Why City of London is so popular with investors

One of the most popular investment trusts with AJ Bell’s ISA millionaires, City of London (CTY) is a favourite with investors seeking long-term income and capital growth and a gateway to large international companies.

However, while the long-run performance record is strong, Curtis’ cautious approach means the fund can underperform in some market conditions. On a 10-year share price total return basis, the trust has lagged AIC UK Equity Income sector peers such as Law Debenture (LWDB), Finsbury Growth & Income (FGT) and Merchants Trust (MRCH) by some distance.

On the positive side of the ledger, City of London offers a higher yield than the sector average and is the sector’s largest trust by assets; this scale is a key reason why it carries the sector’s lowest charges.

City of London is also one of the AIC (Association of Investment Companies) ‘Dividend Heroes’, having raised the payout every year since 1966, the last time England won the football World Cup.

Much of this track record can be attributed to Janus Henderson Investors’ Job Curtis, who has managed the trust for almost 33 years and was formally joined by David Smith as deputy fund manager in 2021. Curtis’ conservative investment philosophy and experience has been pivotal to City of London’s success, as has the investment trust structure which allows the board to tuck away surplus cash and smooth income payouts to shareholders as a result.

The board took advantage of the previous low interest rate environment by arranging long-term, low-cost debt. At 7%, City of London’s gearing remains below the AIC UK Equity Income average and chimes with Curtis’ cautious long-term approach.

City of London currently trades on a modest 2.2% discount to NAV (net asset value) versus an average five-year premium of 1.2%.

DIFFERENTIATED PROPOSITION

What does Curtis believe makes his FTSE 250 vehicle stand out from peers? ‘First of all, we’ve got the longest track record of dividend growth going back to 1966,’ says the value-orientated money manager. ‘That’s 57 consecutive years and we’ve expressed confidence we’re going to do it again this year.’ City of London’s dividend growth record is partly down to running a portfolio of consistent companies, ‘but we also use the investment trust structure with the revenue reserves’, stresses Curtis. ‘In 2020, we wouldn’t have been able to do it (increase the dividend) without that.’

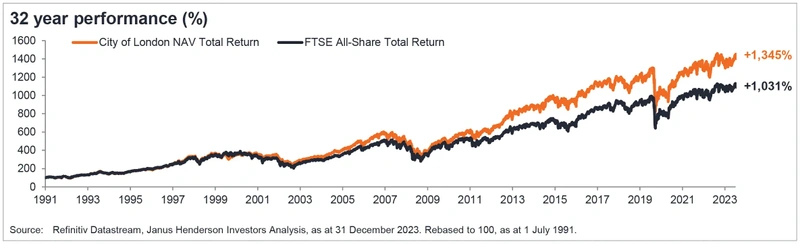

‘And the second thing is we’ve beaten the FTSE All-Share over the long run. I became manager in 1991 and since then, we’re comfortably well ahead. Over the 32 years (to 31 December 2023), City of London’s NAV total return performance is 1,345% and the market’s is 1,031%.’

In terms of being left behind over the last decade, Curtis comments: ‘We don’t do it in every market as it is a conservative approach. We tend to have our best relative performance in more tricky markets and that’s actually part of the appeal.’

Curtis highlights City of London’s good relative performance in 2022, the year in which the war in Ukraine started and there was a lot of market turbulence to contend with.

Looking at the past five years, relative returns were negatively impacted by an underweight exposure to growth stocks in the year to June 2021 and in 2023, City of London underperformed because of an underweight to banks and energy.

But as Kepler Trust Intelligence analyst William Heathcoat Amory explains, ‘it is impossible to get it right every year, but with Job attempting to spread risks across the portfolio at all times, over the long term the benefit of his stock picking should come through, and hopefully deliver long-term outperformance. It is this that has allowed Job to successfully navigate market cycles over his long tenure’.

WHAT’S IN THE BOOK OF JOB?

City of London’s significant heft, with NAV growth and new share issuance increasing its size over the years, is a huge advantage that underpins a third point of differentiation, its competitive charges.

‘The fee is the lowest in the UK Equity Income sector, one of the lowest of any investment trust and lower than any OEIC (open-ended investment company) would be,’ says Curtis.

