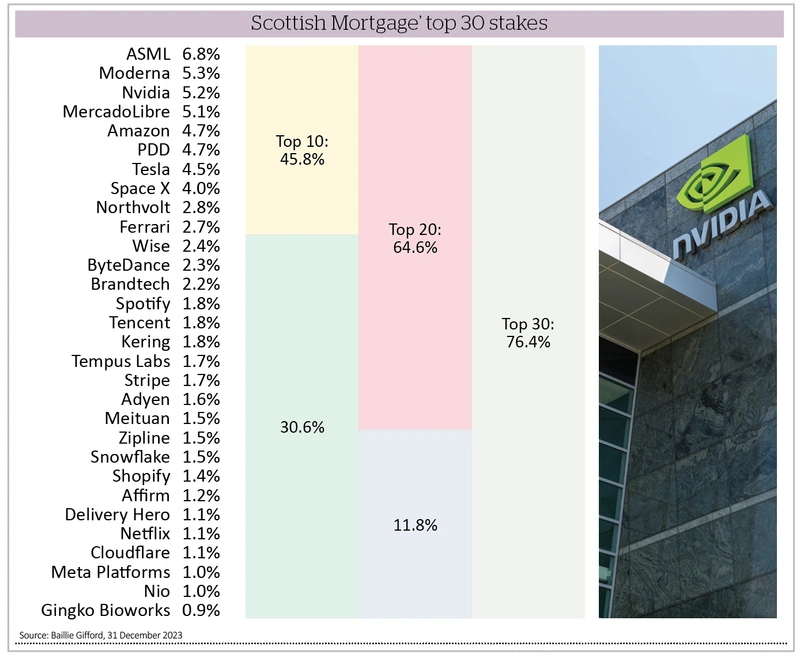

This is almost unheard of, and it is meaningful too. For most of the 21st Century, long-term investors have backed Scottish Mortgage to the hilt, enjoying a seemingly endless supply of successes, including stakes in Amazon (AMZN:NASDAQ), Tencent (0700:HKG), Tesla (TSLA:NASDAQ) long before the rest of the market caught on.

It is a run that has made Scottish Mortgage a foundation stone of thousands of private investor portfolios, powering the trust into the FTSE 100.

INVESTMENT STRATEGY

Many investors will know the pitch – Scottish Mortgage aims to identify and back the world’s most exceptional growth companies, and by doing so, deliver exceptional returns for shareholders over the long term. As with many things, it sounds simple, yet is far from easy to execute and investors must be willing to accept what might be called exceptional risk too.

In theory, 2024 should be a much better year for the trust than recent ones. Investors look forward not backwards, and there is widespread expectation that peak interest rates have been reached across Western economies. Data from Bloomberg shows more than 160 basis point cuts are currently priced in by the market for US interest rates this year, with 150 and 130 basis point cuts for the Eurozone and UK respectively.

This would lower the cost of borrowing and shallow market discount rates on growth assets.

Only it didn’t seem to play out that way for the trust’s shares for most of 2023 when plenty of growth stocks went to the moon, but Scottish Mortgage remained firmly out of favour. While portfolio holdings like Nvidia (NVDA:NASDAQ), Tesla and Shopify (SHOP:NYSE) were clocking up triple-digit 2023 gains, Scottish Mortgage’ share price rose just 12% in 2023, ending the year at 808p, and that was only after a post-Halloween rally – up until then the stock was actually down 11%.

Not much has changed this year so far either, the stock off around 4% in January 2024 (as of 22 January). Even so, the discount to net assets has narrowed, roughly halving from almost 23% to 10.8% now, according to Trustnet data. Yet that remains historically high, with the long-run average discount calculated by Trustnet at 4.8%.

In that light, Scottish Mortgage’ focus on sustained technological advances could be on the cusp of another wave of outperformance, enhanced by a further narrowing of the discount. That would come as a relief for shareholders who have endured a period of poor returns that have tested patience.

During the three years to 31 December 2023, the shares lost 32.8%, according to manager Baillie Gifford, versus a 28.7% gain for its FTSE All World Index benchmark. Even over five years, typically the period joint managers Tom Slater and Lawrence Burns prefer to be judged on, it has barely tracked the benchmark’s 77.8% returns.

