Reviving the big buyback debate

Buybacks are heavily in fashion with UK companies right now. The latest names to declare sizeable share buybacks include Barclays (BARC) and InterContinental Hotels (IHG), which between them plan to repurchase more than £1.5 billion worth of stock this year. Notably, Shell (SHEL), which cut its dividend for the first time since the Second World War in 2020, has shifted towards large buybacks in recent years.

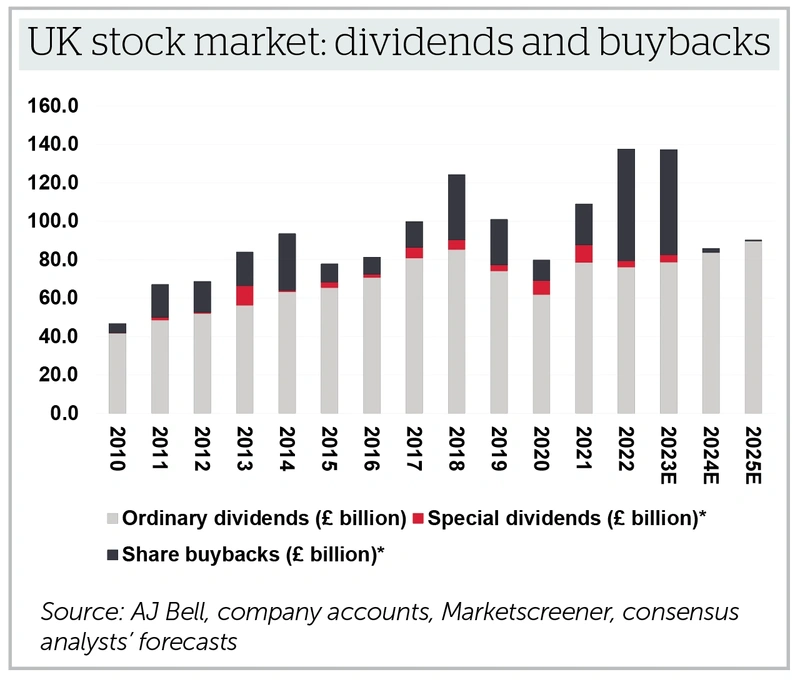

The AJ Bell Dividend Dashboard report released last December recorded that, at the time of publication, the value of buybacks announced for 2023 stood at £54.7 billion, close to the record of £58.2 billion recorded in 2022.

This trend of firms prioritising buybacks makes now a good time to revisit the debate over the merits of dividends versus buybacks as a way of returning capital to shareholders.

In some recent research, Liberum Capital analyst Joachim Klement highlighted buybacks as a potential catalyst for European and UK stocks to enjoy a re-rating.

Klement said: ‘In our view, the increase in buybacks among UK and European companies is not just a temporary phenomenon. Instead, there seems to be a structural shift underway where European and UK companies adopt similar capital allocation policies as their American peers.’

A buyback can be more tax efficient for shareholders, assuming they would prefer to be taxed on a capital gain than the income from dividends. If an investor opts to retain their shares they will have an enhanced stake in the company and will be liable for more dividends in the future (if they are paid). From a company perspective a buyback represents less of a commitment than an increase in the ordinary dividend where any subsequent cut would be more damaging to the share price.

Finally, a buyback implies the management of a company, rightly or wrongly, believes the shares are undervalued. Housebuilder Vistry (VTY) even cancelled its dividend in September 2023 in favour of a buyback arguing its stock was just too undervalued to ignore the merits of buying its own shares.

However, firms have historically bought back a much greater volume of their shares at the top rather than the bottom of the market, suggesting they are not always great at judging whether they are genuinely undervalued.

Also, buybacks can be a cynical way of boosting earnings per share by reducing the number of shares in issue to massage performance and potentially trigger management bonuses.

In an ideal world, a company should explain its capital allocation process clearly to investors so they can make up their own minds if decisions are being taken with their interests at heart. Best-in-class in this regard is Next (NXT), which explicitly states it will only purchase shares if it can achieve what it calls an 8% equivalent rate of return. This is calculated by dividing anticipated pre-tax profit by the current market valuation.

DISCLAIMER: AJ Bell owns Shares magazine. The author (Tom Sieber) and editor (Ian Conway) own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

Money Matters

News

- Why interest in Currys could spark further mergers and acquisitions in the sector

- What have the top US fund managers been doing recently?

- XP Power plummets to 10-year low after two successive profit warnings

- YouGov looks in great shape amid talk of move to US listing

- Uber unveils $7 billion buyback as ride hailing firm shocks investors

magazine

magazine