At the interim results in February, the board announced a management fee reduction from 0.325% to 0.3%, effective 1 January 2024. As Kepler’s Heathcoat Amory explains: ‘Low charges are one of the contributors to the virtuous circle that City of London finds itself in, enabling it to continue to issue shares and grow its asset base.’

Curtis, whose favoured valuation metrics include dividend yield, scours the market for resilient companies with strong balance sheets and the sustainable cash generation which will support dividends and capital expenditure for future growth. In terms of current positioning, he believes the banks are in ‘quite a good place at the moment’ and sees re-rating potential in this part of the UK market. ‘We’ve had a very good reporting season from the banks. We’ve got about 10% in banks, the first time we’ve been as heavy in banks as that for a very long time, but they are benefiting from higher interest rates and a relatively soft landing for the economy as well as their stronger capital ratios.’

The exodus of names from the London stock market may be a troubling trend for the long term, yet City of London’s returns have been boosted by the ‘fair amount of takeover activity going on’, says Curtis. In the second half of last year, portfolio holding Round Hill Music Royalty Fund was taken over and this year, Wincanton (WIN) has backed a £762 million offer from US group GXO Logistics (GXO:NYSE), while insurer Direct Line (DLG) has rejected a £3.1 billion takeover offer from a Belgian rival. ‘I think the UK is very cheap at the moment and M&A is a theme that is going to continue,’ says Curtis.

RUN YOUR WINNERS

Among City of London’s winners is defence contractor BAE Systems (BA.), the biggest holding as of 31 January 2024. ‘BAE is executing really well, but the key thing is the environment has changed hugely,’ says Curtis. ‘We’re no longer in the post-Cold War peace dividend environment. This is an environment where countries want to rearm for obvious reasons.’

City of London may have a yield bias, but the portfolio also contains lower-yielding growth stocks such as RELX (RELX), the information-based analytics and decision tools provider that has successfully pivoted from print to digital. ‘Exhibitions has come roaring back from Covid,’ explains Curtis, ‘and RELX is seen within the UK market as one of the likely beneficiaries of artificial intelligence. It’s not a cheap stock, but RELX has been an incredible compounder and it has a really high-quality risk business and a hugely commanding position in scientific publishing as well.’

Other names in the portfolio include diversified engineering group Smiths (SMIN) as well as DS Smith (SMDS), which recently received an approach from packaging industry peer Mondi (MNDI). ‘UK stocks are quite cheaply rated and in general there is scope for the market to re-rate upwards,’ notes Curtis, who initiated a position in British luxury brand Burberry (BRBY) in the half to December 2023.

‘Luxury is having a difficult time and within luxury, the Europeans look down a bit on Burberry, but it is our one British luxury company on the stock market, an iconic brand and profitable. Burberry is also trying to reposition itself a bit in a difficult environment. I’ve only bought half a position at the moment, but I do sense it is quite interesting. Luxury will recover and I think Burberry will recover with it, but I admit the sector has some headwinds at the moment.’

An interesting addition in the mid cap space is meat and fish packing firm Hilton Food (HFG).

City of London is allowed to hold up to 20% of its assets in overseas listed stocks, which provides Curtis with a bit more choice and has ‘added value over time. But if you look at the whole portfolio, a bit like the UK market, two thirds of the sales come from overseas’, he explains.

Addressing performance, Curtis concedes ‘we are slightly behind the index over one year, but not far behind, but we’re ahead over three, five and 10 years’.

In terms of portfolio detractors, wealth manager St James’s Place (STJ) has been ‘very disappointing, one I’ve clearly got completely wrong, but I think we’ve found a base now. And some of the more defensive sectors like food producers did less well. Our holding in Nestle (NESN:SWX) has done very well in the long run but has had a more difficult year.’ Not being particularly big in technology and missing out on the rise in Rolls-Royce (RR.) have also dragged on performance.

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (James Crux) and the editor (Tom Sieber) own shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Ask Rachel

Daniel Coatsworth

Feature

Great Ideas

Investment Trusts

News

- Easyjet flies high with promotion to the FTSE 100 as miners and energy slip

- Why convenience food giant Greencore has gained 12.3% year-to-date

- Can Nike get back on the front foot?

- Investors turn sour on Tate & Lyle

- UK financial regulator softens stance on digital currencies as Bitcoin surges to new high

- Darktrace hits 18-month high as hack threats increase

magazine

magazine