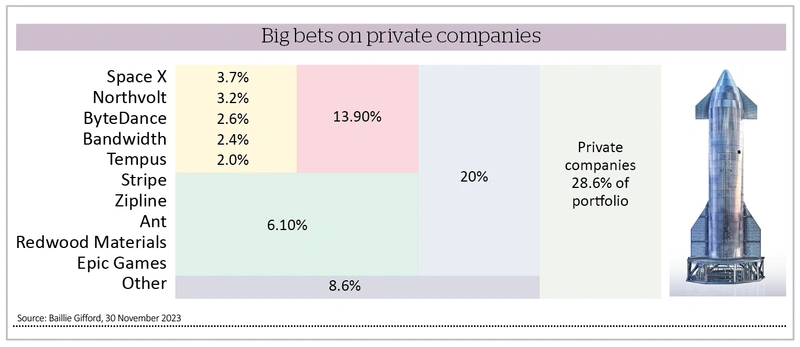

STAKES IN PRIVATE BUSINESSES

A big part of that underperformance comes from Scottish Mortgage’s decisions on the thorny issue of owning stakes in private companies, notoriously difficult to value and especially so during dry spells for funding rounds and an IPOs (initial public offerings) drought.

Scottish Mortgage has scope to invest up to 30% of the portfolio into private companies, and the trust is rock solid in its belief that privates offer some of the most exciting growth opportunities anywhere, such as Elon Musk’s SpaceX, ‘an exceptional and unique company’, according to Claire Shaw, one of the specialists on the trust’s investment team.

SpaceX is not about off-planet tourism, but its launch capabilities to slash the cost of its Starlink satellites network, which is providing super-fast connectivity in parts of the world with little or no alternatives.

The post-carbon economy will have a strong appetite for energy storage solutions, due to the proliferation of electric vehicles and intermittency of renewable energy generation. Yet the West remains hugely reliant on China, which provides about 80% of the world’s batteries production and materials. That’s not a comfortable place to be with tension hot between Washington and Beijing.

This, in turn, bolsters the investment case for Northvolt, aided by the sustainable nature of its materials sourcing and manufacturing process.

Lawrence Burns acknowledged that a variety of battery technologies are gaining prominence but noted that lead times are long and therefore they trust the company to allocate R&D as appropriate.

ByteDance, the owner of the hugely popular social media platform TikTok, is another private company in the portfolio, as is Stripe, one of the world’s biggest payment platforms.

Scottish Mortgage invested £193.7 million into new private companies in 2023.

IPO BOOST COULD LIFT SHARE PRICE

‘Many private companies in the portfolio are ready for IPO as soon as market conditions allow, including Northvolt, Tempus, SpaceX and ByteDance,’ say analysts at Winterflood. Scottish Mortgage conducted more than 400 revaluation exercises last year with most falling within a 5% range after price discoveries, the trust says.

Many believe 2024 will see the IPOs market pick up again, which will help established private company valuations and dispel some of the worries investors might have.

‘Risk aversion is rife among equity market investors, and that’s where we can create value for shareholders,’ says Slater, who claims average growth of portfolio companies is close to 40%.

‘Sometimes, that is not easy, but if it wasn’t a volatile journey there would be lots of investment companies doing what we do,’ he says. ‘You have to endure those periods when what you are investing in is out of favour, and not conform with whatever the market is interested in.’

Despite its previous popularity, Scottish Mortgage’s Slater admits that it won’t suit all investors. But for those willing to accept the volatility inherent in the share price, this remains a clearly focused investment trust aiming to capture outlier returns amid market risk aversion from many of the largest investment themes around, such as AI, (artificial intelligence), energy storage, digital commerce, and healthcare technology.

We believe this means share price performance will improve and could repeat the benchmark-beating return of the past decade’s 318.9% versus 193.2%.

Disclaimer: AJ Bell referenced in this article owns Shares Magazine. The author (Steven Frazer) and editor of this article (Tom Sieber) own shares in AJ Bell. The author of the article (Steven Frazer) owns shares in Scottish Mortgage.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Case study

Feature

- As BRICS grouping grows find out which of the original members has done best

- Emerging markets: positive 2024 outlook for stocks and earnings as voters go to the polls

- Why falling interest rates could be a ‘harbinger of boom’ for commercial property

- Enjoy the retirement you want: How to build a SIPP portfolio

Great Ideas

Investment Trusts

News

- How Advanced Micro Devices has surfed AI wave

- Birkenstock under pressure after disappointing post-IPO earnings

- US stocks hit new high buoyed by biggest jump in consumer confidence in 33 years

- Finsbury Growth & Income marks three years of underperformance

- Under the radar tech star Super Micro Computer surges as earnings set to smash forecasts

- UK core dividend payments rose 5.4% to £88.5 billion last year

magazine

magazine