Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Share pick for 2020: IG Design

You’d be crackers to ignore this global growth winner. Investors willing to pay up for a quality long-term consolidation story with global earnings momentum should snap up IG Design (IGR:AIM).

Despite having already delivered stellar returns for shareholders, we believe there is more to come as the company leverages long-standing ties with the world’s top retailers.

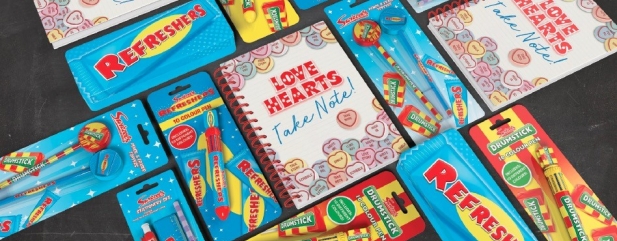

IG Design makes and supplies products that help people celebrate life’s special occasions. Its hugely diverse range spans gift packaging and greetings cards, stationery, creative play products and design-led giftware.

It is growing with the likes of Walmart, the world’s largest retailer, and Target in the US. It also has agreements with names such as Tesco (TSCO), Action, Dollar Tree and Lidl.

Successful licensing deals are in place for key brands including Peppa Pig, Toy Story and Frozen and these offer additional earnings upside for IG Design, whose UK business is taking a lead in developing more environmentally-friendly products such as fully recyclable Christmas crackers.

Results for the six months to 30 September showed a double digit profit gain amid impressive showings in the UK, Europe and US, where IG Design is geared into the buoyant consumer.

Following the acquisition of Impact Innovations, the US now speaks for 60% of group revenue. Sales and profits in the country are growing like topsy and it recently inked a deal with one of the largest retailers – it isn’t allowed to disclose the name for commercial reasons – for the supply of all-year-round themed and seasonal impulse gifting products to over 1,500 stores.

IG Design is primed for long-term organic growth as it expands with new and existing retail customers.

Risks to consider include cost pressures and competition, although this company has scale and manufacturing advantages over peers. Possible disposable income declines could also reduce gifting spend in key markets.

A new printing press in Memphis will reduce costs, increase gift-wrap production capacity and help the company mitigate the impact of tariffs.

Cash-generative IG Design also offers investors a progressive dividend, one forecast to rise from 8.5p to 10.54p in the year to March 2020 ahead of 12.61p and 13.71p in the 2021 and 2022 financial years respectively.

Chief executive Paul Fineman – whose personal stake in IG Design is now worth £15.7m – is likely to pursue further acquisitions, supported by the company’s strong balance sheet, to drive incremental growth.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

- Top performing funds of 2019

- What were the key themes for small caps in 2019?

- Big companies with big decisions to make in 2020

- All change: an unusual period for FTSE 100 CEOs

- Tracking the performance of the biggest emerging markets

- Emerging markets: Views from the experts

- Is inflation really dead and what can investors do if it isn't?

Great Ideas

- Share pick for 2020: IG Design

- Share pick for 2020: Lloyds Banking

- Share pick for 2020: Redrow

- Our 2019 picks have smashed the market with a 23% return

- Share pick for 2020: Luceco

- Four great funds to buy for 2020

- Share pick for 2020: Kainos

- Share pick for 2020: Begbies Traynor

- Share pick for 2020: Hotel Chocolat

- Share pick for 2020: Centrica

- Shares pick 2020: Wizz Air

- Share pick for 2020: Schroders

magazine

magazine